Page 19 - HDFC Bank | Take the cut out of your tax cut

P. 19

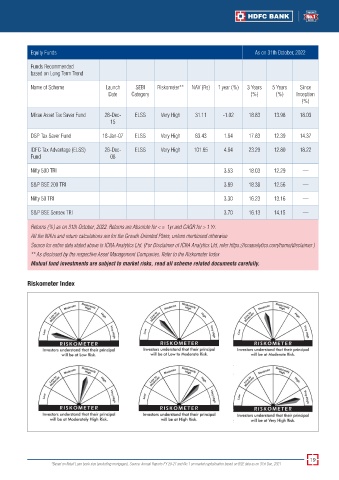

Equity Funds As on 31th October, 2022

Funds Recommended

based on Long Term Trend

Name of Scheme Launch SEBI Riskometer** NAV (Rs) 1 year (%) 3 Years 5 Years Since

Date Category (%) (%) Inception

(%)

Mirae Asset Tax Saver Fund 28-Dec- ELSS Very High 31.11 -1.02 18.83 13.98 18.03

15

DSP Tax Saver Fund 18-Jan-07 ELSS Very High 83.43 1.64 17.83 12.39 14.37

IDFC Tax Advantage (ELSS) 26-Dec- ELSS Very High 101.65 4.64 23.29 12.80 18.22

Fund 08

Nifty 500 TRI 3.53 18.03 12.29 —

S&P BSE 200 TRI 3.89 18.38 12.56 —

Nifty 50 TRI 3.30 16.23 13.16 —

S&P BSE Sensex TRI 3.70 16.13 14.15 —

Returns (%) as on 31th October, 2022. Returns are Absolute for < = 1yr and CAGR for > 1 Yr.

All the NAVs and return calculations are for the Growth Oriented Plans, unless mentioned otherwise

Source for entire data stated above is ICRA Analytics Ltd. (For Disclaimer of ICRA Analytics Ltd, refer https://icraanalytics.com/home/disclaimer )

** As disclosed by the respective Asset Management Companies. Refer to the Riskometer Index

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

Riskometer Index

19

*Based on Retail Loan book size (excluding mortgages). Source: Annual Reports FY 20-21 and No.1 on market capitalisation based on BSE data as on 31st Dec, 2021