Strategy in Action

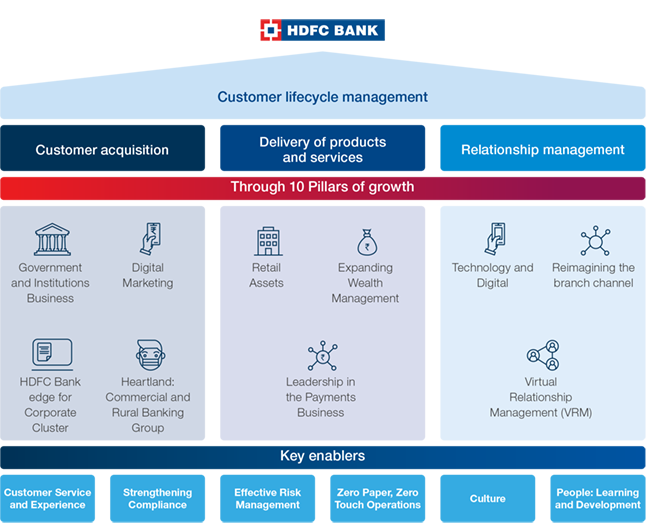

Our future-ready strategy

India is one of the fastest growing major economies and as one of the largest private sector banks in India, we are well-positioned to capitalise on this opportunity. At HDFC Bank, we continue to focus on executing our ten-pillar strategy across various products and segments to create, catalyse and capture the next wave of growth. The focus on our straregic pillars drives our consistent performance.

We continue to enhance our compliance culture and exhibit highest compliance standards. Our risk management and compliance framework is embedded in the systems and processes across operations and functions and is overseen by a diverse, experienced, and competent Board. As we take strides forward, the customer remains at the core of our strategy. Armed with robust technology and capitalising on digitalisation, we are providing seamless digital customer on-boarding and service management journeys. Our investment in our people and adherence to our culture ‘The HDFC Bank Way’ enables us in our onward journey.

Re-imagining Retail Branch Banking

Our growing phygital reimagined branch channel is pivotal to our strategic intent of being India’s best customer-centric brand across industries, within the next three years. Retail Branch banking is the key enabler for retail deposits, retail trade and forex business, unsecured and secured asset business and third-party distribution business. We continue to reimagine our branch channel backed by micro market focused multiformat distribution science, phygital transformation, analytics and Artificial Intelligence (AI). This is backed by an institutionalised approach to customer life cycle management and a ‘Service First culture’.

The levers that bring to life our reimagining branch channel strategy are:

Micro market focused multiformat distribution science

Service First culture

Instutitionalised approach to customer life cycle

Customer life centric insight-led proposition

AI analyticsdriven customer conversations (Next Best Action)

Enabling phygital transformation

Holistic customer life cycle management

It starts from our ability to map and source the right set of customers using a differentiated go-to-market approach and results in having need-based conversations and offering the right product proposition. It also entails continually nourishing the relationship through our relationship management architecture and recommending next best actions and implementing them. Our 'service first culture' is embedded throughout the customer life cycle management journey.

Analytics led customer conversations and distribution planning tool

Our approach is based on ‘Needbased Selling’ and is empowered by robust analytical tools and AI. 'Next Best Actions', are suggested based on a study of customer transactions/digital behavior across the Bank's digital assets. Further, relationship managers are equipped with suggestive 'Immediate Next Best Actions', based on real time digital transactions/customers interactions.

Our micro market focused multiformat scientific study of data drives decisions on meeting customer needs through retail phygital branch/Digital Banking Units/‘Smart Banking Lobby’ or Business Correspondents. An optimum mix of digitisation along with relevant human interactions, enables us to deliver superior services.

Digitisation of sales, service and Branch operations

We continue to embed and enhance customer digital journeys, be it sales, service or operations. It also entails enhancing phygital through digital delivery in physical branches.

Mobile-first approach leveraging Aadhaar and ‘Walk Out Working’ (WOW) straight through journeys, are some of the initiatives that are helping us achieve significant benefits, in terms of improved customer experience along with cost reduction. WOW customer service journeys have scaled up customer adoption by ~45% (cumulative) and is expected to grow further.

Customer Experience Excellence

The cornerstone of Customer Experience Excellence is to delight customers at every touch point. In this endeavour, our initiatives include process simplification through digitisation, reimagining the customer journeys and making them userfriendly. We are enhancing self-service avenues and thus empowering customers in completing paperless journeys on their own. Our Net Promoter Score, a metric of measuring customer satisfaction and loyalty, has shown 22% improvement over FY21.

People capability

Our people are the face of the Bank. Our aim is to strengthen our teams to better understand the ‘Voice of Customer’ to enable us to create newer propositions, simpler processes and seamless customer experiences. We have equipped our teams with AI and analytics-driven pinpointed regular customer level analysis to enable enhanced engagement. Further, we continue to train our teams through interactive learning interventions that equip them to enhance customer delight in all their interactions. The learning interventions are customised based on analytics.

Virtual Relationship Management

As a future-ready Bank, we have further strengthened our Virtual Relationship Management (VRM) channel to enhance customer engagement and provide seamless customer service experience. A banking experience with digital ease and personalised need based conversations, is at the core of our VRM strategy. The Virtual Relationship Management practice is an integrated customer-centric approach consisting of three pillars:

- Virtual Relationship

- Virtual Sales

- Virtual Care

The Virtual Relationship Managers serve the customer life cycle across – a) Save b) Invest c) Borrow d) Transact e) Engage. We believe that we have a head start with our Virtual Relationship Management practice, leveraging an Omnichannel Engagement framework, seamless digital journeys, data science-led customer interactions and a robust talent pool of well-trained Virtual Relationship Managers. Your Bank has made significant investments in technology upgradation of the customer facing solutions around Interactive Voice Response Systems, Data Management and digital engagement platforms like Video KYC, to offer a world-class virtual engagement framework for its customers. Our systems are structured, secure, compliant, automated and avoid any data leakages. Our VRM framework provides seamless 24/7 access to customers and experiences, in line with global service standards.

We provide automated interactive voice response solution in 12 languages with 20+ services. We offer world-class service interaction, with an analyticsled need-based product distribution approach, aimed at making us the preferred banker of choice for the customer.

Our Virtual Care approach is an extension of our customer-centric programme — ‘Infinite Smiles' and we aim for customer satisfaction in every interaction. We have progressed further on our conscious journey of a culture transformation, which is enshrined along with the critical leadership tenets of ‘Nurture, Care and Collaborate’. This has also contributed to better complaints management and reduced customer wait time.

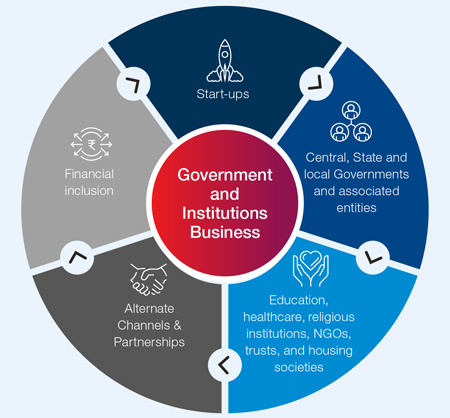

Government and Institutions Business

Growing focus on digitisation of transactions and Government push towards transparency offers an enormous opportunity in this segment. We aim to capitalise on this opportunity by focusing on the following key areas:

The Government of India has unlocked a large revenue pool by allowing private sector banks to participate across all areas of Government business. We are a leading bank in managing Government fund flows, with ~26% of total flows routed through the Bank. The single nodal agency construct introduced in September 2021 by GOI will further augment these flows. We are leveraging our extensive reach, intuitive technological solutions, our deep network, and sustainable livelihood initiatives to maximise this opportunity. We facilitate digitisation of agricultural procurements, e-governance for tendering and auction, amongst others, and offer a differentiated and seamless experience for Government bodies. In FY22, the Bank was recognised as one of the top 5 Banks in the country processing pay-outs, including direct benefit transfer under the single nodal agency construct by the Ministry of Finance to enable this. The Bank has facilitated and/or developed the necessary technological solutions to provide customers with a high quality user experience.

Our comprehensive digital suite also acts as a catalyst driving growth in the institutional business. We have adopted an ecosystem-based approach to harness the growing opportunities in educational institutions, religious institutions, and housing societies. We enable collections of society payments, donations, fees, as well as manage payments to vendors, employees, etc. We have also forged partnerships with tech players to adopt an API-based approach to cater to the needs of this segment.

