Customer Focus is one of the five core values of the Bank. Our customer base consists of individuals, corporates, MSMEs, farmers and Government entities amongst others and our focus is to provide them with a seamless banking experience. We undertake multiple initiatives geared towards serving the diverse needs of the customers and our efforts are reflected in the strength of our brand value and recall.

Service Quality Initiatives and Grievance Redressal

Driven by the core value of Customer Focus, the Bank has always endeavoured to improve customer experience and has adopted a holistic approach for the same across multiple channels ranging from BranchBanking, PhoneBanking, NetBanking, MobilBanking, EVA chatbot and the Bank’s social care handles. The Bank has also improvised on the relationship-based banking programmes. In addition to the branch-based relationship managers, it also has a Virtual Relationship Manager (VRM) programme to cater to various financial needs in a personalized manner. The Bank has adopted a three-step strategy with regards to Customer Service– Define, Measure, and Improve. It invites and reviews performance on customer service as well as grievance redressal at different levels which are Branch Level Customer Service Committees (BLCSCs), Standing Committee on Customer Service (SCCS) and Customer Service Committee of the Board (CSCB). We have put robust processes in place to regularly monitor and measure quality of service levels not only at various touch points but also at a product and process level by Quality Initiatives Group.

As part of its continuous efforts to enhance quality of service, the Service Quality team carries out regular reviews across various products/ processes/channels. The effectiveness of the quality of service provided is also reviewed at different levels, including the Customer Service Committee of the Board.

One of the basic building blocks of providing acceptable level of customer service is to have an effective internal Grievance Redressal mechanism / framework. In this regard, we have outlined a framework for redressal of customer grievances and documented it in the form of a Grievance Redressal Policy – duly approved by its Board. It has also made this policy available in public domain (on the website as well as in the branches). The Bank has also formulated a Board approved Protection Policy, which limits the liability of customers in case of unauthorized electronic banking transactions.

Thanks to these initiatives, the Bank’s customer complaints for FY22 decreased by 21% from 4,67,453* to 3,68,291.

*Restated complaints number based on re classification of queries into complaints from 3,25,786.

Building a customer-centric culture using Net Promoter System (NPS) - ‘Infinite Smiles’

We, at the Bank, believe that delivering an outstanding customer experience is a strong differentiator for a great product and is key to a sustained competitive advantage. The primary aim of the Infinite Smiles programme is to establish employee behaviour and practices which leads to customercentric actions and continuous improvements.

Last year, we initiated measurement on key journeys, identified action areas to improve customer experience and implemented several key initiatives. This has led to a steady improvement on our NPS over the year. This year, we built on our commitment to our customers by scaling the coverage of our Infinite Smiles program – we introduced new journeys, new episodes and new products ensuring a much wider coverage. Customer focus has seen an increased focus - regular cadence with key stakeholders and rigorous follow-up on actions have become the cornerstones of Infinite Smiles.

The programme now encompasses critical episodes – Digital Journey Episodes, Credit Card Episodes, Customer Instructions, Tele Interactions and Collection Process. We now cover 120+ episodes and have contacted around 63 Million customers in FY22 for their feedback.

Our ‘Infinite Smiles’ program rests on three meticulously designed pillars – 'Listen', 'Learn' and 'Act' which enables us to embed customer feedback led transformation as a discipline into our systems, challenge what is considered as the standard, and offer a customer experience that places us amongst the best service brands.

Listen

Feedback of

customers

Learn

Review and follow up to better understand

Act

Resolve the issue in the near and long term

*Bottom Up NPS score

Guided by our aspiration to move from score to systems, we have been working to institutionalize the process for addressing customer issues that transcend beyond measurement and create a culture of customer-centricity and agility.

We would not only like to anticipate and react to changing customer expectations but also like to provide a proposition to our customer that makes us more attractive than competitive alternatives.

With this in view we subscribed to competitive benchmarking of NPS, in form of a subscription based product NPS Prism®.

