Benefits of HDFC Bank FASTag

Scan & Recharge via UPI Enabled QR FASTag

Buy now

Set up Auto recharge

Link your HDFC Bank Account / Credit /Debit Card for Hassle Free

recharge

Activate Auto- Recharge

Easily Add FASTag for your new car.

Apply Now

Get Instant alerts on each Transaction.

Self-Service Customer Portal helps to easily manage your FASTag account

Important FASTag Rules and Guidelines, please click here

About FASTag

HDFC Bank’s National Electronic Toll Collection (NETC) FASTag Account makes paying tolls a seamless

process. You can buy FASTag online and offline, link multiple vehicles to a single prepaid FASTag

wallet and avail of multiple options to recharge it. You can recharge your FASTag using the HDFC Bank FASTag

Portal or through platforms such as MyCards, MobileBanking, NetBanking, PayZapp, WhatsApp, or any other UPI

enabled mobile app, etc.

FASTag Videos

Fees & Charges

Find Answers

-

What is NETC FASTag?

NETC FASTag is a device that employs Radio Frequency Identification (RFID) technology for making toll payments directly from the prepaid account linked to it. It is fixed on the windscreen of your vehicle, which enables you to drive through any toll plaza - so you don’t have to stop for any cash transactions.

-

What are the benefits of FASTag?

- Ease of payment – No need to carry cash for the toll transactions, saves time

- Online Recharge – Tag can be recharged online through UPI / PayZapp / Credit Card / Debit Card / NEFT/ RTGS or Net banking

- SMS & E-mail alerts on each toll transactions & wallet recharge etc.

- FASTag Customer Portal to easily manage your FASTag Account

-

Tag Validity

- The tag has a validity of 5 years

- On the date of expiry, tag will be auto renewed for next 5 years in the system and communicated to respective FASTag customer.

-

FASTag is Blocked / Freezed or will get Blocked due to Non-KYC. or Upgrade your HDFC Bank FASTag Wallet to Full KYC.

Online KYC (v-KYC) Steps:

Update the KYC for your FASTag Wallet via new Video-KYC feature. To proceed with v-KYC, please click here.

Enter Mobile & PAN number & click on “Complete Full KYC” & follow the steps.

Documents Required for v-KYC: Original PAN & Aadhar Card

Offline KYC (Complete KYC through HDFC Branch):

In-case you are unable to complete the online v-KYC process for your FASTag Wallet, please visit nearest HDFC Branch & Submit the copy of below mentioned documents for offline KYC request. All documents submitted by customer should be Self-Attested along with OSV done by Branch.

- Aadhaar /Virtual ID Card (*first 8-digit Masked mandatory)

- Registration Certificate (RC) copy

- PAN copy

- Photograph

- Aadhar declaration form (click here to download)

Note:

- Your KYC will be updated in 3 working days from the date of submission.

- Offline KYC Update will be rejected, in-case first 8-digits of Aadhar Number are not masked.

-

Activation

- When purchased online or issued via HDFC Bank branch, the FASTag will have to be activated for Usage by completing the KYV(Know Your Vehicle) Process.

- Go through the 'FAQs for KYV Process' click here .

-

Track your FASTag Dispatch Status

- Check your FASTag dispatch status using FASTag Application No. / Mobile No. / Vehicle Registration No. on link: https://hdfcbankfastag.in/appTrack/

- Still facing issues, Email us at fastagsupport@1pay.in

-

Application Documentation

Submit the following documents along with the application for FASTag:

- For Individuals:

- Submit a Registration Certificate (RC), and KYC documents according to your vehicle category.

- ID proof and Address proof from the list mentioned:

1) Driving License

2)PAN Card (mandatory)

3) valid Passport (photo page and address page)

4) Voter ID Card

5) Aadhar card with address (First 8 digit to be masked).

- For Corporates:

- GST registration certificate.

- Public Ltd/Private Ltd/Partnership Proprietorship.

- Certificate of Incorporation/Partnership Deed/Registration certificate of the firm/PAN Card of Proprietor.

- PAN Card (mandatory) of the corporate address proof of the Proprietor.

- Photo ID of signing authority under Shop Act or other firm proof.

- List of Directors with names and addresses of partners.

- Our representative will provide an application form, fill the form and submit.

- Ensure all required documents are in the name of the vehicle owner.

- If the car owner is not present at the time of application filing, the driver will need to submit his photo ID proof.

- For Individuals:

-

How do I recharge my HDFC Bank NETC FASTag Wallet?

You can recharge your HDFC Bank NETC FASTag wallet via:

- MyCards

Visit MyCards portal > Add FASTag > Enter Vehicle Number. Once FASTag is added: Recharge > Enter vehicle details and amount > Recharge. - FASTag portal

Visit the portal > Quick recharge > Enter vehicle details and amount > Recharge. - MobileBankingLogin > Pay > Bill Pay > Add Biller > FASTag > Enter details and amount > Recharge.

- NetBanking

Login > Bill Pay & Recharge > FASTag > HDFC Bank – FASTag > Enter details and amount > Recharge. - PayZapp

Login > Bill Pay > FASTag > HDFC Bank – FASTag > Enter details and amount > Recharge.