Parallelly, we are making continuous investments to expand our distribution network in the deep geographies of the country. Rapid adoption of technology coupled with deep penetration of mobile and internet provides fertile ground to tap into opportunities, by digitally connecting the last mile. Till date we have on-boarded 4 Lakh+ Village Level Entrepreneurs (VLE) as Business Facilitators and Business Correspondents to help source business for us. With the help of the VLEs, we have been able to create a large distribution network to capture the opportunities in the semi-urban and rural areas. Our octopus model of distribution puts existing branches at the core, supported by agents empanelled through marquee tieups and partnerships. These agents are capacitated by the Bank through digital infrastructure, branding and visibility to function as a mini branch. Digitallyassisted and unassisted journeys are in play, with a combination of fintech and APIs that deliver a seamless experience securely. These alternate channels not only create value for the Bank but also have a larger societal impact supporting nation-building and the Government’s financial inclusion agenda.

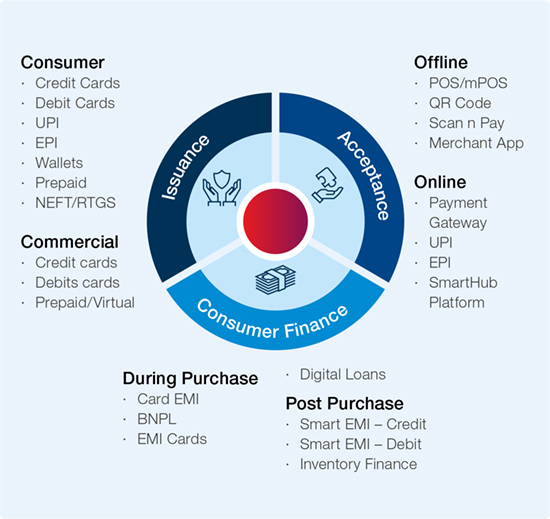

Leadership in Payments Business

Payments business is an integrated business with key wheels of Issuance, Acquiring and Consumer Finance fulfiling the needs of every customer segment. We continue to be a leading player in the payments ecosystem with a leading presence and market share in issuing, acceptance and consumer finance businesses. We also bring throughput value to other businesses of the Bank through our frequency of transactions which is a source of core data for deeper understanding of our customers and drives data analytics for the Bank.

Issuance business provides extensive range of payment solutions to the customers in every segment. We have grown significantly across Credit Cards, Debit Cards, Prepaid cards, PayZapp Wallet, EMI and EPI/Direct Pay. Customer spends have crossed 8 Lakh Crore in FY 22 with 63 Million+ cards (Credit Cards, Debit Cards and prepaid cards) addressing every market segment. Every third rupee spent on cards in India, happens on HDFC Bank cards. Adapting to the changing customer behaviours, we have expanded our customer offerings. We are a leading player in credit cards with a strong growth and market share on both booksize/ENR and spends. We have the best suite of cards curated for the needs of both young professionals and ultra premium customers. Digitally enhancing customer experience and services for our customers is a key strategy and we launched ‘MyCards’ application to help card customers to self service digitally. Our future plan is to fortify the MyCards offering to a comprehensive Cards servicing solution for the Credit Card and Debit Card customers. PayZapp is a key strategy to drive customer engagement across all payment forms. It will be providing a strong, unified experience across contactless payments, QR-based payments, UPI payments, and BNPL, and will be digitising all payment form factors with rich features on a unified platform. The revamped PayZapp 2 is around the corner and will be providing a unified experience across contactless payments. Smartbuy continues to play a key role in providing a strong loyalty framework and has gained popularity among customers for providing accelerated reward points and reward redemptions on a single platform. To complete our suite of products and payment suite to the retail consumers, we are scaling BNPL with multiple variants that we are building to make customer purchases convenient. Between Credit Card EMI, Debit Card EMI and paper financing, we are riding the wave of innovation and have become No.1 among all banks in BNPL.

