Welcome to Vigil Mastery Quiz!

Vanakkam! Did you know today's fraudsters are very smart - they even manage to dupe 1 in 3 people who thought they'd never fall for a scam. Think you’ve got what it takes to outsmart them?

Take the Vigil Mastery Quiz!

Let’s test your Fraud IQ and see if you can stay one step ahead of their sneaky tricks!

Ready to test your fraud-fighting skills, macha?

Start Now

Share your details:

This information will only be used to generate the certificate.

1-5

Your phone buzzes, and you see a message from an unknown number claiming to be your friend. They say, “Hey, it’s me! I lost my phone and I’m in an emergency. Can you send ₹10,000 to this account right away?” What will you do?

Absolutely not!

Correct answer is :

Call your friend on their known number to confirm the situation.

Be cautious! Acting in haste can cost you. Always verify before sending money. A quick call to your friend’s correct number could save you from a fraud.

Correct!

Correct answer is :

Call your friend on their known number to confirm the situation.

You got it right! The safest approach is to confirm the situation by directly calling your friend on their actual number. Don’t let panic cloud your judgment!

2-5

You get a call from a person acting like a police officer threatening you with an arrest warrant. To avoid your arrest, they ask for your details and a fee without letting you rest. What should you do?

Nope, not quite!

Correct answer is :

Ignore the call/SMS and block the number. Report such suspected fraudulent call, SMS or WhatsApp communication on Chakshu portal at https://sancharsaathi.gov.in

Making financial transactions in a moment of panic is a bad idea. The Indian government does not permit digital arrests, and law enforcement officials like the CBI or police will never make arrests digitally. If you are confident that you have not committed any crime, do not panic or fear. Instead report immediately

Bravo, that’s the correct answer!

Correct answer is :

Ignore the calls/SMS and block the number. Report such suspected fraudulent Calls, SMS & WhatsApp communication on Chakshu portal at

Wow, you’re already a pro at this! Your vigilance radar is 5/5

3-5

Mr. A receives a WhatsApp message offering 50% returns in just one month! The sender claims to be from a reputed financial institution and asks him to transfer ₹50,000 immediately to secure the limited-time offer. What should Mr. A do?

Missed the mark!

Correct answer is :

Ignore the message. Invest only through SEBI-registered intermediaries or banks and do not believe in testimonials showcasing too-good-to-be-true returns.

Ignore the message. Invest only through SEBI-registered intermediaries or banks and do not believe in testimonials showcasing too-good-to-be-true returns.

Perfect!

Correct answer is :

Ignore the message/Invest only through SEBI-registered intermediaries or banks

Correct! This message is pure gold...plated with a scam! You know, if something sounds too good to be true, it probably is.

4-5

Got a suspicious call, SMS or WhatsApp communication from a fraudster? Where will you report it to turn the fraudster’s plans into a complete disaster?

Near to correct but not correct!

Correct answer is :

Report on Chakshu Sanchar Saathi https://sancharsaathi.gov.in/

If you receive any suspected / fraudulent Calls, SMS or WhatsApp communication, report on Chakshu portal at https://sancharsaathi.gov.in/

You’re slaying this quiz like a pro!

Correct answer is :

Chakshu Sanchar Saathi https://sancharsaathi.gov.in/

Any suspicious fraudulent communication you receive can be reported to Chakshu to help India have a cyber safe space.

5-5

Aiyoo! If you become a victim of cyber fraud, what would be your next step?

Incorrect

Correct answer is :

Both A and B

The first step is to act fast! Contact your bank immediately to block your card or account and file a complaint on https://www.cybercrime.gov.in or call the toll-free helpline at 1930.

Your vigilance knows no bounds, macha!

Correct answer is :

Both A and B

If you fall victim to fraud, the first step is to act fast! Contact your bank immediately to block your card or account to prevent further loss. Simultaneously, file a complaint on https://www.cybercrime.gov.in or call the toll-free helpline at 1930.

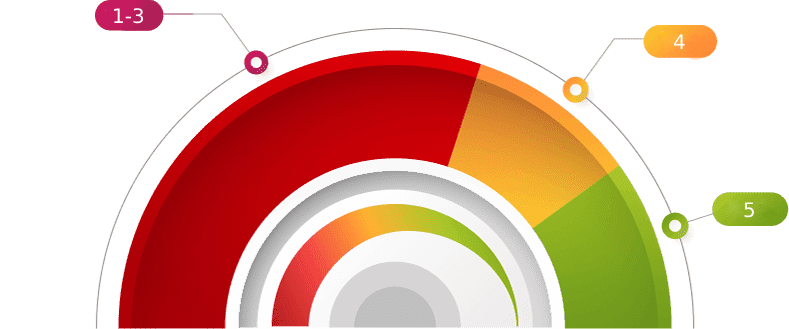

You scored 0

Hi Username,

Unfortunately you may fail prey to various scams.

Here's how you can equip yourself better whilst dealing with a potential fraud.

Click here to read up on some tips to safeguard yourself with Banking Dhyaan Se.

Wish to better your score? Retry Quiz

Hi Username,

While you try to be careful, you are still at risk of falling prey to various scams.

There are some simple ways you can protect yourself.

Click here to read up on some tips to safeguard yourself with Banking Dhyaan Se.

Wish to better your score? Retry Quiz

Hi Username,

WELL DONE! You are a Fraud Detection Expert! You are wise to the ways scammers can try to trick you into falling prey to their traps.

Download your Certificate for your excellent performance!

Click here to read up on some tips to ensure that you continue to safeguard yourself against potential frauds.

Secure Banking Guide

Download the Secure Banking Guide in your preferred language: