Social – People

Embarking on cultural transformation

At HDFC Bank, our culture and people are key enablers to continue creating value for our stakeholders. We have embarked on a conscious Culture Transformation journey i.e. “The HDFC Bank Way”. It is a key element of the 3Cs: Culture, Conscience and Customers that empower our business. The HDFC Bank Way is defined by the six pillars of Culture – Integrity, Execution, Innovation, Humility, Inclusion and Collaboration. With the DNA of a responsible banker, we are aligning our businesses objectives with the 3Cs of culture, conscience and customers.

Further, we brought in a paradigm shift in our approach towards learning and development through the establishment of the Learning Partner model. We moved ahead on our Diversity and Inclusion agenda with specific focus on women and persons with disabilities. Our flagship initiative, ‘HDFC Bank Cares’ is designed to enable people to take charge of their own wellbeing thereby creating an emotionally committed workforce. We are leveraging technology in the entire employee journey from talent onboarding, virtual learning, wellness initiatives, diversity and inclusion programmes to employee performance management.

Our Culture

A connected workforce that has a deep sense of belonging to the organization is imperative to providing a differentiated customer experience. Our onward journey and continued success will come from reinforcing our culture ‘The HDFC Bank Way’. It is defined by six pillars - Integrity |Collaboration | Inclusion |Humility | Innovation | Execution

With a focus to reinforce the HDFC Bank Way, a large-scale Culture Transformation was conceived and deployed across the entire Bank through the ’Nurture, Care and Collaborate (‘NCC’) intervention. A Culture Transformation journey spans several years to get ingrained as the organizational ethos and as a first step towards this, the NCC initiative this year focused on our 12000+ managers as ‘Custodians of Culture’. The objective of the program was to percolate the essence of the HDFC Bank Way by focusing on nine key themes over a five-month journey delivered through versatile and exciting challenges and learning tools. The scale was massive: 99,877 learning content hours were delivered in 145 days and an average of 700 hours of content consumed daily. We are proud that 97% participants gave NCC a thumbs-up for its unique design & content.

Integrity

Doing the right thing..Always

Execution

Delivering excellence

Innovation

Inventing the future

Humility

Gratitude over entitlement

Inclusion

Valuing differences

Collaboration

Independent yet interdependent

Growth reflected in increasing employee strength

EMPLOYEES BY CATEGORY

| 2021-22 | 2021-22 | |||||

|---|---|---|---|---|---|---|

| Male | Female | Total | Male | Female | Total | |

| Senior management | 124 | 15 | 139 | 106 | 10 | 116 |

| Junior & Middle Management | 21,467 | 3,505 | 24,972 | 17,565 | 2,848 | 20,413 |

| Non Supervisory staff | 60,438 | 19,230 | 79,668 | 54,700 | 16,279 | 70,979 |

| Frontline Staff and Sales offiers | 32,553 | 4,247 | 36,800 | 25,976 | 2,609 | 28,585 |

