|

|

|

|

| Type & Investment Objective |

| The fund is a balanced advantage fund that endeavours to provide capital appreciation over a long period of time from a judicious mix of equity and debt investments. |

|

| Fund Characteristics |

| The fund maintains equity allocation in the range of 65% to 100% of the total corpus. Asset allocation between equity and debt largely depends upon valuations, growth outlook and prevailing interest rate scenario. |

|

| Returns (%) |

| (As on 31st May 2019) |

| Period |

Fund |

CRISIL Balanced Fund - Aggressive Index |

| 3 Months |

10.01 |

8.02 |

| 6 Months |

7.36 |

5.52 |

| 1 Year |

23.26 |

16.10 |

| 3 Year |

20.91 |

11.36 |

| 5 Year |

17.51 |

11.12 |

| Since Inception |

16.81 |

_ _ |

|

| Absolute for < = 1 year and annualized for > 1year |

|

|

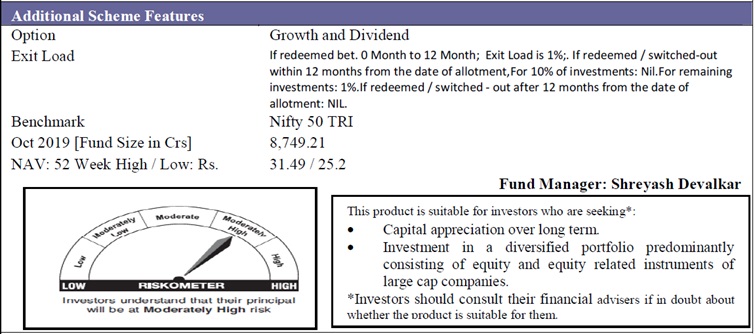

| Type & Investment Objective |

| The aims to achieve long term capital appreciation by investing in a diversified portfolio predominantly consisting of equity and equity related securities of large cap companies including derivatives. |

|

| Fund Characteristics |

| The fund is a large cap equity fund that invest minimum 80% in large caps and can take upto 20% exposure in mid cap stocks. The fund manager maintains a concentrated portfolio of large cap stocks with bottom up investment approach and invests in quality companies which have high growth potential. |

|

| Returns |

| (As On 29th November 2019) |

| Scheme Name |

Inception Date |

SEBI Categorisation |

NAV

Rs. |

Returns For |

| 6 m |

1 Yrs |

3 Yrs |

5 Yrs |

Incep |

| Axis Bluechip Fund |

05-Jan-10 |

Large Cap Fund |

31.62 |

7.30% |

18.29% |

19.28% |

9.91% |

12.33% |

|

|

|

|

| Absolute for <= 1 year and compounded annualized for > 1 year |

|

| Additional Scheme Features |

|

| Source for entire data stated above is ICRA Online Ltd. (For Disclaimer of ICRA Online Ltd, refer http://www.icraonline.com/legal/standard-disclaimer.html) |

|

|

|

| Type & Investment Objective |

| The fund is a large cap equity fund that aims for growth by investing in companies in the large cap category. |

|

| Fund Characteristics |

| The fund invests in large cap companies which have proven track record, quality management and have good growth potential. As a stock selection process, the fund manager applies bottom-up investment approach and mainly invests in companies that offer good growth potential over the long term. The fund manager may also take aggressive positions in high conviction stocks with an aim to generate higher alpha. The fund manager may look at factors such as strong fundamentals, future turnaround in the business cycle and revival in economic growth to select stocks in the portfolio. Further, to maintain diversification at sector level, the fund manager follows benchmark hugging approach with a deviation of +/-5% as compared to sector weight in benchmark index. |

|

| Trailing Returns |

| (As on 31st July 2019) |

| Period |

Fund |

CRISIL Balanced Fund - Aggressive Index |

| 3 Months |

10.01 |

8.02 |

| 6 Months |

7.36 |

5.52 |

| 1 Year |

23.26 |

16.10 |

| 3 Year |

20.91 |

11.36 |

| 5 Year |

17.51 |

11.12 |

| Since Inception |

16.81 |

_ _ |

|

| Absolute for < = 1 year and annualized for > 1year |

|

|

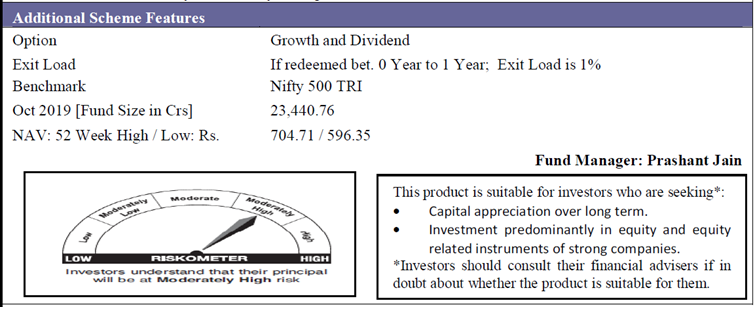

| Type & Investment Objective |

| The fund is a multi cap equity fund that invests across market capitalisation. Primary investment objective of the fund is to achieve capital appreciation over the long term period. |

|

| Fund Characteristics |

| The fund manager applies mix of Top-Down and Bottom-Up investment approach. The fund invests in the companies which are growing faster than its peers, enjoys competitive advantage and have good track record over the longer period. The fund maintains the diversified portfolio across key sectors and variables across the economy to reduce risk. The fund has low portfolio turnover ratio, as the fund manager buys stocks with long term investment horizon and remains invested till the valuations objectives are achieved. |

|

| Returns |

| (As on 29th November 2019) |

| Scheme Name |

Inception Date |

SEBI Categorisation |

NAV

Rs. |

Returns For |

| 6 m |

1 yr |

3 Yrs |

5 Yrs |

Incep |

| HDFC Equity Fund |

01-Jan-95 |

Multi Cap Fund |

672.75 |

-3.04% |

8.82% |

12.02% |

6.73% |

18.39% |

|

|

|

| Absolute for <= 1 year and compounded annualized for > 1 year |

|

| Additional Scheme Features |

|

| Source for entire data stated above is ICRA Online Ltd. (For Disclaimer of ICRA Online Ltd, referhttp://www.icraonline.com/legal/standard-disclaimer.html) |

|

|

|

|