Online Bill Payment

Pay and manage your bills securely and earn up to 5% CashBack*

Know more

100%

Secure

Used by

Customers

of any Bank

Scan & Pay

any UPI QR

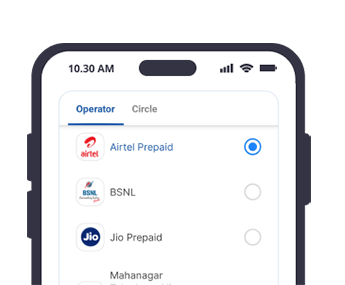

Here’s how you can get on board the all-new PayZapp:

Step 1: Download

Download PayZapp from the Google Play Store or App Store for Android and iOS smartphones, respectively.

Step 2: Register

Launch the app and register using your mobile number. Enter the one-time password (OTP) received on the mobile number to authenticate the number.

Step 3: Complete KYC

PayZapp offers two types of KYC, i.e., bank-based full KYC and basic KYC. Existing HDFC Bank Account/Cardholders can opt for bank-based KYC by entering the last four digits of the card. Non-HDFC Bank Customers must complete the basic KYC where Permanent Account Number (PAN) verification is mandatory.

Help Center feature ensures quicker and better resolutions for customer issues and concerns

- Open your PayZapp app and go to menu option

- Select the issue type that you have concerns with

- Check the FAQ to address your query

- If further assistance required, ‘Raise a ticket’

- Our

team will assist you further at the earliest.

- You may keep interacting and chatting on the same

tickets for clarification

The limits vary depending on your KYC (Know Your Customer) status. Here are the details:

For PAN-Based KYC:

- Wallet Holding Limit: ₹10,000 (per transaction, monthly,

and yearly)

- Loading on Wallet: ₹10,000 (monthly), ₹1,20,000 (yearly)

- Spending on Wallet:

₹10,000 (per transaction), ₹1,20,000 (yearly)

For Bank-Based KYC:

- Wallet Holding Limit: ₹2,00,000 (per transaction,

monthly, and yearly)

- Loading on Wallet: ₹2,00,000 (monthly), ₹5,00,000 (yearly)

- Spending

on Wallet: ₹2,00,000 (per transaction), ₹10,00,000 (yearly)

- Wallet to Account Limit: ₹50,000

(per beneficiary per month); 1,50,000 (per month total); ₹10,00,000 (yearly)

To view your daily, monthly, and yearly add & spend limits, log in to the PayZapp app and go to ‘KYC Status’ under the 'Menu icon' in the top-left corner of the home page

In addition, you can spend from your linked credit / Debit card / UPI transaction as per the limits set at your bank side

This is not the experience we would want to provide to you. There could be a minor chance that your transaction could have failed.

If your transaction fails, the debited amount will be refunded to your source account within the

following time frames:

- Wallet: Refund processed within 1 working day.

- UPI payment method:

Refund processed within 3-4 working days.

- Card payment method: Refund processed within 4-7

working days.

Please note that the exact timing may vary based on your bank or payment provider. If you have not received your refund within the specified time frames, please contact PayZapp customer support for assistance. To do so, open the PayZapp app, go to 'Passbook & Insights', select the transaction in question, tap the '?' icon in the top-right corner, and raise a ticket.

Some common reasons why the transactions fail are:

1. E-commerce Disabled: Your card may have e-commerce transactions disabled. You can check this by

logging in to your bank. For HDFC linked cards, here is how you can do it :

- Tap on Cards at the

bottom of the homepage

- Select the HDFC Linked card

- Go to Payment Limits and set the limits

as per your wish

- Don't forget to click Save once done

2. Bank Decline: Transactions can be declined by your bank for various reasons. Confirm with your bank for more details.

3. Biller Issues: Your biller may currently be unavailable to process this request. You can try again later.

Check for the failure reason and you may re-attempt the transaction and enjoy smooth and seamless experience on Payzapp

Your UPI transaction may have failed due to one of the following reasons:

- Incorrect UPI PIN

entered.

- Insufficient balance in your bank account.

- You have reached your bank or UPI

transaction limits.

- Security reasons

- UPI network issues

- Technical issues with the

bank

To view the exact reason for the failure, log in to the PayZapp app and check the transaction summary on the 'Passbook & Insights' page.

Rectify the issue and re-attempt the transaction and enjoy smooth and seamless experience on Payzapp

PayZapp is a mobile payment and financial services app offered by HDFC Bank, one of India's leading banking institutions. This innovative app is designed to provide users with a wide range of convenient and secure financial solutions, all accessible from their mobile devices.