Once your payment is successful, it may take up to 4 days for the biller to confirm the service. If you haven't received confirmation yet, we recommend reaching out to your biller's customer support team for assistance.

If you don't receive adequate support, you can contact the PayZapp support team by raising an in-app ticket. Here's how:

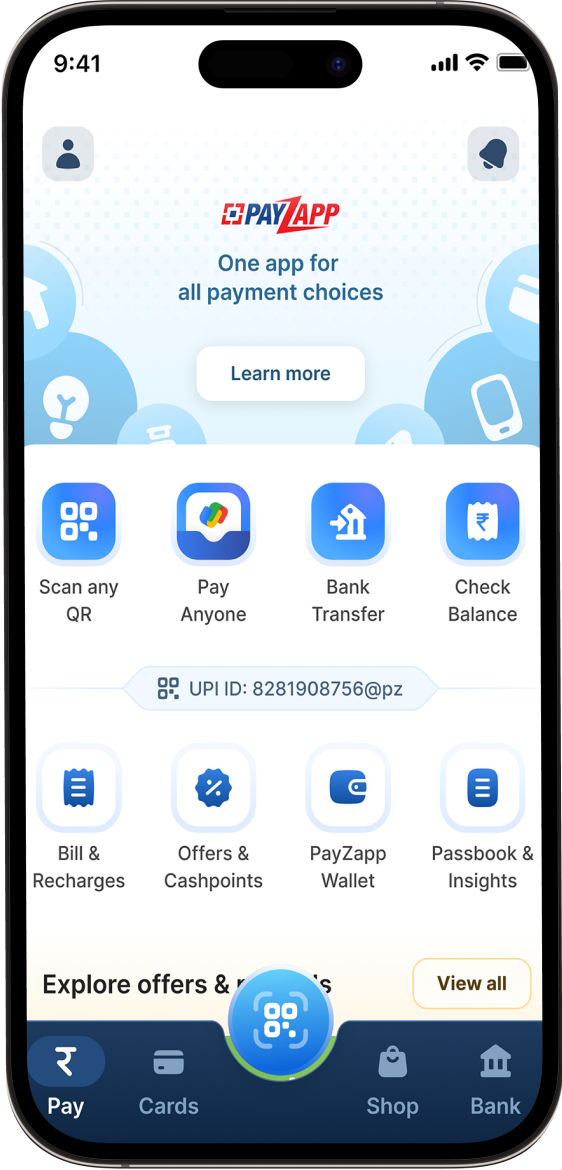

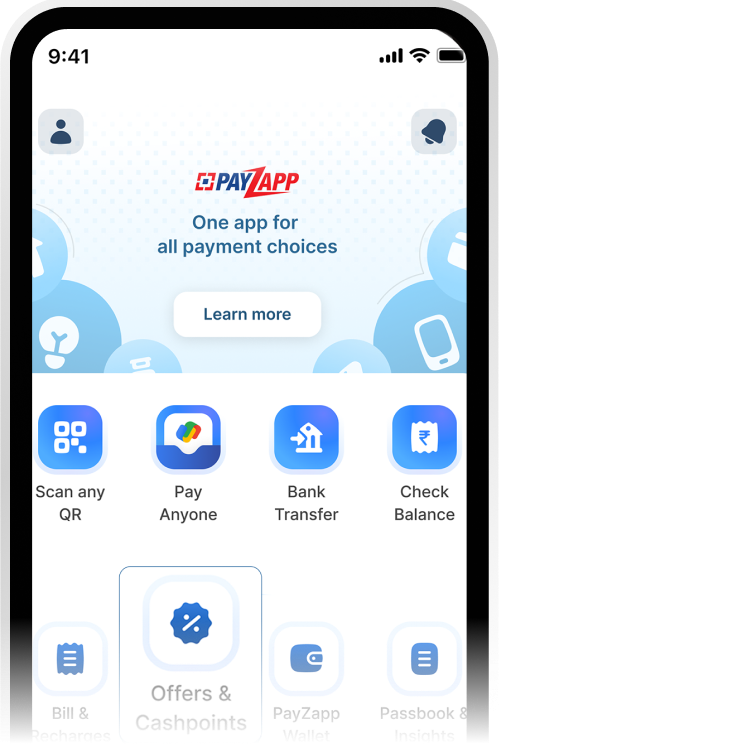

- Open the PayZapp app and go to 'Passbook & Insights'.

- Select the transaction you're referring to

- Tap the '?' icon in the top-right corner.

- Choose the relevant question and raise ticket.

Our team will assist you further.