Our governance framework forms the bedrock of our value creation process. At HDFC Bank, stringent regulatory compliance is a given. Beyond compliance, our practices aim to embody the principles of ethical conduct, independence, responsibility, accountability, and transparency in true spirit. This is reflected in our strategic thinking, decision-making, monitoring processes and underlines all our activities and operations.

We are led by a diverse, experienced and competent Board. The Board, along with its committees, institutes policies and frameworks on ethical conduct, anti-corruption, anti-money laundering, compliance, IT, information security, ESG, and customer satisfaction, among others, and monitors their implementation. We strive to adhere to best practices in corporate governance, such as alignment of executive pay to company performance, disclosure of Board evaluation outcomes, and wide scope of whistle-blower policy, to name a few.

Board expertise and competence

Our Board is diverse and inclusive, comprising of members with rich experience to fulfil its governance role and related responsibilities, objectively and effectively. Our Board includes members with varied skill sets and competencies across banking and allied sectors such as finance, agriculture, rural economy, risk management, small scale industries and technology. The Board also seeks opinions from external experts whenever required. Further information on the skills, expertise and competence of our Board is included in our Corporate Governance Report on Page 385.

Beyond compliance

At HDFC Bank, compliance with regulatory requirements is just the starting point for good governance practices. We have consistently ensured that the composition of the Board and its Committees, in terms of independence, diversity in skills, expertise and gender, meets and at times, exceeds the requirements prescribed by regulations.

BOARD DIVERSITY BY AGE AND GENDER

As on March 31, 2022

Independence in Committee composition

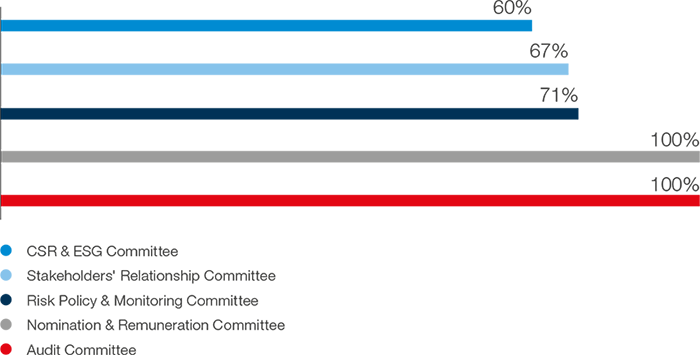

We ensure a high level of independence in the composition of our Board Committees. The below Committees are chaired by an independent director.

(Percentage of Independent Directors)

‘Leadership’ category organisation in Corporate Governance by IIAS

The Indian Corporate Governance Scorecard is developed by Institutional Investor Advisory Services India Limited (IIAS) with support from International Finance Corporation (IFC) and BSE Limited. The scorecard is built around the G20/OECD Principles of Corporate Governance, which are the globally accepted benchmark for corporate governance. In the 2021 scorecard (published in February 2022), HDFC Bank was one of the 20 companies which ranked in the ‘LEADERSHIP’ category. For more details, please refer to https://www.iiasadvisory.com/ governance-scorecard.

Board initiatives and involvement

The Board provides leadership and strategic guidance in shaping our procedures and processes for value creation. The key focus areas in FY22 included adherence to regulatory compliance, creating a strong technological backbone to mitigate IT and operational risks, infrastructure scalability, talent management and ESG commitments.

Culture of transparency and accountability

We strive to inculcate global best practices in governance, timely disclosures and fair presentation of information. Transparency and accountability are among the key expectations of stakeholders. We have put in place policies and processes that allow for a sufficient and visible flow of information with adequate safeguards in place. We have also formulated a Code of Practices and Procedures for Fair Disclosures in accordance with the SEBI (Prohibition of Insider Trading) Regulations, 2015. This Code lays down principles of prompt disclosure along with uniform and universal dissemination of information. Further, the Board has also approved the following policies which are available on our website: https://www.hdfcbank.com/personal/ about-us/corporate-governance/ codes-and-policies for easy reference:

- Policy on Appointment and Fit and Proper criteria for Directors

- Whistle Blower Policy

- Compensation Policy

Policies and frameworks for ethical conduct

To ensure a pervasive culture of ethical behaviour, we have created an environment and instituted policies and frameworks that encourage appropriate business conduct. These policies are communicated regularly to the management, employees and other stakeholders.

