Page 17 - HDFC Bank TPP Flipbook

P. 17

Mutual Funds

ELSS – tax saving coupled with higher potential returns

Tax planning is a part of overall financial planning to achieve long term goals. Choosing the right investment

option is the key to save tax and reap maximum benefits of long term investments. Investing in Equity Linked

Savings Schemes (ELSS) can help an individual to save tax under Section 80C. As per Section 80C of the

Income Tax Act, qualifying investments up to a maximum of r 1,50,000/- are deductible from total income of

the individual. There are fixed income options available under Section 80C, but they may not be able to provide

returns commensurate to beat the inflation. This is where ELSS - Equity Linked Savings Schemes come into the

picture, however these schemes are more volatile compared to fixed income options. Moreover, past returns

cannot be taken as an indicator of future performance.

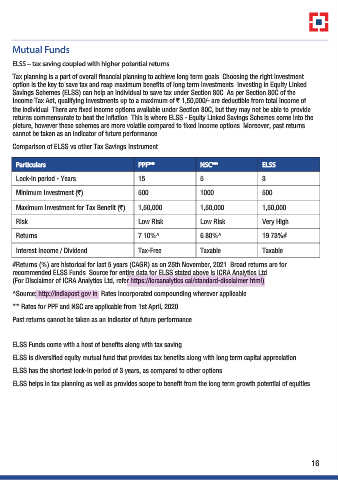

Comparison of ELSS vs other Tax Savings Instrument

Particulars PPF** NSC** ELSS

Lock-in period - Years 15 5 3

Minimum Investment (r) 500 1000 500

Maximum Investment for Tax Benefit (r) 1,50,000 1,50,000 1,50,000

Risk Low Risk Low Risk Very High

Returns 7.10%^ 6.80%^ 19.73%#

Interest Income / Dividend Tax-Free Taxable Taxable

#Returns (%) are historical for last 5 years (CAGR) as on 25th November, 2021. Broad returns are for

recommended ELSS Funds. Source for entire data for ELSS stated above is ICRA Analytics Ltd.

(For Disclaimer of ICRA Analytics Ltd, refer https://icraanalytics.cal/standard-disclaimer.html)

^Source: http://indiapost.gov.in. Rates incorporated compounding wherever applicable.

** Rates for PPF and NSC are applicable from 1st April, 2020.

Past returns cannot be taken as an indicator of future performance.

ELSS Funds come with a host of benefits along with tax saving.

ELSS is diversified equity mutual fund that provides tax benefits along with long term capital appreciation.

ELSS has the shortest lock-in period of 3 years, as compared to other options.

ELSS helps in tax planning as well as provides scope to benefit from the long term growth potential of equities.

16