Page 22 - HDFC Bank TPP Flipbook

P. 22

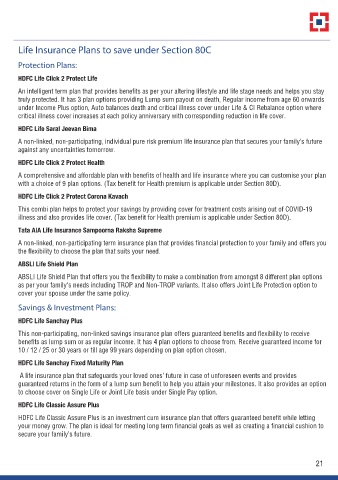

Life Insurance Plans to save under Section 80C

Protection Plans:

HDFC Life Click 2 Protect Life

An intelligent term plan that provides benefits as per your altering lifestyle and life stage needs and helps you stay

truly protected. It has 3 plan options providing Lump sum payout on death, Regular income from age 60 onwards

under Income Plus option, Auto balances death and critical illness cover under Life & CI Rebalance option where

critical illness cover increases at each policy anniversary with corresponding reduction in life cover.

HDFC Life Saral Jeevan Bima

A non-linked, non-participating, individual pure risk premium life insurance plan that secures your family’s future

against any uncertainties tomorrow.

HDFC Life Click 2 Protect Health

A comprehensive and affordable plan with benefits of health and life insurance where you can customise your plan

with a choice of 9 plan options. (Tax benefit for Health premium is applicable under Section 80D).

HDFC Life Click 2 Protect Corona Kavach

This combi plan helps to protect your savings by providing cover for treatment costs arising out of COVID-19

illness and also provides life cover. (Tax benefit for Health premium is applicable under Section 80D).

Tata AIA Life Insurance Sampoorna Raksha Supreme

A non-linked, non-participating term insurance plan that provides financial protection to your family and offers you

the flexibility to choose the plan that suits your need.

ABSLI Life Shield Plan

ABSLI Life Shield Plan that offers you the flexibility to make a combination from amongst 8 different plan options

as per your family's needs including TROP and Non-TROP variants. It also offers Joint Life Protection option to

cover your spouse under the same policy.

Savings & Investment Plans:

HDFC Life Sanchay Plus

This non-participating, non-linked savings insurance plan offers guaranteed benefits and flexibility to receive

benefits as lump sum or as regular income. It has 4 plan options to choose from. Receive guaranteed income for

10 / 12 / 25 or 30 years or till age 99 years depending on plan option chosen.

HDFC Life Sanchay Fixed Maturity Plan

A life insurance plan that safeguards your loved ones’ future in case of unforeseen events and provides

guaranteed returns in the form of a lump sum benefit to help you attain your milestones. It also provides an option

to choose cover on Single Life or Joint Life basis under Single Pay option.

HDFC Life Classic Assure Plus

HDFC Life Classic Assure Plus is an investment cum insurance plan that offers guaranteed benefit while letting

your money grow. The plan is ideal for meeting long term financial goals as well as creating a financial cushion to

secure your family’s future.

21