Page 11 - HDFC Bank TPP Flipbook

P. 11

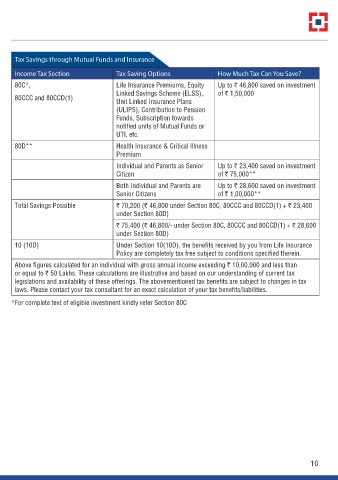

Tax Savings through Mutual Funds and Insurance

Income Tax Section Tax Saving Options How Much Tax Can You Save?

80C^, Life Insurance Premiums, Equity Up to r 46,800 saved on investment

Linked Savings Scheme (ELSS), of r 1,50,000

80CCC and 80CCD(1)

Unit Linked Insurance Plans

(ULIPS), Contribution to Pension

Funds, Subscription towards

notified units of Mutual Funds or

UTI, etc.

80D** Health Insurance & Critical Illness

Premium

Individual and Parents as Senior Up to r 23,400 saved on investment

Citizen of r 75,000**

Both Individual and Parents are Up to r 28,600 saved on investment

Senior Citizens of r 1,00,000**

Total Savings Possible r 70,200 (r 46,800 under Section 80C, 80CCC and 80CCD(1) + r 23,400

under Section 80D)

r 75,400 (r 46,800/- under Section 80C, 80CCC and 80CCD(1) + r 28,600

under Section 80D)

10 (10D) Under Section 10(10D), the benefits received by you from Life Insurance

Policy are completely tax free subject to conditions specified therein.

Above figures calculated for an individual with gross annual income exceeding r 10,00,000 and less than

or equal to r 50 Lakhs. These calculations are illustrative and based on our understanding of current tax

legislations and availability of these offerings. The abovementioned tax benefits are subject to changes in tax

laws. Please contact your tax consultant for an exact calculation of your tax benefits/liabilities.

^For complete text of eligible investment kindly refer Section 80C

10