Page 55 - HDFC Bank TPP Flipbook

P. 55

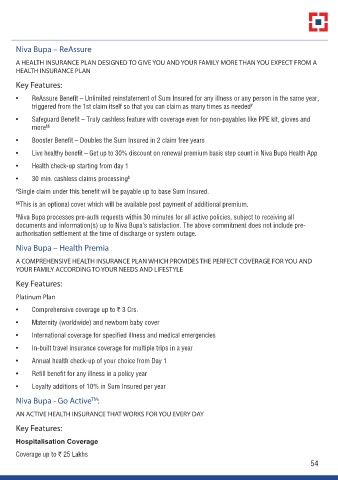

Niva Bupa – ReAssure

A HEALTH INSURANCE PLAN DESIGNED TO GIVE YOU AND YOUR FAMILY MORE THAN YOU EXPECT FROM A

HEALTH INSURANCE PLAN

Key Features:

• ReAssure Benefit – Unlimited reinstatement of Sum Insured for any illness or any person in the same year,

triggered from the 1st claim itself so that you can claim as many times as needed #

• Safeguard Benefit – Truly cashless feature with coverage even for non-payables like PPE kit, gloves and

more $$

• Booster Benefit – Doubles the Sum Insured in 2 claim free years

• Live healthy benefit – Get up to 30% discount on renewal premium basis step count in Niva Bupa Health App

• Health check-up starting from day 1

• 30 min. cashless claims processing $

# Single claim under this benefit will be payable up to base Sum Insured.

$$ This is an optional cover which will be available post payment of additional premium.

$ Niva Bupa processes pre-auth requests within 30 minutes for all active policies, subject to receiving all

documents and information(s) up to Niva Bupa’s satisfaction. The above commitment does not include pre-

authorisation settlement at the time of discharge or system outage.

Niva Bupa – Health Premia

A COMPREHENSIVE HEALTH INSURANCE PLAN WHICH PROVIDES THE PERFECT COVERAGE FOR YOU AND

YOUR FAMILY ACCORDING TO YOUR NEEDS AND LIFESTYLE

Key Features:

Platinum Plan

• Comprehensive coverage up to r 3 Crs.

• Maternity (worldwide) and newborn baby cover

• International coverage for specified illness and medical emergencies

• In-built travel insurance coverage for multiple trips in a year

• Annual health check-up of your choice from Day 1

• Refill benefit for any illness in a policy year

• Loyalty additions of 10% in Sum Insured per year

Niva Bupa - Go Active :

TM

AN ACTIVE HEALTH INSURANCE THAT WORKS FOR YOU EVERY DAY

Key Features:

Hospitalisation Coverage

Coverage up to r 25 Lakhs

54