| Total | 1,14,582 | 26,997 | 1,41,579 | 98,347 | 21,746 | 1,20,093 |

EMPLOYEE BY REGION

| 2021-22 | 2021-22 | |||||

|---|---|---|---|---|---|---|

| Male | Female | Total | Male | Female | Total | |

| East | 14,335 | 2,221 | 16,556 | 12,557 | 1,917 | 14,474 |

| West | 42,093 | 10,329 | 52,422 | 36,244 | 8,448 | 44,692 |

| South | 26,542 | 7,249 | 33,791 | 22,166 | 5,567 | 27,733 |

| North | 31,509 | 7,147 | 38,656 | 27,286 | 5,770 | 33,056 |

| Abroad | 103 | 51 | 154 | 94 | 44 | 138 |

| Total | 1,14,582 | 26,997 | 1,41,579 | 98,347 | 21,746 | 1,20,093 |

EMPLOYEE BY AGE

| 2021-22 | 2021-22 | |||||

|---|---|---|---|---|---|---|

| Male | Female | Total | Male | Female | Total | |

| <30 | 41,035 | 13,892 | 54,927 | 30,713 | 10,257 | 40,970 |

| 30-50 | 72,310 | 12,880 | 85,190 | 66,818 | 11,348 | 78,166 |

| >50 | 1,237 | 225 | 1,462 | 816 | 141 | 957 |

| Total | 1,14,582 | 26,997 | 1,41,579 | 98,347 | 21,746 | 1,20,093 |

EMPLOYEE BY CONTRACT TYPE

| 2021-22 | 2021-22 | |||||

|---|---|---|---|---|---|---|

| Male | Female | Total | Male | Female | Total | |

| Permanent | 1,14,582 | 26,997 | 1,41,579 | 98,347 | 21,746 | 1,20,093 |

| Contract(Individual) | 21 | 5 | 26 | 19 | 4 | 23 |

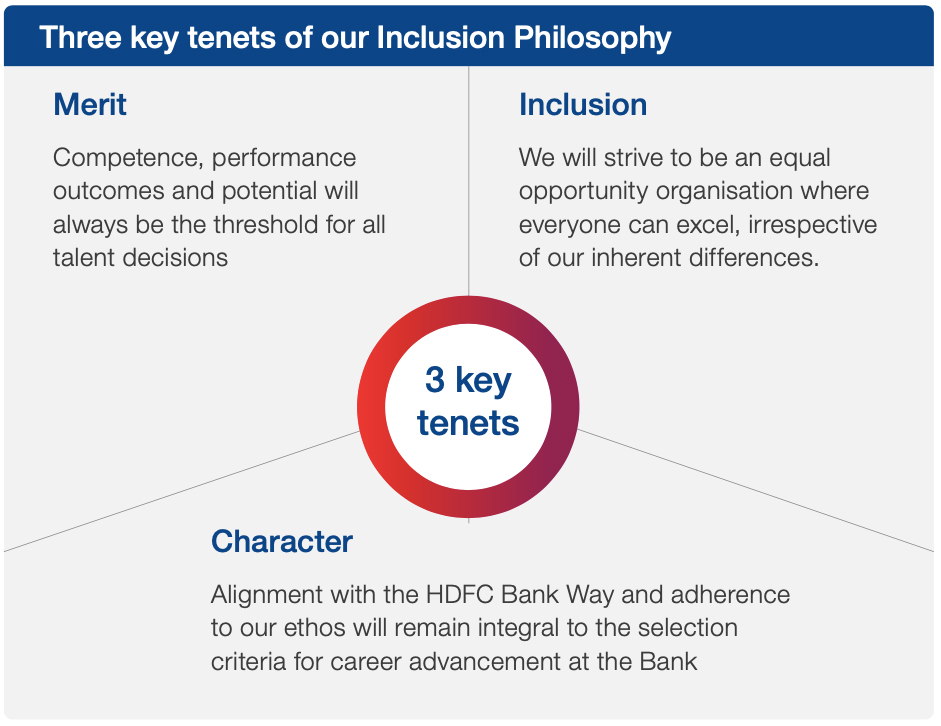

Diversity and Inclusion (D&I)

Inclusion is one of the key culture pillars of The HDFC Bank Way. We promote a work culture where everyone feels included, respected and valued, and has access to equal opportunity. We have branded our inclusion agenda as ‘Valuing Differences’. We provide equal and fair remuneration opportunities, irrespective of gender. No complaints related to incidents of discrimination reported during FY22.

Three-pillar governance structure for driving D&I agenda

HDFC Bank Apex Inclusion Council 6-Member Group Head Panel

- Reports to the MD & CEO

- Set the strategy and agenda for inclusion

- Framework for a culture of inclusion

- Remove Barriers to Inclusion

Working committee inclusion SPOCs from all verticals

- Senior level representatives of Group Heads for the Inclusion agenda

- Partner with stakeholders to drive the agenda

- Business specific inclusion enablers

Regional council north Regional council south Regional council east Regional council west (mum) Regional council west (RoW)

- Monitor on-ground implementation of the Inclusion strategy

- Employee senistization and feedback

- Regional initiatives and events

Our D&I agenda focuses on two critical segments:

- Gender diversity

- Persons with Disabilities (PwD)