Our corporate governance policies include:

- Code of Ethics/Conduct

- Policies to prevent insider trading, govern related-party transactions

- Policies around Prevention of Sexual Harassment (POSH)

- Environmental Social & Governance (ESG) Policy Framework

Transparency and accountability are embedded in our culture. Our Code of Ethics/Conduct directs the Board and senior management to uphold our values and carry out business worldwide with integrity and highest ethical standards. As per our Conduct Philosophy, we do not employ child, forced or compulsory labour in our operations. Our Whistle-blower Policy provides a comprehensive framework for capturing and addressing stakeholder complaints/grievances. In FY22, we had 147 whistle-blower complaints filed by various stakeholders including shareholders, employees, customers and value chain partners. The nature of complaints varied; while some were linked to corruption and improper business practices, others pertained to behavioural issues. We did not make any political contributions.

Our publicly available Conduct Philosophy codifies mechanisms to deal with issues related to mental or physical coercion or verbal abuse, sexual harassment, sexual abuse, slavery, of employees. During FY22, there were no complaints of infringement of human rights.

We have a ‘Zero Tolerance’ policy on sexual harassment and an internal complaints committee is in place to address such complaints. During the year, we received 51 complaints pertaining to sexual harassment, of which 48 were resolved during the year. For more information, please refer to our Corporate Governance Report on Page 385.

Anti-corruption, Anti-bribery, and Anti-money Laundering (AML)

We have focused programmes consisting of Foreign Corrupt Practices Act and Bribery Act, Code of Ethics and Commitment, Trade-based Money Laundering, and KYC and AML norms to enable effective training on anti-corruption, anti-bribery and anti-money laundering. Our operations are assessed for corruption and any complaints by any stakeholder can be raised through our whistle-blower mechanism.

Customer satisfaction

The Customer Service Committee of the Board (CSCB) works towards continuously improving the quality of services rendered to the customer. It also ensures the implementation of directives received from the RBI in this regard. Accordingly, the CSCB formulates the Bank’s comprehensive deposit policy, incorporating the issues arising out of the product approval process, annual survey of depositor satisfaction, and the triennial audit of such services, among others. We ensure strict adherence to market conduct regulations and have defined frameworks in place to maintain transparency in communications to our customers and clients. During FY22, we did not record any new cases of non-compliance concerning product and service information and labelling, or marketing communications.

During the year, we undertook several initiatives to strengthen our IT systems, augment capabilities and increase resiliency. To read more about our initiatives, refer Pg. 78 (Digitisation). During FY22, we received no complaints regarding identified leaks, thefts, or losses of customer data with respect to data security. During the same period, we received 298 complaints from customers concerning breaches of customer privacy, 1 complaint from an outside party and 19 from regulatory bodies. The major areas of customer complaints in FY22 were related to unauthorised transactions done through UPI, unauthorised usage through Credit Card, unauthorised transactions done through NetBanking, unauthorised usage through Debit Card online and failed transactions at the Bank's ATMs.

We have a transparent Grievance Redressal Mechanism that ensures quick and effective resolution of complaints. Customers can reach out to us through multiple channels including retail branches, phone banking application, website and net banking application and retail asset customer service centres. Any grievance received, either verbally, by email or in writing, if not resolved and responded to on the same day, is logged into CRMnext – a state-of-the-art web-based system or Vision Plus (for Credit Card related issues). The CRMnext system has the capability to record and categorise grievances into different types and maintain turnaround times (TAT) for specific category/sub-category. It also has an auto escalation mechanism for cases not resolved within the defined TAT. This not only ensures proper recording and resolution of cases, but also provides for effective escalation channels in case of delays in resolution. Acknowledgement is provided for every grievance logged, in the form of a Complaint Reference Number (CRN), and the customer is kept informed in case of any delay envisaged by the Bank, in resolution of the grievance beyond the stated timelines.

Apart from direct grievances from customers, grievances received through various regulatory bodies including Reserve Bank of India and Banking Ombudsman are handled by designated Nodal Officers. The Bank has also appointed an Internal Ombudsman as per the guidelines prescribed by the Reserve Bank of India. Denial/partial denial cases are referred to the Internal Ombudsman for guidance. The decision of the Internal Ombudsman is binding on the Bank.

ESG governance

ESG matters are a vital component in the Bank’s governance framework. The CSR and ESG Committee of the Board oversees the Bank’s sustainability and climate change initiatives. The Board level committee is guided by the ESG apex committee. The ESG apex committee that comprises of key representatives from the senior management, oversees sustainability reporting initiatives, climate change disclosures, internal projects to ensure reduction of our overall emissions and tracks its progress on ESG, to achieve industry leadership. This Committee is further supported by ESG action subcommittees which includes Product Responsibility Sub-committee, which looks at ESG risks (including climate risks) in the existing portfolio and ESGlinked opportunities; the Environment Sub-committee which oversees the environmental impact from our operations and Social and Governance Sub-committee which works on workplace policies and governance initiatives.