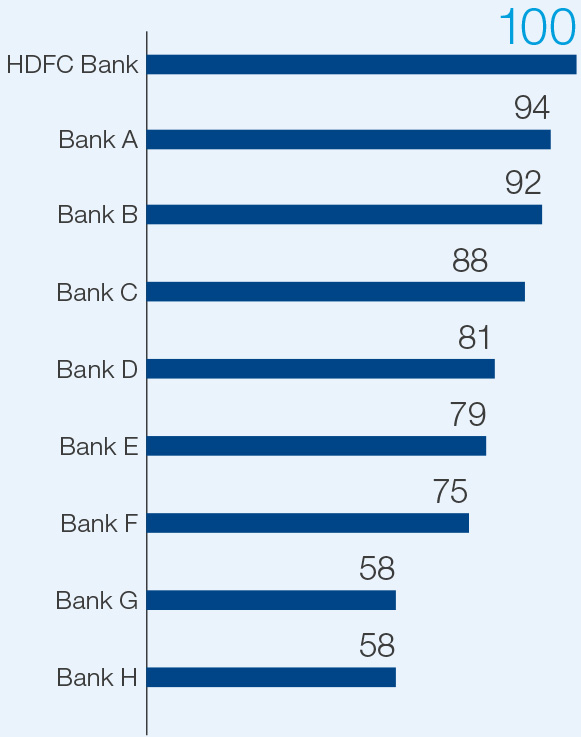

HDFC Bank leads the overall brand NPS ranking among 20+ competitors in the banking category.

Our commitment to building a customer obsessed culture and constant effort to include everyone in the organisation has ensured continuous improvement leading to growth in customer advocacy of the brand.

BRAND NPS SCORE (INDEXED) | BANKING CATEGORY

Source: NPS Prism® benchmarking report (2021). NPS Prism® is a registered trademark of Bain & Company, Inc.

- Name of competition banks intentionally masked

- Score indexed to HDFC Bank

- Competition bank does not include pure-play credit card providers

Some of our customer-centric initiatives

On Doctors Day - 2021, we presented Salaam Dil Sey – a platform for our customers to thank doctors and their families for their hard work, sacrifice and tireless service. As they bravely continue to fight the pandemic, we tried to put a smile on their faces.

Customers dedicated a “Salaam Dil Sey” (a personalized greeting card) to over 1 lac doctors and their families. HDFC Bank put all these greeting cards in a collage, displayed on ‘Wall of dedication’ at its Sandoz Bank House and unveiled on 1st July 2021 virtually by Dr Naresh Trehan in presence of prominent media and Bank’s Sr. officials. This attempt was also recorded in Asia Book of Records & India Book of Records for “Largest Collage of Thank you messages”. The Bank also gave musical tribute to the doctor's fraternity by a specially curated anthem on the Salaam Dil Sey theme. HDFC Bank reached out to 23Mn+ people through print, social media and email/SMS. Our branch staff personally met and greeted 40,000+ doctors during this campaign.

After the tremendous success of our Mooh Band Rakho campaign in 2020, we launched the second edition in support of the International Fraud Awareness Week in November 2021. Aimed at increasing awareness on all types of financial fraud, the campaign underlined the importance of not disclosing information, especially banking details, and to safeguard oneself from digital frauds.

We launched a series of videos using relatable real-life situations to educate customers on various types of modus operandi. We conducted over 2,000 workshops over 4 months across the country, advocating simple steps such as not clicking on unknown links, sharing card details, CVV, Expiry Date, OTP NetBanking/ MobileBanking Login ID & Password over Phone, SMS, email and social media. It focused on the younger segment targeting Senior Secondary Schools & Colleges to make safe banking an early habit in their financial journey.

Our Festive Treats 3.0 had more than 10,000 offers on cards, loans and EasyEMI. Just as the country started to unlock, the campaign aimed to spread reasons for joy and cheer. Revolving around the theme of 'Karo Har Dil Roshan', the Bank reached out to every Indian through high impact visibility via TV, branches, ATMs, partnerships with stores/websites and digital media campaigns with a hyper local focus.

HDFC Bank partnered with over 10,000+ merchants across 100+ locations to offer its customers an opportunity to avail fabulous deals specifically created for their personal and business needs.

A pioneering digital self-service platform was introduced by adding convenience, ease of usage, smarter user design into a mobile-friendly ON THE GO service platform, called MyCards. This solution stands to revolutionize the way our customer experiences digital banking services by getting more control and one-view of all products under a single-login interface. MyCards provides a fully cloud-hosted, digitized service stack to all segments of Credit and Debit Card customers.

Key Features of MyCards:

- Dedicated platform providing 24 X 7 banking services ON THE GO

- Manage multiple HDFC Bank payments products in one single login interface

- Easy to save, no downloads or installation or upgrades required on phone

- Seamless login with just mobile-based one-time password

- Faster, simpler and smarter User Interface

Most importantly, the digital selfservice card control feature on contactless, online and international transactions on Credit Card is easily accessible on MyCards, with realtime limit setting and transaction mode enablement.

Since its roll-out to customers on 1st Oct 2021, over 2.5 Cr service requests have been processed digitally on the platform.