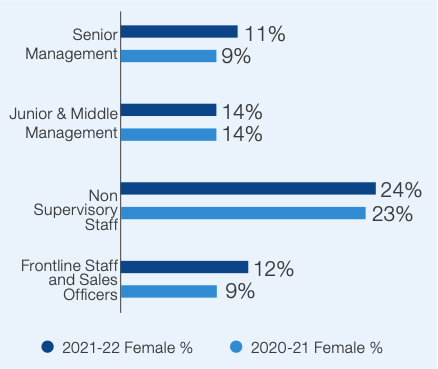

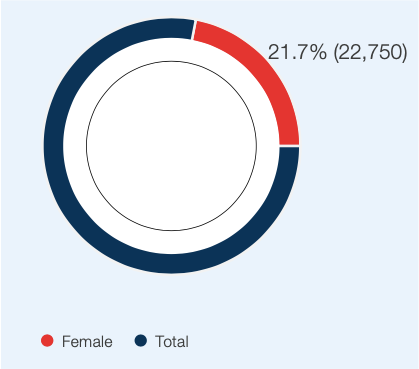

Women at our Workplace

We work relentlessly to support the women at our workplace and provide them with an ecosystem that nurture their careers while being mindful of their unique challenges. Today, 21.7% of our workforce consists of women and we have set a target to increase this to 25% by 2025.

‘Family reasons’ was revealed as a top driver for women attrition in our attrition studies. We also understood that returning mothers were finding it difficult to balance work and personal responsibilities. To this effect, we have undertaken focused interventions and designed programmes that address these challenges.

Bank Again Program: This programme enables women to re-start their careers after a break. We reached out to over 3,000 women employees who had left from the bank over the past 5 years, out of which over 300 former colleagues have re-joined the Bank. We are also closely monitoring our gender hiring with 28% of those hired in the year being women. This excludes front-line sales hiring.

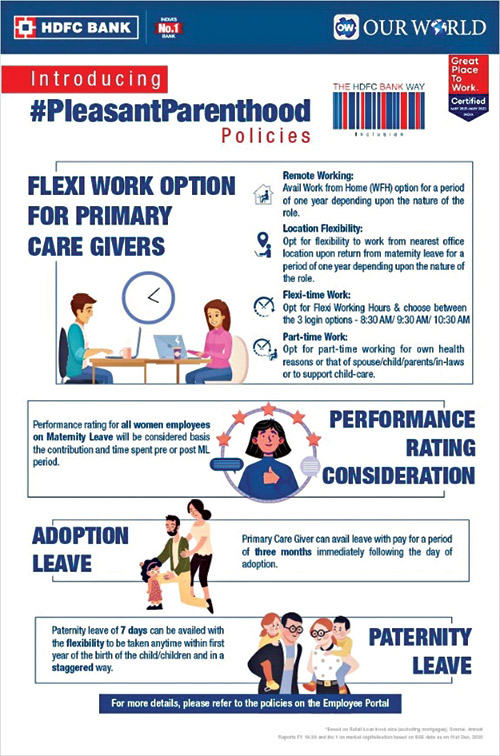

‘Pleasant Parenthood Program: Under this programme, we have a suite of offerings and initiatives to support women along their critical milestones – pre, during and post maternity leave. This programme also enables flexibility with respect to work timings, location and provides part-time working options. All our full-time employees are entitled to avail parental leave. In FY 22, 1182 female and 3072 male employees availed parental leave of which 99.75% female (1179) and 100% male (3071) returned to work. 6.6% women (78) and 5% men (160) who returned to work after leave ended, were still employed with us after 12 months.

The Career Accelerator Programme: Our flagship intervention is aimed at building and augmenting the women talent pipeline for senior roles. It incorporates unique learning elements like sponsorship, group coaching, virtual learning journey, leadership connect and employee resource groups.

She Inspires: This year we also ran a campaign called ‘She Inspires’ celebrating women leaders at the Bank. A video series was created to disseminate, powerful messages of encouragement and leadership journeys by colleagues across the organisation.