Acceptance business is all about building the core network connecting the entire payment ecosystem and receipts business. Our full suite of online and offline payment solutions consists of Payment gateway, UPI, EPI, Smart Hub platform, POS/M POS, QR Code and Scan & Pay, among others. Within acceptance business, Merchant Acquiring business provides the railroad for banking solutions and payment offerings to the largest customer segment – MSMEs. As a Bank, this business gets us entry into the large and thriving MSME ecosystem that forms the backbone of our economy. We have been leading this business and despite the disruptive competition in this space, we have about 47% market share in cards, 1 Million+ POS terminals deployed and 14.5 Lakh Crore+ volume acquired across cards, NetBanking and UPI. We are strengthening our Partnership pillar by forging alliances with large fintech players to corner large opportunity segments with targeted value propositions like EMI, pay later and digital storefronts. Smart Hub continues to be a pioneer comprehensive payment and banking solution for all merchants, and we will be launching the enhanced Smart Hub App Platform soon. We have been continuously transforming the experience on SmartHub Vyapar App platform to instantly become a merchant with the widest range of payment acceptance, easy access to loans and banking solutions with a single view of all transactions. Further, the platform will allow merchants to instantly open current account and start accepting payments on the go.

Consumer Financing consists of lending at the point of sale i.e. the EMI business, and this business feeds off the acceptance and issuance business. We fund both during purchase and post purchase transactions through cutting-edge offerings such as Cards EMI, Buy now Pay later (BNPL), digital loans, Smart EMI – Credit, Smart EMI – Debit and inventory finance, among others. We are reaching out to New to Credit (NTC) customers and new age customers, extensively in this space.

Technology and digital

As a future-ready bank, we are technology and digital led in most of our operations. Today, 93% of the Bank’s transactions are processed digitally. As a part of our technology transformation agenda, we have taken great strides under the three legs of Digital Factory, Enterprise Factory and Enterprise IT. While Enterprise Factory and Enterprise IT focus on strengthening the core technologies and networks, Digital factory is aimed at enhancing customer experience through differentiated products and services. This approach is further illustrated through our 5-pillar strategy for bringing in key shifts in the banking experience.

We aim to make day-to-day banking simple for our retail customers through easy and unified payment experiences and seamless assisted and unassisted journeys. Our ecosystem-based offerings for MSMEs cover the entire supply chain with native journeys in local languages providing a transformational commercial banking experience. With APIfication and deep ERP embedding, we offer frictionless banking services for large corporates, mimicking retail experiences. We are leveraging advanced AI and deep analytics to simplify investments for our wealth customers. We contribute to the Digital Bharat growth story with a local touch through assisted journeys, multilingual capabilities, and deep digital distribution points. The objective is not just to develop new products but to innovate rapidly and at scale, so as to serve the entire gamut of our 7.1 Crore strong customer base. In order to achieve this, we also forge strategic partnerships with new-age fintech players to offer plug and play solutions.

Powering these initiatives is our strong technological backbone. We have fortified our infrastructure security and resilience through scalable, state-ofthe-art data centers, AI/ML based security and monitoring systems and deep automation in DR resiliency. We are also strengthening the foundation by re-architecting the core technology. We are ‘hollowing out the core’ by moving away from legacy systems into a cloud native, agile system, and a neo-technology stack.

Our people are the most important enablers as we transform into a future-ready, digital-first bank. We are refreshing our people practices adapting to new ways of working. Our hiring strategies leverage Gen X to Gen Z talent offering diverse skillsets to build in-house deep-tech capabilities. Our focus is on fostering a culture of innovation, agility and growth.

The Bank has lined up exciting launches in the coming quarters with offerings that not only make banking simpler but also augment the experience through value added services. Our MobileBanking app is undergoing a massive re-write with a refreshed UI/UX focusing on journey simplification for the customer. The end goal is simple, customer delight across all segments on the back of a resilient infrastructure and seamless digital experiences.

