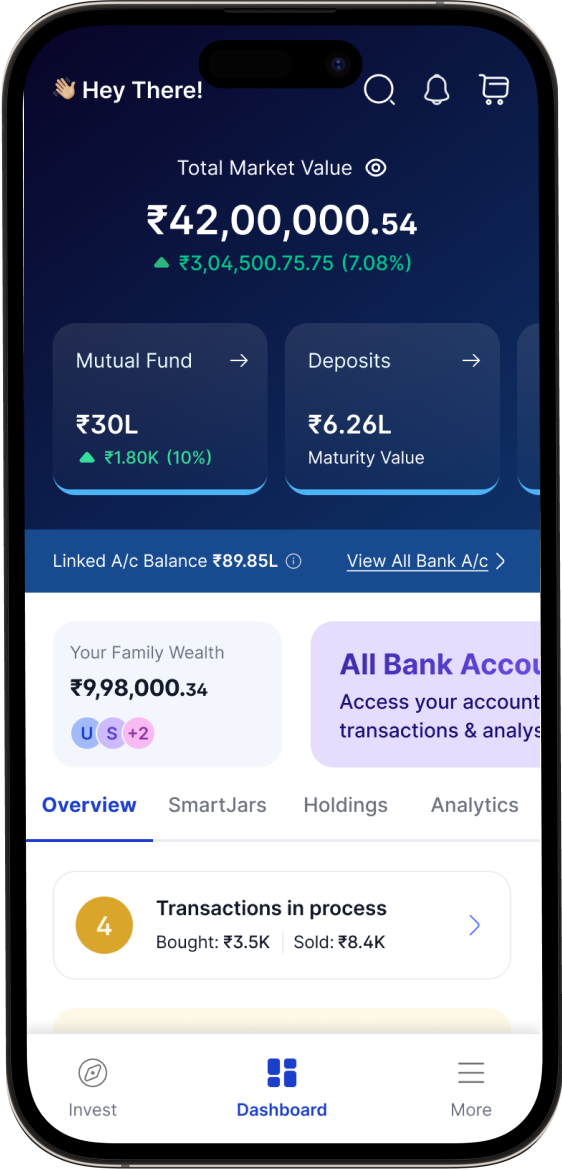

HDFC Bank SmartWealth is a comprehensive investment platform for all investors with cutting edge features and user-friendly interface.

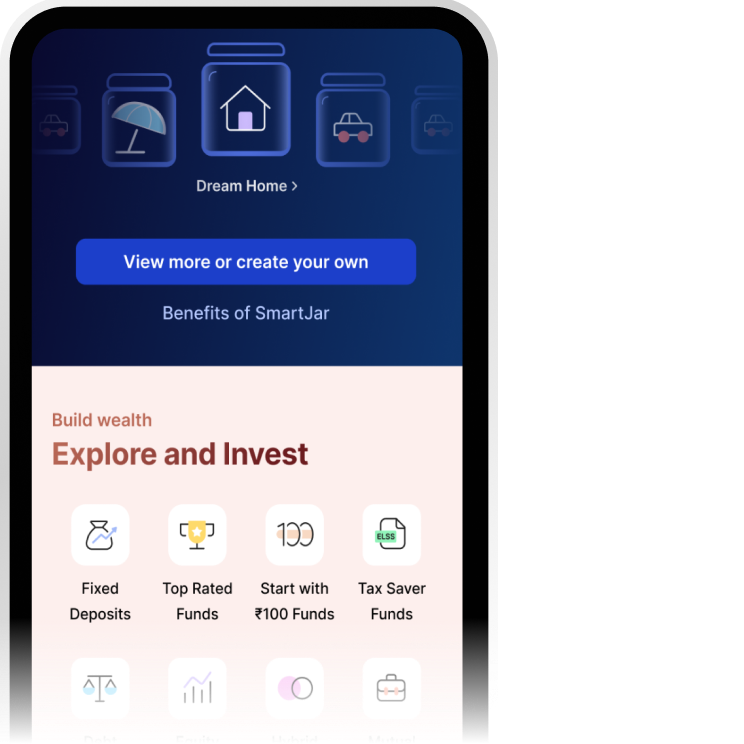

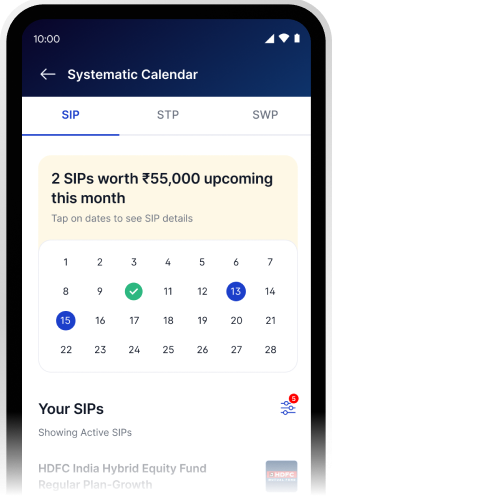

- It simplifies investing by taking the mental load off investors and serving as a one-stop-shop for all their needs.

