HDFC Bank customers who have a current account with HDFC Bank or are self employed savings account holders, can register for and avail of MyBusiness Digital Banking facility.

Take Charge Of Your Business

Mange your business end-to-end through My Business Digital Banking for all your payments and receivables.

DESIGNED FOR EASE

Business Banking, Simplified

THERE'S LOTS MORE TO IT

Checkout the video

WANT TO KNOW MORE?

FAQs

Who can register for MyBusiness Digital Banking ?

What is needed to register for MyBusiness Digital Banking ?

The registration process is simple and fully digital, and can be completed in less than 3 minutes. All you need to have is the authorised signatory customer ID, email ID and Mobile No. updated on the Customer ID, authorised signatory's PAN, and NetBanking or Debit Card credentials. View the video to get step wise details of the process. https://youtu.be/_2rV670Z5AU

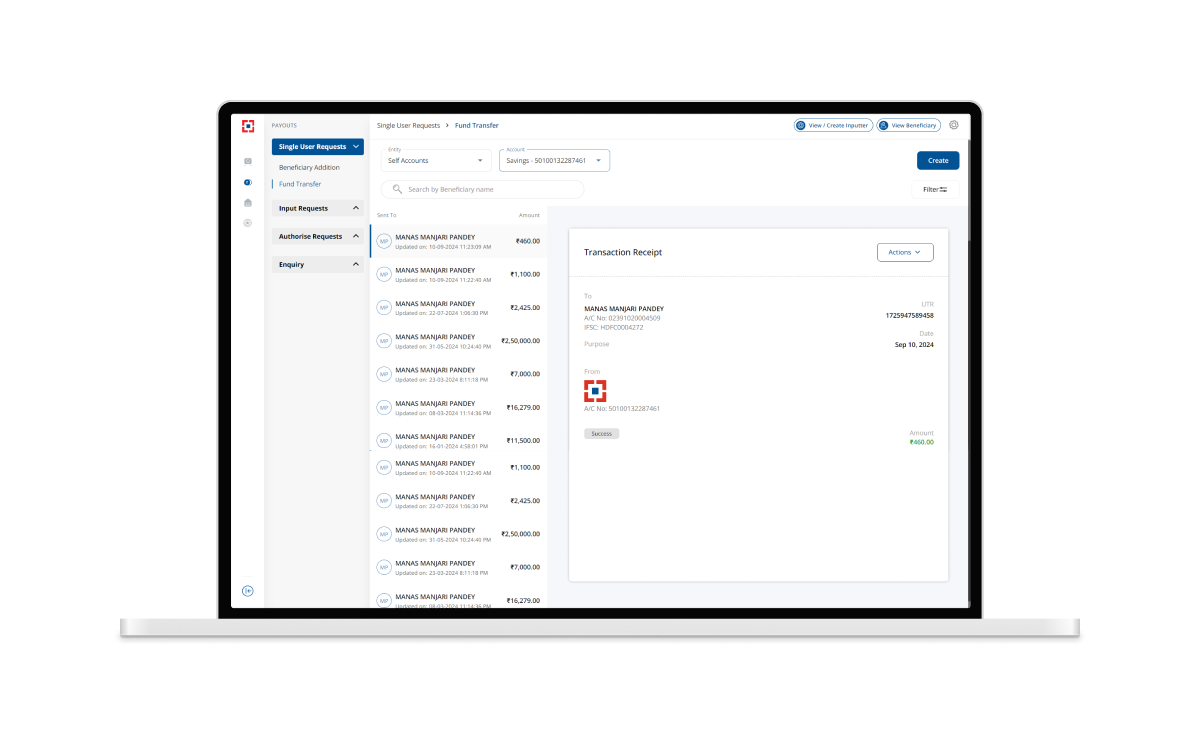

What is the funds transfer limit available on MyBusiness Digital Banking ?

Customers can avail limit of Rs. 50 Lakh/ account via MyBusiness Digital Banking. Sole Proprietor and individual current account customers are provided with a default limit of Rs. 10 Lakh at User ID level, which they can use without any documentation.

Can the default limit of Rs. 10 Lakh be increased / reduced / customised at Account level for Sole Proprietors or Individual C.A. holders ?

Yes. Using the form based process, the limits can be customised exactly as per customer's requirements.

If the customer has already given the form based request for one of the accounts, will the default limit still be available to him? How will the default limit behave?

Yes, the default limit will still be available to rest of his Sole Prop. & Individual C.A.s. The accounts for which customer has already given a form based request or gives in future, the form based limits will supersede the default limits.

Is maker checker facility available on MyBusiness Digital Banking ?