WOMEN IN WORKFORCE-

CATAGORY WISE

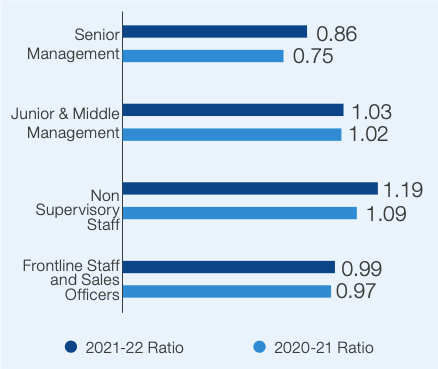

RATIO OF BASIC SALARY AND REMUNERATION OF WOMEN TO MEN

WOMEN EMPLOYEES AS A % OF TOTAL EMPLOYEES

Excluding frontline staff and sales officers percentage of women employees is 19.1% including frontline staff and sales officers

A different perspective — Persons with Disabilities at our workplace

We are focused on building a workplace wherein every individual has an opportunity to do meaningful work, irrespective of any disabilities.

We are taking small but steady steps in this direction:

- Sensitising our people to create an environment of inclusion for Persons with Disabilities (PwD). Initiated by our Board of Directors and Group Heads in May 2021, sensitisation workshops that dealt with unconscious biases were organised for 6,900+ managers across the organisation.

- The inclusion governance teams work in tandem with HR to codify roles for integrating PwD seamlessly within the organisation. Teams are consciously working to improve the infrastructure requirements for fair and free access and identifying specific barriers for inclusion of PwDs.

We are in the process of augmenting our internal systems for better interconnection for persons with disabilities. Currently, we have about 115 persons with disabilities employed with us and have additional hires in the pipeline. Furthermore, a programme for enabling the certification of team leaders on building and managing inclusive teams is being initiated in FY23.

Learning and Development

Learning initiatives

In FY22, we brought in a paradigm shift in our approach to learning and development through the establishment of the Learning Partner model. This model institutionalises performance consulting, which consists of identifying a business need, its cause(s) and the capability building strategy (if applicable) that can meet that need. Performance consultants are experts in understanding business and improving human performance, and specialise in enhancing employees' performance through a collaborative approach.

The intent is to align business priorities with learning goals. Further, we strengthened our offerings on Leadership and Professional Development journeys.

‘Ignite’, a programme aimed at middle management levels, focuses on collaborative and strategic skills and encourages courageous leadership.

‘Trailblaze’ delivers key competencies and management essentials for frontline managers to enhance their effectiveness.

Building on the foundation laid last year, we are progressing towards creating a Virtual University and Learning Experience platform (LXP). Targeting the next generation of employees, LXP facilitates self-paced, learner-led modules on the go in a virtual setting.

AVERAGE HOURS OF LEARNING BY CATEGORY

| Employee by category | 2021-22 | 2021-22 | ||||

|---|---|---|---|---|---|---|

| Male | Female | Total | Male | Female | Total | |

| Senior management | 12.17 | 14.78 | 12.45 | 11.07 | 28.83 | 12.6 |

| Junior & Middle Management | 90.83 | 101.58 | 92.34 | 111.2 | 110.35 | 111.08 |

| Non Supervisory staff | 139.83 | 170.65 | 147.27 | 139.12 | 154.31 | 142.6 |

| Frontline Staff and Sales offiers | 9.88 | 10.41 | 9.95 | 12.19 | 11.99 | 12.17 |

| Total | 93.59 | 136.39 | 101.75 | 100.47 | 131.42 | 106.07 |

TOTAL HOURS OF LEARNING BY CATEGORY

| 2021-22 | 2021-22 | |||||

|---|---|---|---|---|---|---|

| Male | Female | Total | Male | Female | Total | |

| Senior management | 1,509 | 222 | 1,730 | 1,173 | 288 | 1,462 |

| Junior & Middle Management | 19,49,764 | 3,56,045 | 23,05,809 | 19,53,219 | 3,14,272 | 22,67,491 |

| Non Supervisory staff | 84,51,114 | 32,81,633 | 1,17,32,747 | 76,09,840 | 25,11,958 | 1,01,21,798 |

| Frontline Staff and Sales offiers | 3,21,785 | 44,218 | 3,66,003 | 3,16,595 | 31,289 | 3,47,885 |

| Total | 1,07,24,172 | 36,82,117 | 1,44,06,289 | 98,80,828 | 28,57,808 | 1,27,38,636 |