Download PayZapp App - UPI

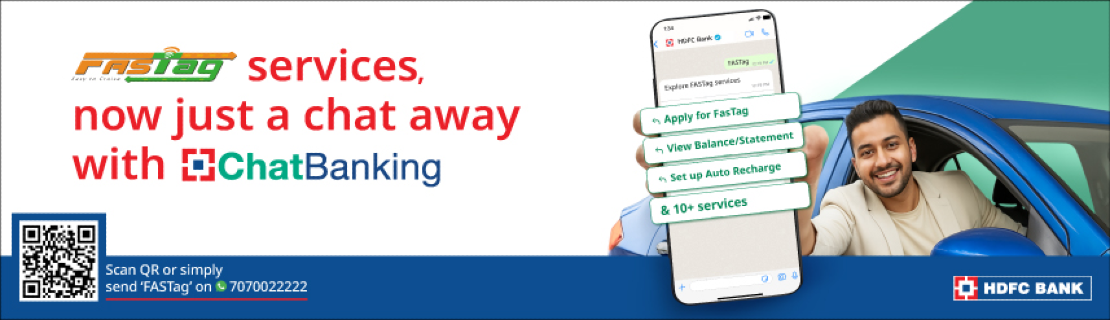

Log into any UPI app > FASTag Recharge > HDFC Bank – FASTag > Enter vehicle number and amount > Recharge. - WhatsApp

i. Incase unregistered for ChatBanking on WhatsApp

Save 70-700-222-22 in contacts > Send "FASTag" to 70-700-222-22 on WhatsApp > Select "Recharge" from the menu options > Confirm Amount > Confirm UPI PIN

ii. If you are already registered on ChatBanking

Send "FASTag" to 70-700-222-22 on WhatsApp > Select "Recharge" from the menu options > Confirm Amount > Confirm UPI PINQR Code for FASTag on WhatsApp (Scan below QR for HDFC FASTag Recharge)

-

Via HDFC FASTag QR code:

Now you can recharge your wallet using QR printed on your HDFC Bank NETC FASTag.

Steps:

Open any UPI application > Scan QR provided on the HDFC FASTag > Confirm Recharge Amount > Enter UPI Pin

- MyCards

-

How can I check balance in my HDFC Bank FASTag Wallet?

You can give a missed call on 720 805 3999 from your registered mobile number and receive an SMS with your wallet balance details.

-

Does the balance in FASTag expire?

Your FASTag balance does not expire. The Balance is maintained in your FASTag Wallet. Refer below available options to check your HDFC Bank FASTag Wallet Balance:

- Login to HDFC FASTag Customer Portal to check your Wallet Balance.

- UPI apps: Select FASTag Option on UPI App > Select HDFC Bank FASTag > Enter your Vehicle Number > Link the Vehicle No with UPI app > Wallet will be reflected.

- You can also check your Balance by giving a missed call on 720-805-3999 from your registered mobile number & receive an SMS with Wallet balance details & Status.

-

Can I withdraw my FASTag balance?

No, you cannot withdraw your FASTag balance. However, after you close the wallet, any balance amount shall be refunded to your source bank account.

-

What is the minimum balance required for FASTag?

There is no requirement for minimum balance in your FASTag account. However, if sufficient balance is not maintained, any toll amount charged will be deducted from the security deposit paid at the time of FASTag application.

-

How to get HDFC Bank FASTag?

Online Portal: You can apply for HDFC Bank FASTag online by clicking here. The Tag will be delivered to your address. While availing the FASTag you will be prompted to upload RC (Front & Back) for vehicle number verification.

HDFC Branch: You can check with your nearest HDFC Bank branch for FASTag availability. -

Why do I have to pay for security deposit?

Security deposit is used to pay any outstanding toll charges in case of insufficient funds in your FASTag wallet.

-

Do I get any interest on the wallet balance & security deposit?

No, there is no interest given on any balance/security deposit in the FASTag wallet.

-

Does the security deposit remain on the tag or in the wallet?

The security deposit you pay will be applicable for each tag and won’t be a part of your wallet balance.

-

Is it possible to transfer my FASTag from existing bank to HDFC Bank?

It is not possible to transfer the FASTag and wallet balance from one bank to another. You will need to close your existing FASTag account with other banks & get a new FASTag from HDFC Bank. Click here to apply for HDFC Bank FASTag.

-

I have received an HDFC Bank FASTag from Paytm, will it get blocked due to recent RBI circular against Paytm Payment Bank?

No, your HDFC Bank FASTag will be accepted at all toll plazas as usual.

-

I have a Paytm FASTag for my vehicle. Will it be mapped to HDFC Bank FASTag system?

No, it will not get mapped to HDFC Bank FASTag system. You must close the Paytm issued tag by raising closure request with Paytm Payment Bank Team.

-

Can I buy the HDFC Bank FASTag even if I don’t have a savings/current account with HDFC Bank?

You can buy an HDFC Bank NETC FASTag even if you don’t have any savings/current account by visiting the link: https://apply.fastag.hdfc.bank.in/issuance/loginPage

-

What are the fees and charges for FASTag?

Please click here for Fees and Charges

-

When will I get my FASTag once successfully applied for HDFC Bank FASTag?

Your FASTag will be Delivered under 7 working days.

-

I have a requirement for a few tags for my commercial vehicles. Can I apply online?

You can apply for FASTag online only for vehicles under Vehicle Class 4 (passenger cars) and Vehicle Class 20 (Small Pick-up trucks like Tata Ace/ Maruti Carry/ Mahindra Maximo, etc). Contact your nearest HDFC Bank branch for FASTag on heavy vehicles like Trucks, Buses, Earth Moving vehicles, Cranes, etc.

For more details, please click here

For more Frequently Asked Questions, please click here

For the Schedule of charges, please click here

For Terms & Conditions, please click here

Contact Us

-

720-805-3999

Give us a missed call to know your wallet status & Balance.

-

1800-120-1243 /

022 65431234Services & Sales queries

Write to:

fastagsupport@1pay.in -

24×7

National Highway Helpline Number1033