Key tenets of technology and digital

Differentiated customer experience

- Design frictionless journeys for straight through processing

- Digitisation of branches with paperless journeys

- Create Neo customer digital experiences

Rapid innovation at scale

- New products and journeys designed at pace and scale

- Plug & play integration with new age Fintech partners

- Best-in-class products and services powered by innovation, agility-atscale

Data and platform orchestration

- Embedded AI/ML capabilities spanning products and processes

- Deeper analytical capabilities and synergised operational efficiencies

- APIfication of data to enable sophisticated customer journeys

Resilient and secure core systems

- Zero-trust architecture, advanced platforms and analytics for best-in-class security posture

- Next level disaster recovery with automation and ‘Hot DR’ setup

- Multi-cloud strategy, data centre consolidation augmented with scalability through containerisation

Nurturing tech talents

- Transforming people practices to adopt new ways of working

- Fostering a culture of innovation, agility and growth

- Gen X to Gen Z: leveraging diverse skill sets as a key enabler

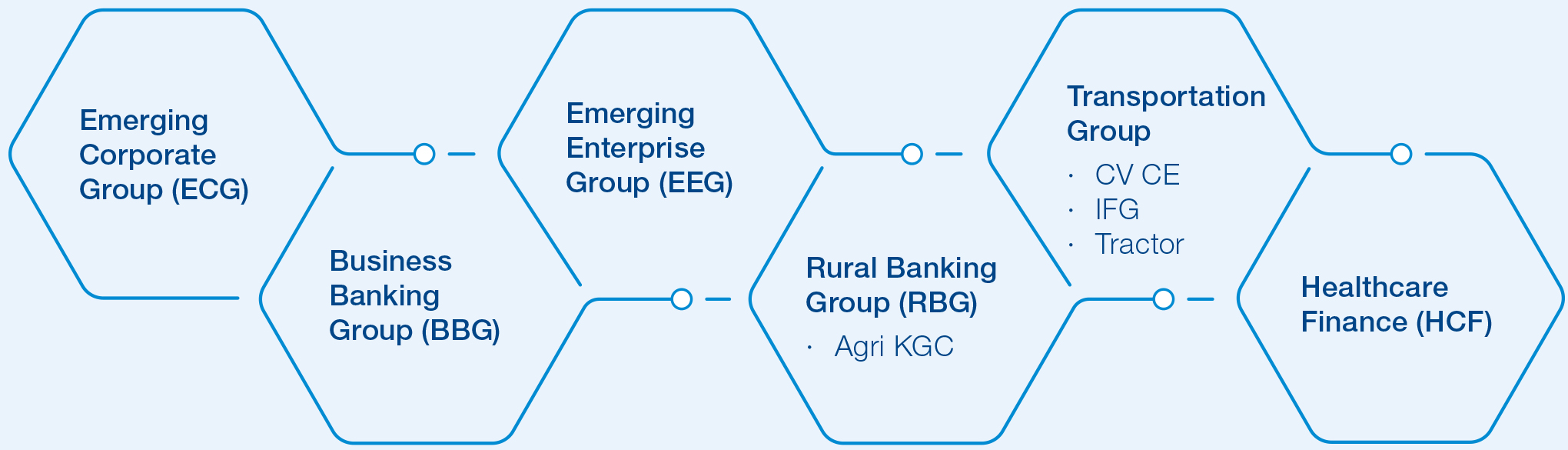

Commercial & Rural Banking

Commercial and Rural Banking (CRB) primarily caters to entities in manufacturing, exports, employment, retail and trade, supply chain network and infrastructure. CRB lending constitutes a large part of our PSL lending book. CRB serves Micro, Small and Medium Enterprises (MSMEs), emerging corporates, commercial agriculture, farmer finance, healthcare finance, equipment finance and commercial transport companies. We are committed to helping resolve the challenges faced by this market segment, like lack of easy or timely access to credit, high cost of credit and collateral constraints.

This group enables acquisition of customer at an early stage. For instance today’s SME and MSME will transition to tomorrow’s midcorporates and large corporates. The Bank aims to support the journeys of these companies as they mature through the lifecycle.

The rise of the digitally-enabled customers presents a unique opportunity to scale business and increase wallet share through augmented end-to-end digital journeys and increasingly personalised offerings and services. With products and platforms such as the SME portal, the Bank caters to the needs of the new-age customer. The Bank intends to grow its agriculture and allied book by diversifying its portfolio from staple crops to agri allied and high value horticulture crops. It also plans to augment as well as facilitate the growth of individual ecosystems that exist within the group, (such as the rural ecosystem, healthcare ecosystem, transportation ecosystem or the supply chain network) with products and services tailored to add value and financial strength. The market potential in the segment that the CRB group caters to is immense and the Bank is well-poised to capitalise on this opportunity by leveraging its reach, innovation capabilities, digital prowess and ecosystem offerings.