HR Tech

This year saw the Bank’s HR tech transformation journey took a decisive turn, with most of the HR services made available on mobile. The interventions were designed to amplify a ‘DIY’ approach through new-age interfaces, in line with the digital vision of the Bank. ‘I-Cube’, an HR conversational bot, was introduced to enable self-service and easy resolution of queries, not just for active employees but also for our former employees. Time Management piece was brought on mobile devices for all HDFC banks working in offshore locations. Many changes related to process governance, reporting, user friendliness were incorporated in the areas of hiring, employee on- boarding and learning. Other hygiene HR services were also brought on the device and network environment agnostic HCM solution.

Talent management

We have a structured, well- documented Leadership Competency Framework. as well as a Functional Capability Framework which defines key competencies and forms the bedrock for various talent processes in the Bank.

We have also institutionalised the process of Talent Review Councils, wherein a panel of leaders take an in-depth understanding of the Talent from multiple data points – self view from employee (mobility, career aspiration etc.), performance track record, Line Manager’s feedback on the talent and inputs of potential from the Development Center Report. This as a process, is covered for CX & 3 levels down of their leadership hierarchy.

The year also saw the launch of a 360-degree feedback at apex levels of leadership. The intervention covering Group Heads, Business Heads and senior leaders reporting to the Group Heads was launched with credible external partners and facilitated the gathering of honest feedback by those who experience the leaders at work every day. This helped creating better self-awareness for the leadership team.

Succession Planning in the Bank is a continuous process that aligns with the other talent management interventions and endeavours to mitigate critical people risks such as vacancy fulfilment, and transition risk. The process of development involves relevant role exposures, specific mentoring or coaching exposures and any specific learning need identified for employees, to assume higher responsibilities when the need arises.

We have a comprehensive, bi-annual performance management system (PMS) in place. Every employee is required to make a self-assessment and or her own performance (bi- annual basis) based on the key result areas of his roles and responsibilities. The Appraiser and Appraisee have a joint performance discussion based on the self-evaluation filled by the Appraisee. In FY22, the PMS was brought on mobile with pleasant and easy design, facilitating qualitative and quantitative dialogue between the supervisor and the supervised. It seamlessly encompassed elements of competence and Bank values in the process.

Talent: acquisition and attrition

Including frontline sales staff, we hired 57,200 employees. When compared to the hiring of FY21, the increase stands at 166%. In order to meet the growing requirements to outperform the market in identification, digital evaluation and quick onboarding of the best talent, we aim to implement the Applicant Tracking System in FY23.

ATTRITION BY CATEGORY

| 2021-22 | Attrition Rate | |||||

|---|---|---|---|---|---|---|

| Male | Female | Total | Male | Female | Total | |

| Senior management | 13 | - | 13 | 10.5% | - | 9.4% |

| Junior & Middle Management | 1804 | 377 | 2181 | 8.4% | 10.8% | 8.7% |

| Non Supervisory staff | 13080 | 4751 | 17831 | 21.6% | 24.7% | 22.4% |

| Total | 14,897 | 5,128 | 20,025 | 18.16 | 22.5% | 19.1% |

| Frontline Staff and Sales offiers | 14268 | 1820 | 16088 | 43.8% | 42.9% | 43.7% |

