growth benchmarks

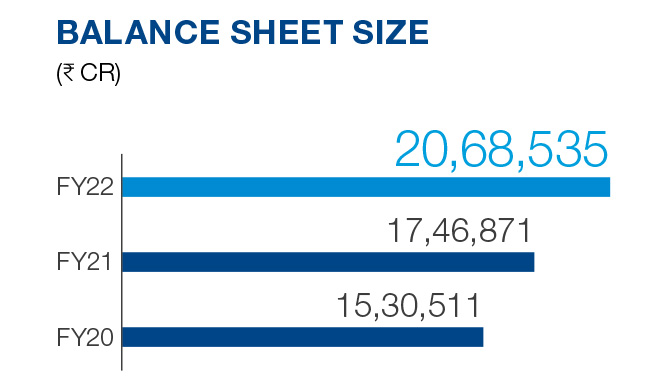

The hallmark of the Bank's financial performance has been consistent growth across all key metrics, which has helped consolidate its leadership position. Its Balance Sheet continues to be healthy and strong which is evident by a growth of 18.4% in the current year.

18.4%

18.4%

18.8%

18.8%

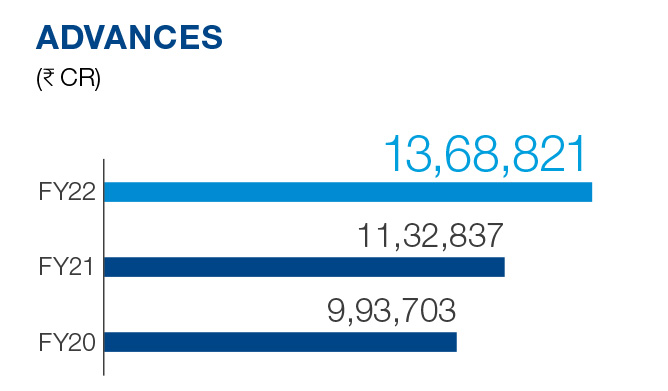

The endeavour to reach all customers across India has contributed to an increase in branches to 6,342 as at the year end. This together with our ability to understand and fulfil customers' financial needs along with management of customer relationships has led to an overall increase of 16.8% in Deposits and 20.8% in Advances. The continuous monitoring of costs and building of operational efficiencies has resulted in only a marginal increase of 0.60% in the Cost to Income Ratio to 36.9%.

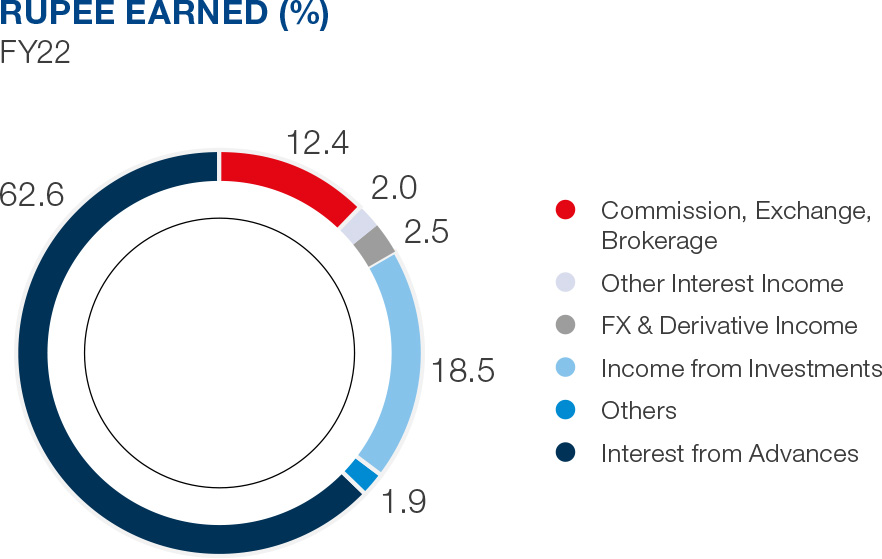

The asset mix of the Bank has shifted to high rated but low yielding segments.

Consequently, the Net Interest Margin has reduced marginally to 4.0%. It is pertinent to note that the change in asset mix has a positive impact on the net credit margin which has increased to 3.3% in the current year.

