Page 15 - HDFC Bank TPP Flipbook

P. 15

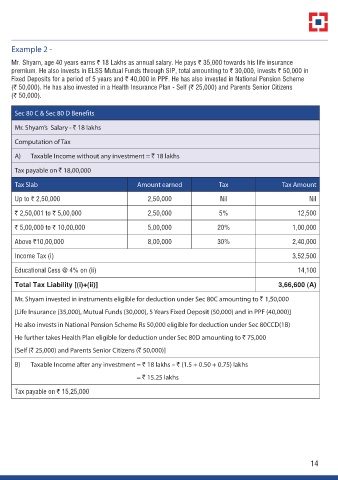

Example 2 -

Mr. Shyam, age 40 years earns r 18 Lakhs as annual salary. He pays r 35,000 towards his life insurance

premium. He also invests in ELSS Mutual Funds through SIP, total amounting to r 30,000, invests r 50,000 in

Fixed Deposits for a period of 5 years and r 40,000 in PPF. He has also invested in National Pension Scheme

(r 50,000). He has also invested in a Health Insurance Plan - Self (r 25,000) and Parents Senior Citizens

(r 50,000).

Sec 80 C & Sec 80 D Benefits

Mr. Shyam’s Salary - r 18 lakhs

Computation of Tax

A) Taxable Income without any investment = r 18 lakhs

Tax payable on r 18,00,000

Tax Slab Amount earned Tax Tax Amount

Up to r 2,50,000 2,50,000 Nil Nil

r 2,50,001 to r 5,00,000 2,50,000 5% 12,500

r 5,00,000 to r 10,00,000 5,00,000 20% 1,00,000

Above r10,00,000 8,00,000 30% 2,40,000

Income Tax (i) 3,52,500

Educational Cess @ 4% on (ii) 14,100

Total Tax Liability [(i)+(ii)] 3,66,600 (A)

Mr. Shyam invested in instruments eligible for deduction under Sec 80C amounting to r 1,50,000

[Life Insurance (35,000), Mutual Funds (30,000), 5 Years Fixed Deposit (50,000) and in PPF (40,000)]

He also invests in National Pension Scheme Rs 50,000 eligible for deduction under Sec 80CCD(1B)

He further takes Health Plan eligible for deduction under Sec 80D amounting to r 75,000

[Self (r 25,000) and Parents Senior Citizens (r 50,000)]

B) Taxable Income after any investment = r 18 lakhs – r (1.5 + 0.50 + 0.75) lakhs

= r 15.25 lakhs

Tax payable on r 15,25,000

14