Commercial and Rural Banking Group

Retail Assets

Our Retail assets strategy is to deliver best-in-class algorithm-driven Digital lending. We continue to be a responsible, agile and innovative retail services provider. Our portfolio consists of secured/unsecured lending products such as auto loans, home loans, personal loans, gold loans, etc. to cater to various classes of retail customers. We aim to expand across newer geographies and deepen our presence in existing geographies through a customer centric approach, prudent pricing, introducing indigenous digital products while maintaining the quality of our portfolio. Our increased end-to-end digital lending journey across most of our products, backed by robust credit research, analytics and strong IT infrastructure, is enabling our consistent growth.

Over the years, we have simplified and digitised processes, thus reducing turnaround time across products, by digital integration coupled with algorithm-based usage experience. Our key indigenous digital products such as Xpress Car loans, 10 Second Personal loans, Digital loan against shares, and Digital loan against Mutual funds, among others, enable not only our existing customers but also new to bank customers to avail loans in a seamless manner. These initiatives address the needs of the growing population of digital savvy customers including the millennials.

One of the key focus areas is strengthening our position in unsecured product by further penetrating in Government segment supported by our increasing geographical presence and nimblefooted lending solutions. We have built in processes and controls and invested in our branch network to manage the risks, to ensure our Gold Loan portfolio grows significantly. We are offering seamless loans across geographies, expanding our reach in semi-urban and rural markets for deeper penetration.

Corporate Cluster

Corporate Banking continues to consistently contribute to our growth. Our holistic suite of products and services gives us an edge over competitors. Our customer base extends from large business houses, MNCs, Companies in the manufacturing and service sectors to public sector enterprises, and financial institutions, among others.

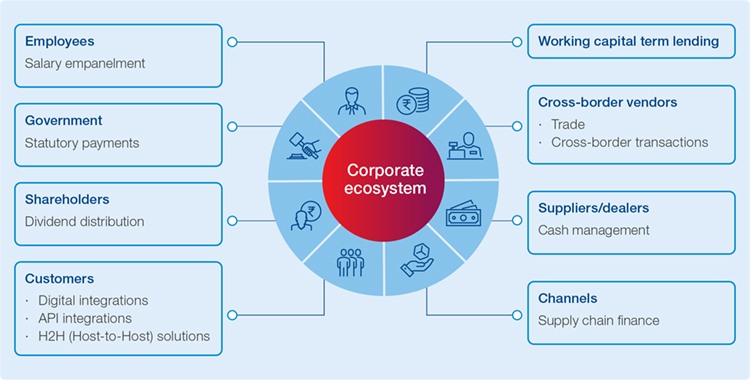

While lending is the mainstay of Corporate Bank, our strategy has been to strengthen relationships by providing banking products, solutions to corporates, to manage their receivables, payables, taxes and trade. Our product suite covers the entire corporate ecosystem which includes providing payroll management and personal banking services to their employees and key officials.

The Bank provides value-added and industry-specific solutions by leveraging its detailed processes and on-ground intelligence about corporates’ processes, distribution networks and geographies.

As a Digital Bank, we have host to host connectivity with the large corporates using APIs and we are working towards digitising end-toend transaction processing within their ecosystems. We are leveraging cutting-edge technologies such as Artificial Intelligence and Machine Learning for deep analytics to derive actionable insights for increase in share of wallet. The quality service offering that is provided to our corporate customers can be extended to customers and suppliers of the corporate using ‘ecosystem banking’. The idea is to bring the corporates' entire financial world under one umbrella. We aim to continue to add value to the corporate ecosystem by focusing on:

- Use of technology, processes, and products to cater to the corporate journeys

- Offering financing solutions to the eco system partners – vendors, suppliers/dealers, channel, and customers – of the corporates through digital platforms

- Identifying white spaces and cocreating financial products by benchmarking with the best-in-class

- Innovating Trade Products to cater to specific needs of the Corporates

- Being the Banker of choice to MNCs with the goal of becoming the largest bank to multinationals in India

