Please select one of these options to continue

DINERS CLUB BLACK

CREDIT CARD

- Unparalleled Protection

- Unparalleled Protection

- Unparalleled Protection

- Unparalleled Protection

- Unparalleled Protection

- Unparalleled Protection

![]()

Complimentary Annual Memberships

![]()

Welcome Benefits

Complimentary annual memberships from the above partners can be availed upon spending ₹1.5 lakhs within the first 90 days or upon joining fees realization. Terms and conditions applicable.

![]()

Annual Benefits

Complimentary annual memberships can be availed upon achieving annual spend milestone of ₹8 lakhs at the time of Card Anniversary

(Card anniversary is 12 months from card open month).

Terms and Conditions applicable

![]()

Monthly Milestone Benefits

HDFC Bank Diners Club Black Credit Card holders can select any two benefits amongst  Live one month membership or

Live one month membership or

or

or  or

or  vouchers worth ₹500 every month on spends of ₹80,000.

vouchers worth ₹500 every month on spends of ₹80,000.

Click here to redeem your welcome, annual and monthly milestone benefits or call 1800 118 887.

Terms and conditions applicable.

From 10 June '22, your HDFC Bank Diners Card's Welcome/Annual benefits are revised Know more Know more

![]()

Eligibility Criteria

You are eligible for HDFC Bank Diners Club Black Credit Card based on the following

Salaried

Salaried

Age: Min 21 yrs & Max 60 yrs

Income: Net Monthly Income > ₹1.75 lakhs per month

Self Employed

Self Employed

Age: Min 21 yrs & Max 65 yrs

Income: ITR > ₹21 lakhs per annum

![]()

Fees and Charges

Annual Membership fee - ₹10,000 + Applicable Taxes

Annual Membership fee - ₹10,000 + Applicable Taxes

Spend ₹5L in 12 Months and get Renewal Fee waived for next renewal year

Spend ₹5L in 12 Months and get Renewal Fee waived for next renewal year

Enjoy Revolving Credit on your Credit Card at one of the lowest interest rate of 1.99% per month

Enjoy Revolving Credit on your Credit Card at one of the lowest interest rate of 1.99% per month

Lowest Foreign Currency Markup of 2%

Lowest Foreign Currency Markup of 2%

Please click here to know most important terms and conditions and schedule of charge

![]()

Enjoy Annual Spend Milestone Benefits

Spend ₹5 lakhs in 12 Months and get Renewal Fee waived for next renewal year

Spend ₹8 lakhs in 12 Months and get complimentary Annual Membership Benefits at the time of card anniversary

![]()

Goods and Services Tax (GST)

The applicable GST would be dependent on place of provision (POP) and place of supply (POS).If POP and POS is in the same state then applicable GST would be CGST and SGST/UTGST else, IGST

GST For FEE & Charges / Interest transactions Billed on

statement date will reflect in next month statement

GST levied will not be reversed on any dispute on

Fee & Charges / interest

Please click here to know most important terms and conditions and schedule of charge

![]()

Wellness Benefits

![]()

Golf Program

Complimentary golf games (6 per quarter) across the finest courses in the world.

Complimentary golf games (6 per quarter) across the finest courses in the world.

International Golf

International Golf

Courses (Handicap certificate mandatory), click here

For Domestic Golf Courses details, click here

For Domestic Golf Courses details, click here

Get 24-hour access to Golf Concierge Assistance services, call 022-42320226 / Toll free:1800 118 887 (India)

Get 24-hour access to Golf Concierge Assistance services, call 022-42320226 / Toll free:1800 118 887 (India)

Terms and Conditions apply: Click here for the detailed T&C and FAQ on the golf program.

Please confirm/present the identity proof & Credit Card on the golf course to enjoy the golf game benefits.

![]()

Concierge

Exclusive 24/7 Concierge Services on Your HDFC Bank Diners Club Black Credit Card. All your exclusive booking needs will be taken care by the concierge while you enjoy the exciting moments.

