What is the CIBIL Credit Score and how to check your score?

By clicking on this link you will be redirected to a 3rd party website. HDFC Bank does not have control over the content, security or data collected on the 3rd party website nor shall HDFC Bank be responsible for the use of this website.

Have you ever considered taking a loan to buy a new house, or to purchase that dream car of yours? Maybe even start that business of yours?

If you want to borrow or take a loan from the bank or a financial institution, make sure you have a good credit score. Banks and financial institutions check CIBIL score formerly before granting any loan.

The CIBIL score explained

The Credit Information Bureau (India) Limited (CIBIL) is the one of popular bureaus of the four credit information companies licensed by Reserve Bank of India. There are three other companies also licensed by the RBI to function as credit information companies. They are Experian, Equifax and Highmark.

CIBIL Limited maintains credit files on 600 million individuals and 32 million businesses. CIBIL India is part of TransUnion, an American multinational group. Hence credit scores are known in India as the CIBIL Transunion score. CIBIL Score is a 3-digit numeric summary of your credit history, rating and report, and ranges from 300 to 900. The closer your score is to 900, the better your credit rating is.

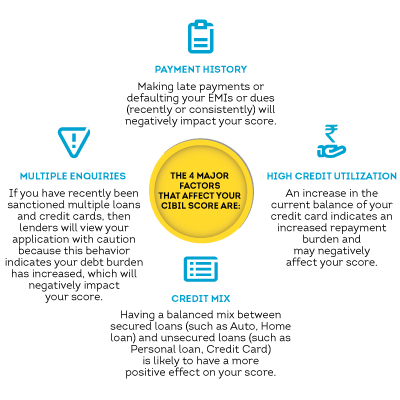

What factors affect your CIBIL Score?

How to improve your CIBIL score?:

You can improve your score by practising financial prudence – repay your Credit Card bills on time, don’t miss your loan EMIs, never default on debts, use credit wisely. You can read more on how to improve your cibil score. Read More