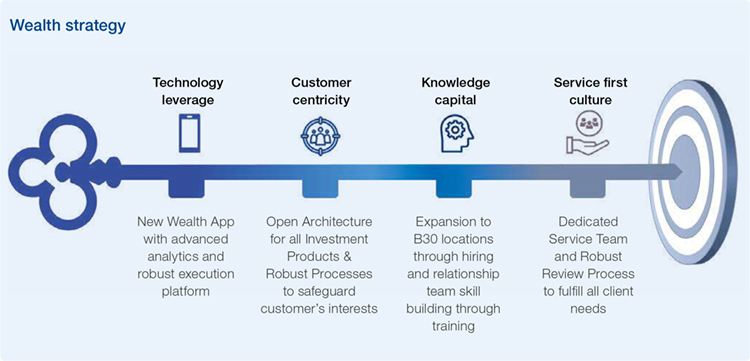

Wealth

Wealth is one of the key focus areas for the Bank. We are focused on the Affluent and Mass Affluent segment of customers to drive growth. A large proportion of wealth in India is distributed even beyond the top 20 cities of the country. The Bank aims to increase the Wealth Relationship team and expand its reach in B30 (beyond top 30) cities, to tap into this segment through a hub and spoke model. The Bank’s Wealth team is currently serving customers across 216 cities and is on track to reach 800+ locations by the end of this financial year. We are also investing in our people through intensive training to develop the right knowledge capital and service skillsets to provide consistent quality of service across these locations.

Our dedicated service team for Wealth Clients ensures delivery of our 'Service First' philosophy. The bank has adopted Annual Recurring Revenue (ARR) as a key metric to ensure transition from transactional approach to portfolio management approach and minimise churn. We have an open architecture for insurance where we have multiple partners across life, health, and general insurance to offer the right product to the right customer. Our non-proprietary framework across investment products which makes recommendations based on robust quantitative and qualitative evaluation model, re-accentuate our customer centricity.

We are developing a mobile-first Wealth Platform that will leverage advanced analytics and AI-driven recommendations to provide differentiated wealth solutions across all customer segments. The digital platform will focus on agile, unassisted journeys and mass personalisation to cater to customers across the country. The goal is to deliver a highly personalised experience that democratises wealth management and makes it accessible for all our customers.

Digital Marketing

Our digital marketing strategy is to create awareness about our brand, build brand loyalty for our financial solutions and services through a deep understanding of customer behaviour and preferences. Digital marketing for us entails providing frictionless customer journeys and addressing customer requirements with the right product, at the right time, in their most preferred channel of communication and with high levels of personalisation. One of the key outcomes expected from this strategy is contribution to direct business generation. Our website has seen growth in customer visits in both tier and non-tier cites evidencing increase in our reach and recall.

We are executing our strategy through our omni-channel presence, advanced analytics, data science, working in cross functional teams and through customer advocacy.

- Omni-channel: We are using our Omni-channel forte consisting of website, Net and MobileBanking, notifications, SMS, Email, WhatsApp and social media to deliver the business portfolio objectives. We are developing segmented and personalised communication based on highly advanced AI/ML models.

- Advanced analytics and data science: Investments in Cloudrelated advanced analytics tools enable deep understanding of customer behaviour, and their preferences to curate personalised interventions, at scale and to create relevant customer engagement. Through technology and digitisation, we are executing digital marketing plans at scale and in tandem with the traditional marketing channels to provide our customers quick and easy access to all our financial solutions. We have revamped our digital journeys for loans, deposits and payment solutions which allow our customers to purchase products in a few clicks in a frictionless manner.

- Our investment in advanced analytics engine ‘Spark Beyond’ tests millions of hypotheses and builds multiple models in minutes with the aim to understand customer needs, have meaningful customer interactions and build customer relationships. 'Spark Beyond' impacts all channels of the Bank, bringing higher productivity for manned channels and increase of business in unassisted channels.

- PODs: To support end-to-end outcomes like un-assisted business generation digitally, we work in multidisciplinary and cross-functional teams called PODs. These PODs solve business problems through a lens of data-backed root-cause analyses and hypotheses.

- Stimulating customer advocacy: We identify and address grievances across customer digital journeys and products to earn customer trust and create brand advocates using online reputation management, ratings, reviews, and testimonials.