Page 52 - HDFC Bank TPP Flipbook

P. 52

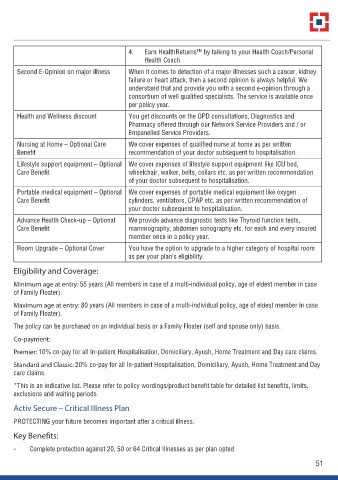

4. Earn HealthReturns by talking to your Health Coach/Personal

TM

Health Coach

Second E-Opinion on major illness When it comes to detection of a major illnesses such a cancer, kidney

failure or heart attack, then a second opinion is always helpful. We

understand that and provide you with a second e-opinion through a

consortium of well qualified specialists. The service is available once

per policy year.

Health and Wellness discount You get discounts on the OPD consultations, Diagnostics and

Pharmacy offered through our Network Service Providers and / or

Empanelled Service Providers.

Nursing at Home – Optional Care We cover expenses of qualified nurse at home as per written

Benefit recommendation of your doctor subsequent to hospitalisation.

Lifestyle support equipment – Optional We cover expenses of lifestyle support equipment like ICU bed,

Care Benefit wheelchair, walker, belts, collars etc. as per written recommendation

of your doctor subsequent to hospitalisation.

Portable medical equipment – Optional We cover expenses of portable medical equipment like oxygen

Care Benefit cylinders, ventilators, CPAP etc. as per written recommendation of

your doctor subsequent to hospitalisation.

Advance Health Check-up – Optional We provide advance diagnostic tests like Thyroid function tests,

Care Benefit mammography, abdomen sonography etc. for each and every insured

member once in a policy year.

Room Upgrade – Optional Cover You have the option to upgrade to a higher category of hospital room

as per your plan’s eligibility.

Eligibility and Coverage:

Minimum age at entry: 55 years (All members in case of a multi-individual policy, age of eldest member in case

of Family Floater).

Maximum age at entry: 80 years (All members in case of a multi-individual policy, age of eldest member in case

of Family Floater).

The policy can be purchased on an individual basis or a Family Floater (self and spouse only) basis.

Co-payment:

Premier: 10% co-pay for all In-patient Hospitalisation, Domiciliary, Ayush, Home Treatment and Day care claims.

Standard and Classic: 20% co-pay for all In-patient Hospitalisation, Domiciliary, Ayush, Home Treatment and Day

care claims.

*This is an indicative list. Please refer to policy wordings/product benefit table for detailed list benefits, limits,

exclusions and waiting periods.

Activ Secure – Critical Illness Plan

PROTECTING your future becomes important after a critical illness.

Key Benefits:

- Complete protection against 20, 50 or 64 Critical Illnesses as per plan opted

51