ATTRITION BY REGION

| 2021-22 | Attrition Rate | |||||

|---|---|---|---|---|---|---|

| Male | Female | Total | Male | Female | Total | |

| East | 3,649 | 549 | 4,198 | 25.50% | 24.70% | 25.4% |

| West | 10,639 | 2,585 | 13,224 | 25.30% | 25.00% | 25.2% |

| South | 7,006 | 2,009 | 9,015 | 26.40% | 27.70% | 26.7% |

| North | 7,868 | 1,799 | 9,667 | 25.00% | 25.20% | 25% |

| Abroad | 3 | 6 | 9 | 2.90% | 11.8% | 5.8% |

| Total | 29,165 | 6,948 | 36,113 | 25.50% | 25.70% | 25.50% |

ATTRITION BY AGE

| 2021-22 | Attrition rate | |||||

|---|---|---|---|---|---|---|

| Male | Female | Total | Male | Female | Total | |

| <30 | 15,009 | 4,453 | 19,462 | 36.6% | 32.1% | 35.4% |

| 30-50 | 14,066 | 2,485 | 16,551 | 19.5% | 19.3% | 19.4% |

| <62 | 90 | 10 | 100 | 7.3% | 4.4% | 6.8% |

| Total | 29,165 | 6,948 | 36,113 | 25.50% | 25.70% | 25.50% |

NEW HIRES BY CATEGORY

| 2021-22 | New hire rate | |||||

|---|---|---|---|---|---|---|

| Male | Female | Total | Male | Female | Total | |

| Senior Management | 9 | 2 | 11 | 7.30% | 13.30% | 7.90% |

| Non Supervisory Staff | 3,597 | 647 | 4,244 | 16.80% | 18.50% | 17.00% |

| Junior Management | 18,971 | 7,951 | 26,922 | 31.40% | 41.30% | 33.80% |

| Frontline Staff and Sales Officers | 22,446 | 3,628 | 26,074 | 69.00% | 85.40% | 70.9 |

| Total | 45,023 | 12,228 | 57,251 | 39.30% | 45.30% | 40.40% |

NEW HIRES BY AGE

| 2021-22 | New hire rate | |||||

|---|---|---|---|---|---|---|

| Male | Female | Total | Male | Female | Total | |

| <30 | 27,848 | 8,826 | 36,674 | 67.90% | 63.50% | 66.80% |

| 30-50 | 17,143 | 3,390 | 20,533 | 23.70% | 26.30% | 24.10% |

| <62 | 32 | 12 | 44 | 2.60% | 5.30% | 3.00% |

| Total | 45,023 | 12,228 | 57,251 | 39.30% | 45.30% | 40.40% |

NEW HIRES BY REGION

| 2021-22 | New hire rate | |||||

|---|---|---|---|---|---|---|

| Male | Female | Total | Male | Female | Total | |

| East | 5,283 | 858 | 6,141 | 36.90% | 38.60% | 37.10% |

| West | 16,507 | 4,538 | 21,045 | 39.20% | 43.90% | 40.10% |

| South | 11,252 | 3,652 | 14,904 | 42.40% | 50.40% | 44% |

| North | 11,973 | 3,167 | 15,140 | 38.00% | 44.30% | 39.20% |

| Abroad | 8 | 13 | 21 | 7.80% | 35.50% | 13.60% |

| Total | 45,023 | 12,228 | 57,251 | 39.30% | 45.30% | 40.40% |

Employee well-being

Our flagship initiative ‘HDFC Bank Cares’ aims to provide resources and a platform for physical, mental, emotional and financial wellness for all employees.

Our wellness initiatives are aimed to help keep our employees and their families healthy and safe in a year that saw an unprecedented test of human resilience. We also introduced a comprehensive ‘Compassion Package’ with an aim to reduce financial burden on surviving family members in case of the unfortunate event of the demise of an employee. The key features include offer of employment to a family member and financial support for education of 2 children till graduation, upto `10 Lakh. Other initiatives include providing additional leave, reimbursement of treatment expenses, on-call counselling support, e-consultation with doctors and awareness drives through various channels. Further, the Bank has an Employee Welfare Trust which cover expenses beyond Mediclaim on a case-to-case basis.

We also conduct regular health check- ups and mental health awareness sessions to address issues arising from a sedentary lifestyle and stress. All our employees are provided medical cover. For our women employees on the path to embracing motherhood, we have a comprehensive maternity care programme.

Further, as a part of our credit policy, we evaluate all large industrial/ infrastructure projects for potential adverse social impact, such as land acquisition, resettlement and rehabilitation, livelihood losses and compensation for the same, and also for exploitative labour or child labour practices. We strictly prohibit child labour, forced or compulsory labour in all forms in our operations. In addition, through our ESG policy framework, we strive to ensure that our vendors and suppliers abide by the labour laws and human rights – including prohibition of child labour, forced labour and trafficked labour. In FY22, we received no complaints on infringement of human rights, cases of child labour, forced labour, and involuntary labour. The facility attendants deployed at our sites for ensuring security are imparted training under the provisions of the PSARA Act, 2005 through security agencies on various aspects of security, safety, etiquette and personal conduct/behaviour.

