Page 18 - HDFC Bank | Take the cut out of your tax cut

P. 18

Key features of ELSS - Equity Linked Savings Schemes.

Objective Long-term Capital Appreciation and Tax Planning

Risk Very High

Investment Portfolio Equity and Equity Related instruments – Generally Large and Midcap stocks

Who should invest? Investors with higher risk appetite, and relatively higher return expectation

Investment Horizon Long-term (lock-in period of 3 years)

Tax Deduction- Section 80C* Investments up to Rs. 1.50 lakh exempt from tax

Tax Implications Long Term Capital Gains Tax

*As per current income tax rates individual falling in highest tax bracket.

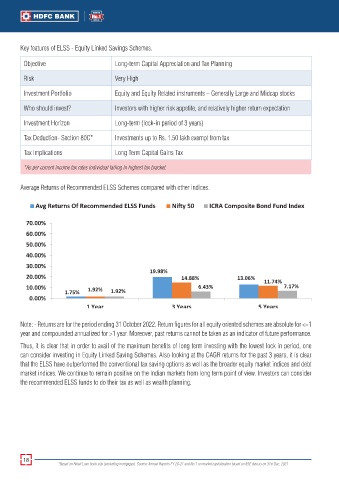

Average Returns of Recommended ELSS Schemes compared with other indices.

Avg Returns Of Recommended ELSS Funds Ni�y 50 ICRA Composite Bond Fund Index

70.00%

60.00%

50.00%

40.00%

30.00%

19.98%

20.00% 14.88% 13.06% 11.74%

10.00% 1.92% 6.43% 7.17%

1.75% 1.92%

0.00%

1 Year 3 Years 5 Years

Note: - Returns are for the period ending 31 October 2022. Return figures for all equity oriented schemes are absolute for <=1

year and compounded annualized for >1 year. Moreover, past returns cannot be taken as an indicator of future performance.

Thus, it is clear that in order to avail of the maximum benefits of long term investing with the lowest lock in period, one

can consider investing in Equity Linked Saving Schemes. Also looking at the CAGR returns for the past 3 years, it is clear

that the ELSS have outperformed the conventional tax saving options as well as the broader equity market indices and debt

market indices. We continue to remain positive on the Indian markets from long term point of view. Investors can consider

the recommended ELSS funds to do their tax as well as wealth planning.

18

*Based on Retail Loan book size (excluding mortgages). Source: Annual Reports FY 20-21 and No.1 on market capitalisation based on BSE data as on 31st Dec, 2021