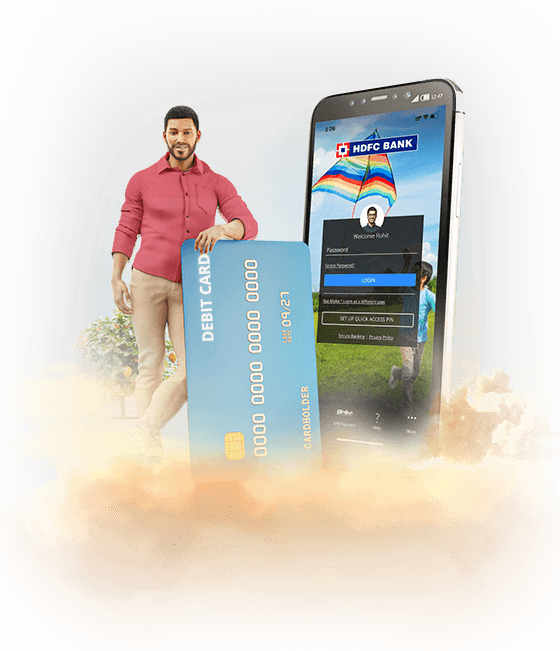

Welcome to HDFC Bank

India’s No. 1* Bank

Why step out when you can

bank from the safety of your home.

Welcome to HDFC Bank

India’s No. 1* Bank

Why step out when you can

bank from the safety of your home.

Trusted by over 30 Lakh Savings Account customers

To get started, all you need is your Account Number

The A/C no. and IFSC code can be viewed by logging into the HDFC Bank MobileBanking app.

Please follow the steps mentioned below:

- 01

Login to HDFC Bank MobileBanking app

To know your Login ID, CLICK HERE

- 02

Tap on the arrow next to Savings Account

- 03

Tap on ‘Show Account Details’

- 04

The screen will then show you the A/C no. and IFSC code which can be shared easily through WhatsApp or SMS, with anyone who needs to send you money

Just 3 steps to

Add money to your Account

3 ways to Add Money

- 01

UPI helps you make your fund transfers effortless, on the go. Add money to your account or transfer funds easily & quickly with UPI. Click here to Know More

- 02

Online Bank Transfer: Provide your account details (A/C number, IFSC Code) to your employer/business partner or use it to transfer money to yourself from another bank account.

- 03

Digital Wallets: With your account details (A/C number, IFSC Code) you can add money easily into your account using any digital wallet

Important

Debit Card & Other Benefits = KYC (Video/Branch)

KYC is mandatory for a full benefit account.

To locate your nearest branch, CLICK HERE

Always maintain your AMB to avoid Non Maintenance charges.

- 01

Regular Savings Account

₹10,000 (Metro / Urban)

₹5,000 (Semi-Urban)

₹2,500 (Rural)

- 02

Women's Savings Account

₹10,000 (Metro / Urban)

₹5,000 (Semi-Urban / Rural)

- 03

DigiSave Youth Account

₹5,000 (Metro / Urban)

₹2,500 (Semi-Urban / Rural)

- 04

Senior Citizens Account

₹5,000 (Urban/Semi Urban)

- 05

SavingsMax Account

₹25,000 (Metro / Urban)

OR

FD Relationship of

₹1.50L (Metro/ Urban)

₹1L (Semi Urban / Rural)

Deposits

Guaranteed returns, safe investment

Choose the perfect Fixed Deposit/Recurring Deposit Account for your needs

You can start saving with ₹500

Contact us

For any help, reach out to us through WhatsApp; give us a missed call on 70659 70659 for any information on InstaAccount and to locate your nearest HDFC Bank ATM / Branch, please click here

FAQs

There are two means to add money to Savings Account or your HDFC Bank InstaAccount:

- You can transfer money through any other bank account of yours or provide your bank account details to your employer, business partner or any other individual who will then transfer the money to your InstaAccount.

- Through any digital wallets, you can add money using IFSC code and your bank account details.

To add money using IFSC code into your Insta Savings Account:

- You need to log in to your other bank account that you will be transferring money from.

- Input your HDFC Bank Savings Account number and IFSC Code

- Input the specific money to be added into the account

- Submit your request

Your money is added to your Insta Savings Account using IFSC Code in the aforementioned manner.

Yes, IFSC code is required for money transfer as it is a unique code used by your Bank for the specific branch where your account is located.

To transfer money using IFSC Code, you could:

- Provide your IFSC code details and Account Number to the person/organisation that intends to transfer money to your account.

- Input the IFSC code and bank account details on the online banking portal of the bank.

- Using your IFSC code and bank account number through any digital payment aggregator to transfer the money using the IFSC code.

There is no limit to add money using the IFSC code. However, most banks offer IMPS, NEFT and RTGS depending on the value of the amount to be added.

Below Rs. 1 lac is IMPS.

Below Rs. 2 lacs is NEFT.

Above Rs. 2 lacs and more is RTGS.