Golf Course Referral and Reservation Assistance

Golf Course Referral and Reservation Assistance

Flower and Gift Delivery Assistance

Flower and Gift Delivery Assistance

Hotel Referral and Reservation Assistance

Hotel Referral and Reservation Assistance

Courier Service Assistance

Courier Service Assistance

Dining Referral and Reservation Assistance

Dining Referral and Reservation Assistance

Car Rental and Limousine Referral and Assistance

Car Rental and Limousine Referral and Assistance

Business Services

Business Services

Simply call us toll-free on 1800-118-887 (India) / Landline : 91-22-42320226

Please note that calls made from outside India will not be toll-free. International calling charges will apply.

![]()

Dining Privileges

Embark on a delectable journey where you can enjoy upto 25% discount or other benefits at the finest restaurants. With exclusive offers and rewards in every bite, gift yourself and your family an enjoyable dining experience. Click here to know more

Enjoy 2X Reward Points on your Diners Privilege Credit Card on spends at standalone restaurants during weekend

1.png)

Reward Points Accrual

Earn 5 Reward Points for every ₹150/- retail spends*

1.png)

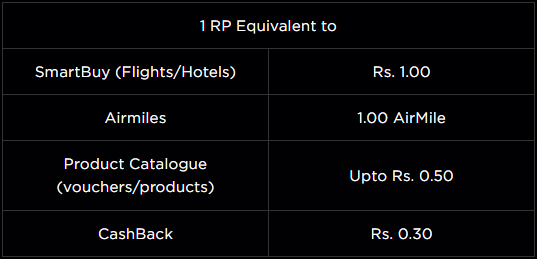

Reward Points Redemption - Options

Redeem Reward points for booking Air Tickets / Hotels

Redeem Reward points for booking Air Tickets / Hotels

Redeem Reward points for booking Air Tickets / Hotels across Airlines and Choice of hotels (Domestic & International) at https://offers.smartbuy.hdfcbank.com/diners ( 1 Reward Point = 1 Rupee)

Redeem Reward Point for AirMiles

Redeem Reward Point for AirMiles

Reeem Reward Point for AirMiles across InterMiles, Singapore Airlines (KrisFlyer Miles), Club Vistara , (1 Reward Point = 1 Airmile). Please complete Frequent flyer registration before attempting Airmiles redemption in NetBanking

Redeem Reward Points on exclusive reward redemption

Redeem Reward Points on exclusive reward redemption

Redeem Reward Points on exclusive reward redemption catalogue for HDFC Bank Diners Club Black Credit Cards

For flight and hotel bookings, HDFC Bank Diners Club Black card members can redeem upto maximum of 70% of booking value through Reward Points. Rest will have to be paid via Credit Card

This is effective 25th July 2020

1.png)

Reward Points Validity

Reward Points are valid only for 3 years from the date of accumulation. ex:- if you receive Reward Points in Nov 2019, same will expire in Nov 2022

*Effective 15th Apr 2016, Reward Points will not be accrued for fuel transactions

Effective 1st Jul 2017,

a. EasyEMI and e-wallet loading transactions will not accrue Reward Points.

b. Reward Points accrued will be reversed if a retail transaction is converted into SmartEMI.

W.e.f 20th Dec 2019, Reward Points accrued for insurance transactions will have a maximum cap of 5000 per day for Diners Black credit cards

![]()

Plan Your Travel

Book Air Tickets / Hotels across 150+ Airlines and Choice of

hotels (Domestic & International) at

https://offers.smartbuy.hdfcbank.com/diners

Redeem Reward Points for booking Air Tickets / Hotels across

Airlines and Choice of hotels (Domestic & International) at

https://offers.smartbuy.hdfcbank.com/diners ( 1 Reward Point

= 1 Rupee)

Redeem Reward Point for AirMiles across InterMiles, Singapore Airlines (KrisFlyer Miles), Club Vistara , (1 Reward Point = 1 Airmile).

Please complete Frequent flyer registration before attempting Airmiles redemption in NetBanking

![]()

Enjoy Your Travel

Sit back and relax in leading lounges across the world through Exclusive Lounge Program

Unlimited Airport lounge access to more than 1300 lounges in India & worldwide for primary & add-on card holders.