There is also an employee association at the Bank. As of FY22, 0.18% of our permanent employees are part of this association. The Bank has an internal Memorandum of Settlements that may be interpreted as a collective bargaining agreement, signed between the Management and Union office bearers. There are periodic negotiations with Union Office Bearers and the Memorandum of Settlement is signed by the Management to the extent of their benefits and service conditions – including any significant operational changes. We provide 21 days’ notice typically to employees and their representatives prior to implementation of significant operational changes that could substantially affect them.

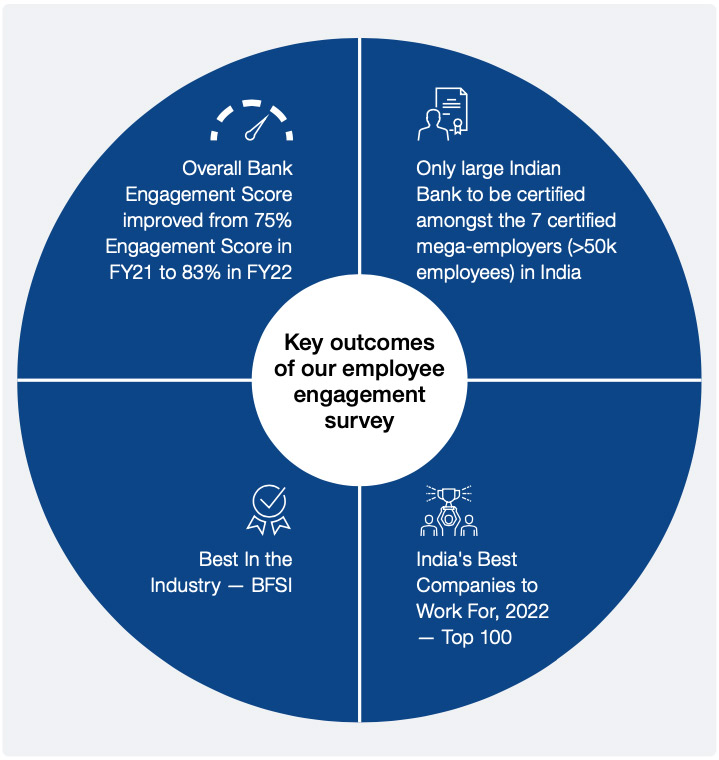

Measuring employee engagement

HDFC Bank continues to be certified as a Great Place to Work® Organisation. This certification is a testimony to the Bank's inherent strength as an institution par excellence and the efforts to support and enable employees through best-in-class people practices and processes.

The Bank partners with Great Place to Work® to conduct their employee engagement survey over three cycles (18 months per cycle). Organisations participating in the survey are assessed through two lenses — the Trust Index and the Culture Audit. Great Place to Work® Institute audits the company’s human resource practices and policies. On meeting the qualifying criteria, the organisation is certified as a Great Place to Work for a period of one year.

The survey was conducted for a second time in November 2021. Over 94% of the eligible employees (86,506 employees) participated and scored the Bank on five key parameters, namely, camaraderie, fairness, respect, pride, and credibility, amongst its employees. The important distinction that this score brings is as follows:

The important distinction that this score brings is as follows:

Employee connect initiatives

Over the year, we organised several initiatives that provide employees an opportunity to connect with the organisation beyond their work-life. These initiatives spanned multiple areas including sports, art, music, wellness, and photography, ensuring there is something in it for everyone. We also focused on involving family members which was met with an enthusiastic response. 43,121 employees participated across 21 initiatives during the year. Following is a brief on some of the key initiatives

Wellness sessions

Morning fitness sessions on Zumba, Yoga, Suryanamaskara, Meditation and Pranayama were introduced to help keep our people physically and mentally fit during challenging times.

Take-a-break

We introduced weekly quizzes via e-mail on topics including general knowledge, famous personalities, logical reasoning, and visual puzzles like spot the difference for employees. The initiatives garnered a lot of interest and participation while providing a much-needed break to the employees.

