Page 14 - HDFC Bank | Take the cut out of your tax cut

P. 14

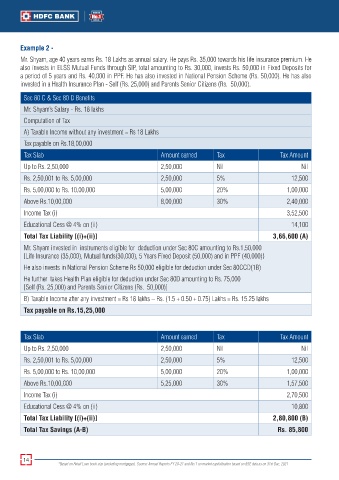

Example 2 -

Mr. Shyam, age 40 years earns Rs. 18 Lakhs as annual salary. He pays Rs. 35,000 towards his life insurance premium. He

also invests in ELSS Mutual Funds through SIP, total amounting to Rs. 30,000, invests Rs. 50,000 in Fixed Deposits for

a period of 5 years and Rs. 40,000 in PPF. He has also invested in National Pension Scheme (Rs. 50,000). He has also

invested in a Health Insurance Plan - Self (Rs. 25,000) and Parents Senior Citizens (Rs. 50,000).

Sec 80 C & Sec 80 D Benefits

Mr. Shyam’s Salary - Rs. 18 lakhs

Computation of Tax

A) Taxable Income without any investment = Rs 18 Lakhs

Tax payable on Rs.18,00,000

Tax Slab Amount earned Tax Tax Amount

Up to Rs. 2,50,000 2,50,000 Nil Nil

Rs. 2,50,001 to Rs. 5,00,000 2,50,000 5% 12,500

Rs. 5,00,000 to Rs. 10,00,000 5,00,000 20% 1,00,000

Above Rs.10,00,000 8,00,000 30% 2,40,000

Income Tax (i) 3,52,500

Educational Cess @ 4% on (ii) 14,100

Total Tax Liability [(i)+(ii)] 3,66,600 (A)

Mr. Shyam invested in instruments eligible for deduction under Sec 80C amounting to Rs.1,50,000

[Life Insurance (35,000), Mutual funds(30,000), 5 Years Fixed Deposit (50,000) and in PPF (40,000)}

He also invests in National Pension Scheme Rs 50,000 eligible for deduction under Sec 80CCD(1B)

He further takes Health Plan eligible for deduction under Sec 80D amounting to Rs. 75,000

[Self (Rs. 25,000) and Parents Senior Citizens (Rs. 50,000)]

B) Taxable Income after any investment = Rs 18 lakhs – Rs. (1.5 + 0.50 + 0.75) Lakhs = Rs. 15.25 lakhs

Tax payable on Rs.15,25,000

Tax Slab Amount earned Tax Tax Amount

Up to Rs. 2,50,000 2,50,000 Nil Nil

Rs. 2,50,001 to Rs. 5,00,000 2,50,000 5% 12,500

Rs. 5,00,000 to Rs. 10,00,000 5,00,000 20% 1,00,000

Above Rs.10,00,000 5,25,000 30% 1,57,500

Income Tax (i) 2,70,500

Educational Cess @ 4% on (ii) 10,800

Total Tax Liability [(i)+(ii)] 2,80,800 (B)

Total Tax Savings (A-B) Rs. 85,800

14

*Based on Retail Loan book size (excluding mortgages). Source: Annual Reports FY 20-21 and No.1 on market capitalisation based on BSE data as on 31st Dec, 2021