Please visit Diners Club International website for the list of international lounges.

Please download the Diners club Travel Tools App to view the latest list of Domestic lounges and now customers can also access the]

domestic lounges using the App.

Low Foreign Currency Markup fee of 2%

These charges will be billed on your subsequent statement within 60 days of date of visit. Currency conversion rate is applicable as on the

date of settlement.

![]()

Reward Points Accrual

Earn 5 Reward Points for every ₹150/- retail spends*

![]()

Reward Points Redemption - Options

Redeem Reward points for booking Air Tickets / Hotels

Redeem Reward points for booking Air Tickets / Hotels

Redeem Reward points for booking Air Tickets / Hotels across Airlines and Choice of hotels (Domestic & International) at

https://offers.smartbuy.hdfcbank.com/diners ( 1 Reward Point = 1 Rupee)

Redeem Reward Point for AirMiles

Redeem Reward Point for AirMiles

Redeem Reward Point for AirMiles across InterMiles, Singapore Airlines (KrisFlyer Miles), Club Vistara , (1 Reward Point = 1 Airmile). Please

complete Frequent flyer registration before attempting Airmiles redemption in NetBanking

Redeem Reward Points on exclusive reward redemption

Redeem Reward Points on exclusive reward redemption

Redeem Reward Points on exclusive reward redemption catalogue for HDFC Bank Diners Club Black Credit Cards

For flight and hotel bookings, HDFC Bank Diners Club Black card members can redeem upto maximum of 70% of booking value through

Reward Points. Rest will have to be paid via Credit Card

This is effective 25th July 2020

1 RP Equivalent to

SmartBuy (Flights/Hotels)

Rs. 1.00

Airmiles

1.00 AirMile

Product Catalogue

(vouchers/products)

Upto Rs. 0.50

CashBack

Rs. 0.30

![]()

Reward Points Validity

Reward Points are valid only for 3 years from the date of accumulation. ex:- if you receive Reward Points in Nov 2019, same will expire in

Nov 2022

*Effective 15th Apr 2016, Reward Points will not be accrued for fuel transactions

Effective 1st Jul 2017,

a. EasyEMI and e-wallet loading transactions will not accrue Reward Points.

b. Reward Points accrued will be reversed if a retail transaction is converted into SmartEMI.

W.e.f 20th Dec 2019, Reward Points accrued for insurance transactions will have a maximum cap of 5000 per day for Diners Black credit

cards

From 23 July '22, Reward points earned on property management services including rent, made with HDFC Bank Diners Black Credit Card

will be capped at 2000 RP/month.

![]()

Travel Cover

Air accidental death coverage: ₹2 Crore

Emergency overseas hospitalisation: ₹50 Lacs

Credit Liability Cover of up to ₹9 Lacs

Travel Insurance Cover of up to ₹55,000 on baggage delay

(Capped to 10$ per hour restricted to 8 hours)

Click here to update Nominee details

Click here For the Policy Cover

![]()

Preferential Financial Benefits

Enjoy low foreign currency mark up of 2% on all your foreign currency spends

Enjoy low foreign currency mark up of 2% on all your foreign currency spends

Convenience fee waiver of 1% on all fuel

Convenience fee waiver of 1% on all fuel

transactions. (Maximum waiver of INR 1,000 per

statement cycle)

Enjoy up to 50 days of interest free credit and

Enjoy up to 50 days of interest free credit and

manage your payments at your convenience. You

can choose to pay only the minimum amount due

and carry forward the balance amount to next

month at an extremely low interest charge of just

1.99*% per month.

![]()

Below are the customer contact points under Travel Insurance claims

Global Toll Free No :+800 08250825

Landline No: (Chargeable) : 0120-

4507250

Travel Claim document submission at the below address

Address:

HDFC ERGO General Insurance Company Limited

5th floor, Tower 1, Stellar IT Park, C-25, Sector-62, Noida-201301