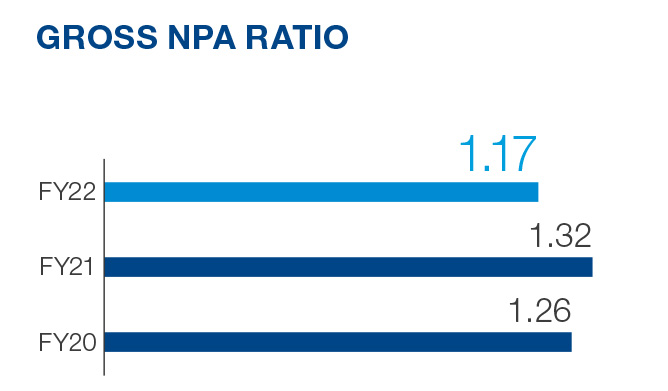

The impact of our effective risk management system along with robust credit policy and underwriting skills can be seen in the quality of our assets and low GNPA ratio of 1.17%. Even with a low GNPA, as a responsible banker, specific provision coverage has been increased to 72.7% and the coverage of total provisions comprised of specific, floating, contingent and general provisions, has been increased to 182% as at the year end.

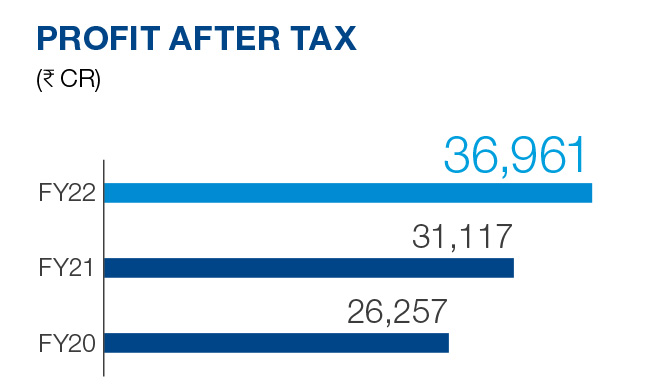

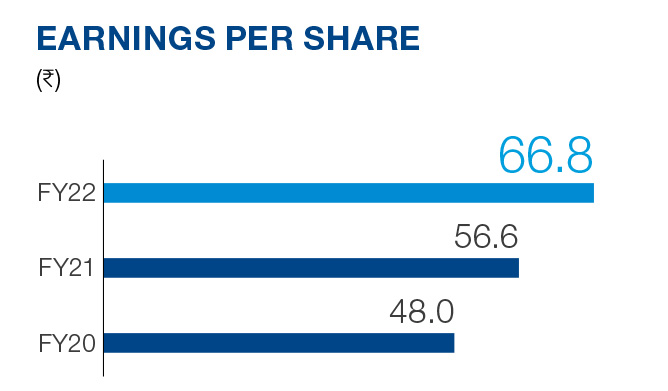

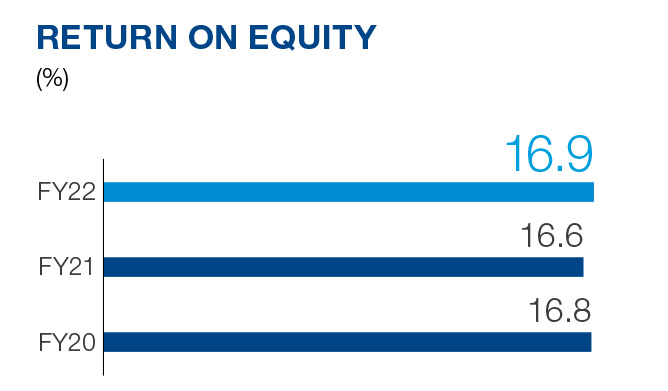

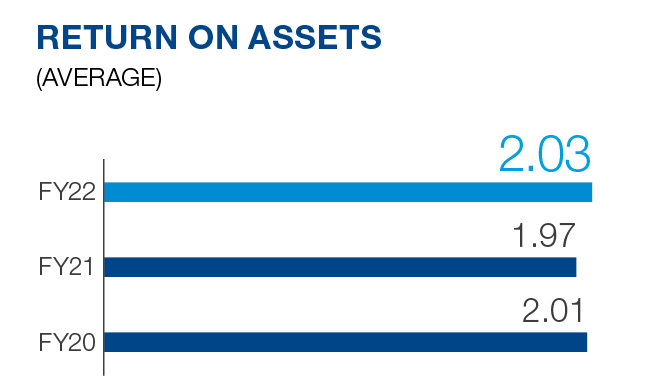

We continue to deliver double-digit growth both in earnings and return on equity. The Profit After Tax has grown by 18.8% and return on equity has increased to 16.9%.

*Proposed

**Basis RBI notification dated April 22, 2021

***Basis RBI notifications dated April 17, 2020 and December 4, 2020