Page 12 - HDFC Bank TPP Flipbook

P. 12

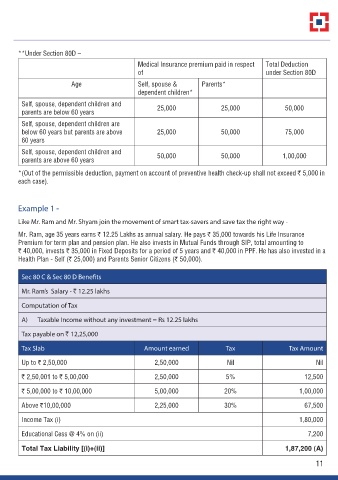

**Under Section 80D –

Medical Insurance premium paid in respect Total Deduction

of under Section 80D

Age Self, spouse & Parents*

dependent children*

Self, spouse, dependent children and 25,000 25,000 50,000

parents are below 60 years

Self, spouse, dependent children are

below 60 years but parents are above 25,000 50,000 75,000

60 years

Self, spouse, dependent children and 50,000 50,000 1,00,000

parents are above 60 years

*(Out of the permissible deduction, payment on account of preventive health check-up shall not exceed r 5,000 in

each case).

Example 1 -

Like Mr. Ram and Mr. Shyam join the movement of smart tax-savers and save tax the right way -

Mr. Ram, age 35 years earns r 12.25 Lakhs as annual salary. He pays r 35,000 towards his Life Insurance

Premium for term plan and pension plan. He also invests in Mutual Funds through SIP, total amounting to

r 40,000, invests r 35,000 in Fixed Deposits for a period of 5 years and r 40,000 in PPF. He has also invested in a

Health Plan - Self (r 25,000) and Parents Senior Citizens (r 50,000).

Sec 80 C & Sec 80 D Benefits

Mr. Ram’s Salary - r 12.25 lakhs

Computation of Tax

A) Taxable Income without any investment = Rs 12.25 lakhs

Tax payable on r 12,25,000

Tax Slab Amount earned Tax Tax Amount

Up to r 2,50,000 2,50,000 Nil Nil

r 2,50,001 to r 5,00,000 2,50,000 5% 12,500

r 5,00,000 to r 10,00,000 5,00,000 20% 1,00,000

Above r10,00,000 2,25,000 30% 67,500

Income Tax (i) 1,80,000

Educational Cess @ 4% on (ii) 7,200

Total Tax Liability [(i)+(ii)] 1,87,200 (A)

11