Syahi

Syahi is the online writing contest of the Bank and this year a separate category for Hindi writers. Employees showcased their creative writing skills through enthralling fictional as well as anecdotal accounts. The winning stories, selected by an external judge, were curated and published in the form of an e-book on the Our World platform.

Corporate fitness challenge

We participated in an inter-corporate fitness challenge contest. The contest conducted over 10 weeks included different challenges such as doing the maximum number of push-ups, planks, etc. The first position in the contest was bagged by one of our employees. Apart from this, six employees won awards across different categories.

Festive webinars

To add some excitement in the festivals during the pandemic, we conducted different webinars/DIY workshops for employees during popular festivals like Ganesh Chaturthi, Navratri, Diwali and Christmas. These workshops were also focused on involving employees’ children. Activities such as creating an Eco Ganesha, storytelling around the history of the festival, and interesting games centred around such stories, were conducted as a part of these workshops.

Million dollar challenge

In 2020, we introduced this interactive online team building game which became very popular among employees. Last year was the second season of this challenge. This game served as a very effective icebreaker for new joiners. We also leveraged the game to build camaraderie in cross- functional teams.

AnalytIQ

In Season 2, employees had the option to play Chess, Sudoku and Scrabble online. It was a round robin contest and had different levels of shortlisting. The competitive format spurred a lot of excitement among employees and led to a high level of engagement.

Breakfast cycle rides

Breakfast cycle rides were organised for our riding enthusiasts in Mumbai. This being the first on-ground initiative post lifting of lockdown, saw limited albeit enthusiastic participation.

Corporate photography contest

This is an inter-corporate photography contest held every year. Out of a total of 3,349 photographs contributed by our employees, 332 were shortlisted in the top 1,500. We bagged the second prize in the wildlife category. A virtual 3-D exhibition of these photographs was held for all employees.

Digital Voice Hunt

This was the second season of this initiative wherein we collaborated with Furtados School of Music to organise a music competition for our employees, their children and spouses. This year, we also involved their parents, grandparents and in-laws. We received rave reviews from the family members who participated.

Xpressions

In season 7 of Xpressions, we saw some very creative artwork prepared by our employees and their children with an artistic bent. The artwork was displayed as wallpapers on the Bank’s laptops, thus earning organisation-wide recognition for the participants.

HUNAR

HUNAR is an annual talent hunt organised for employees and their families. 17,000+ votes were cast in appreciation of their performances, from which we announced popular choice as well as judges’ choice awards.

Women’s day celebration

This unique initiative was arranged for the women in the workforce. We held a series of webinars on topics such as ‘Happiness Inside Out’, ‘Mental Health Awareness’ and ‘How to love yourself?’ over a course of 4 days in a virtual setting.

Summer camp

A novel 5-day online summer camp introduced for the kids of our employees included some interesting activities around science experiments, fire-free cooking, talent showcases as well as behavioural learning. We received heart-warming feedback for the event.

Zaika

Zaika is a cooking contest launched in 2019. The initial rounds were conducted online in six cities out of which the shortlisted candidates were invited to Mumbai for a finale. The winning recipes of Zaika were compiled in an e-book and uploaded on Our World for display.

Energise yourself

Mental well-being is as important as physical well-being. In order to raise awareness on the subject, we conducted webinars on topics like reboot happiness, energy and frequency, art therapy and healing with sound. These sessions helped employees stay happy and energised.

Funtakshari

Centred around our love for Bollywood songs, ‘Funtakshari’ is a fun competition open to employees as well as their families. The initiative became very popular and was much appreciated by all.

Session on photography

Looking at the interest in the inter-corporate photography contest, we decided to conduct a workshop on photography in which the employees learnt different techniques of photography, camera care 101 and types of lenses that can be used for different types of photographs.

Auction Premier League

This was an interactive activity conducted in the IPL auction style to promote team building, thinking out-of-the-box, presence of mind, collaboration and strategic thinking.

The InQUIZitive Family

Organised as a team activity for families, this was an online quiz competition held in multiple levels. There was enthusiastic participation with request for more of such initiatives in the future.