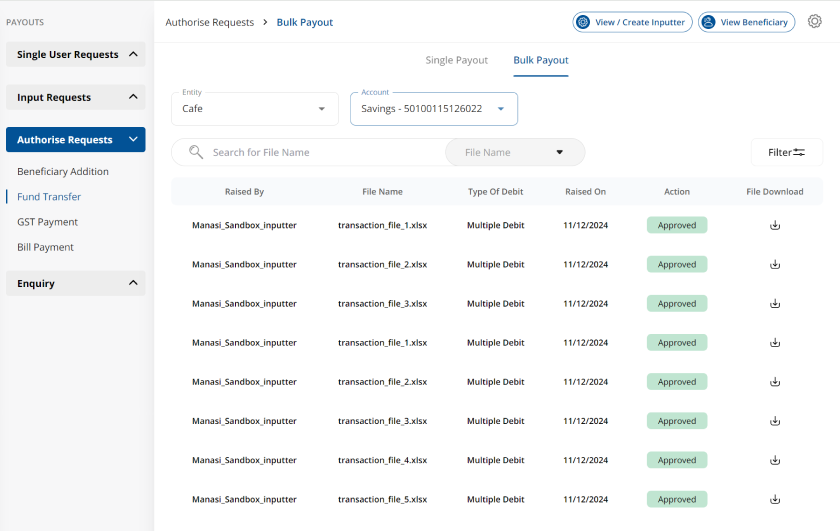

Yes, one level maker checker with fully digital process is available on the platform. View the video to know more about it. https://youtu.be/4M8GP3uExMA

Can file based funds transfer be done through MyBusiness Digital Banking ?

Yes, if maker checker facility has been availed, file based funds transfer requests can be uploaded. Upto 25 records can be uploaded in each file.

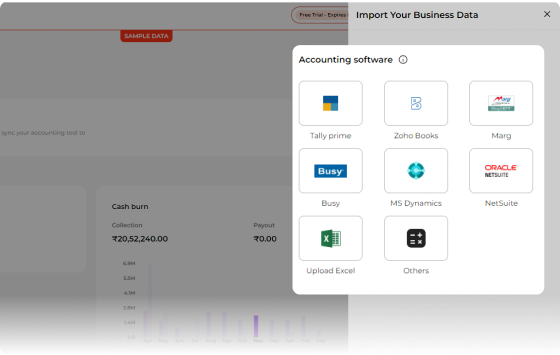

Which ERP platforms can be integrated with MyBusiness Digital Banking? What are the benefits? How can this be set-up?

Tally, ZoHo, Marg, Busy, Oracle NetSuite can be integrated currently. The facility allows customers to synch their ERP and Bank data seamlessly, both ways. There is support available for first time set up and demo to customers. The Customer can visit the platform's Finance Hub portal and from the Cashflow analytics section, set up an appointment as per their convenient time. A support team will call the customer and provide the assistance over online session.

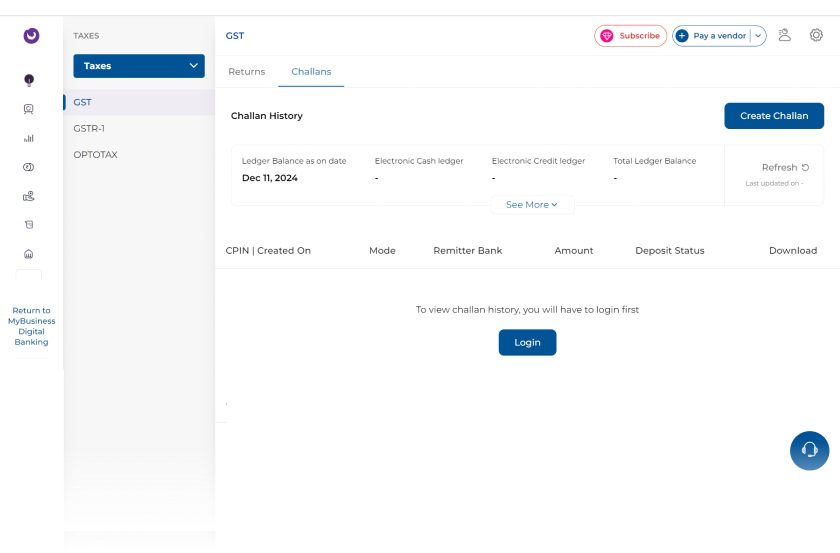

What are the charges associated with the eCMS facility?

You can streamline your fund transfers with HDFC Bank's eCMS facility at a very nominal cost. Presently, the transaction fee is ₹ 1.20 per inward transaction. This applies to all NEFT, RTGS, IMPS and within-HDFC Bank transfers.The fees charged on your inward transactions are billed to your account every month. You will also receive a monthly GST invoice for the transaction fees levied against your transactions.

For other queries, please visit the FAQ section.

Take Charge of your

Business Banking with One

platform.

Activate Debit Card Through

Activate Credit Card Through

Please scan this QR code to visit MyBusiness Digital Banking