- It helps users get investment ready across various financial products, including mutual funds, equities, bonds, and deposits.

- Users can identify their investment profile and invest appropriately.

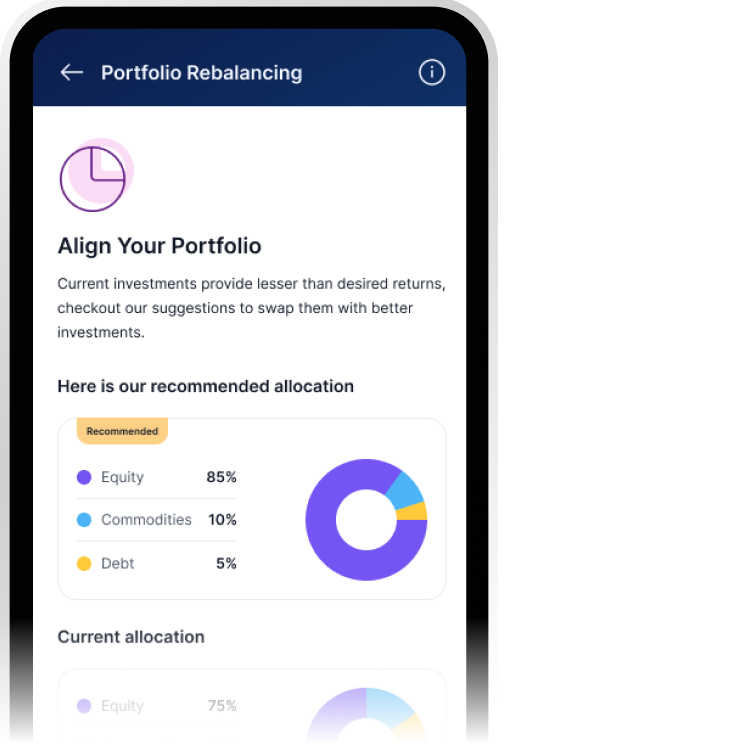

- The HDFC Bank SmartWealth offers investment solutions curated by HDFC Bank Research.

- It helps users set and track their financial milestones by providing recommendations and progress tracking.

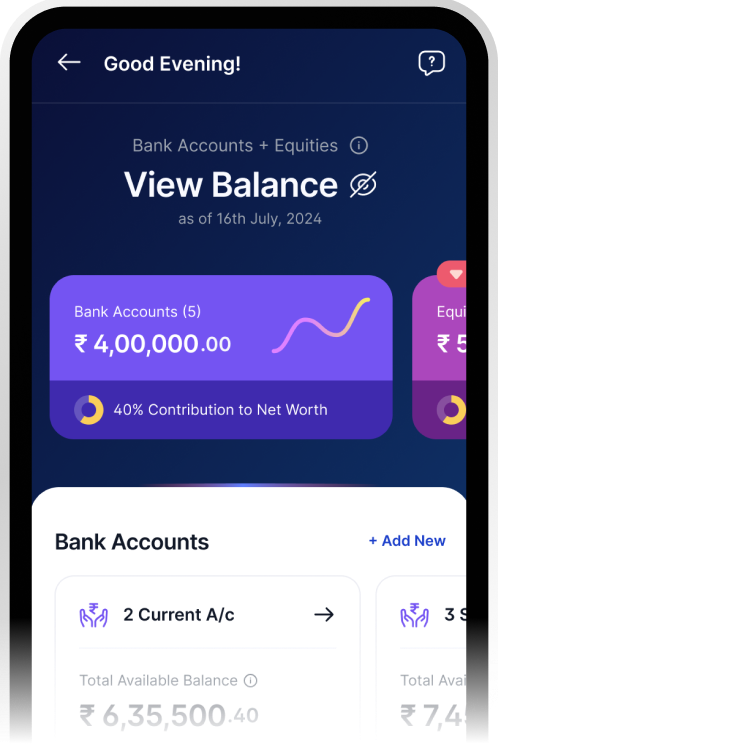

- HDFC Bank SmartWealth allows users to bring all their bank accounts, mutual funds, and equity investments onto one platform for a consolidated view.

- Users can access various reports pertaining to their investments.