This Integrated Annual Report for 2021-22 provides insight into the process followed by the Bank as it endeavours to deliver on its purpose. It provides a holistic assessment of the Bank’s financial and non-financial performance. It also outlines relevant information on the Bank’s strategy, governance, risks and prospects to offer better insights into its activities and progress.

Reporting principles and framework

The financial information presented in this report is in line with the requirements of

- The Companies Act, 2013 (including the rules made thereunder)

- The Companies (Accounting Standards) Rules, 2006

- The Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015

- The Banking Regulation Act, 1949 and other relevant RBI regulations

The report has been prepared in accordance with the <IR> framework prescribed by the International Integrated Reporting Council (IIRC) and also contains disclosures as per the Global Reporting Initiative (GRI) Standards: Comprehensive option, Task Force on Climate-related Financial Disclosures (TCFD), Business Responsibility and Sustainability Report (BRSR) and United Nations Sustainable Development Goals (UNSDGs).

There are no restatements of information provided in the integrated report during the reporting year. However the changes in the GHG accounting methodology from FY21 are documented on pages 59-61.

Materiality and scope

This report includes information which is material to all stakeholders of the Bank and provides an overview of its business and related activities. The report discloses matters that substantially impact or affect the Bank’s ability to create value and could influence decisions of providers of financial capital. In FY19 we conducted a materiality assessment in line with GRI requirements through consultations with internal and external stakeholders. Subsequently, in FY21, we have refreshed our materiality study to consider emerging topics of interest within the ESG domain. The GRI Content Index, which specifies the GRI Standards and disclosures made under them in the Report, has been provided in this report.

Reporting boundary

The non-financial information in this report covers the activities and progress of the Bank on a standalone basis. It covers information pertaining to the period from

April 1, 2021 to March 31, 2022.

Assurance statement

The report has also been externally assured by an independent third party, based on ISAE 3000 (Revised).

Responsibility statement

The content of this report has been reviewed by the senior management of the Bank, and reviewed and approved by the Board of Directors to ensure accuracy, completeness and relevance of the information presented in line with the principles and requirements of the International Integrated Reporting Framework.

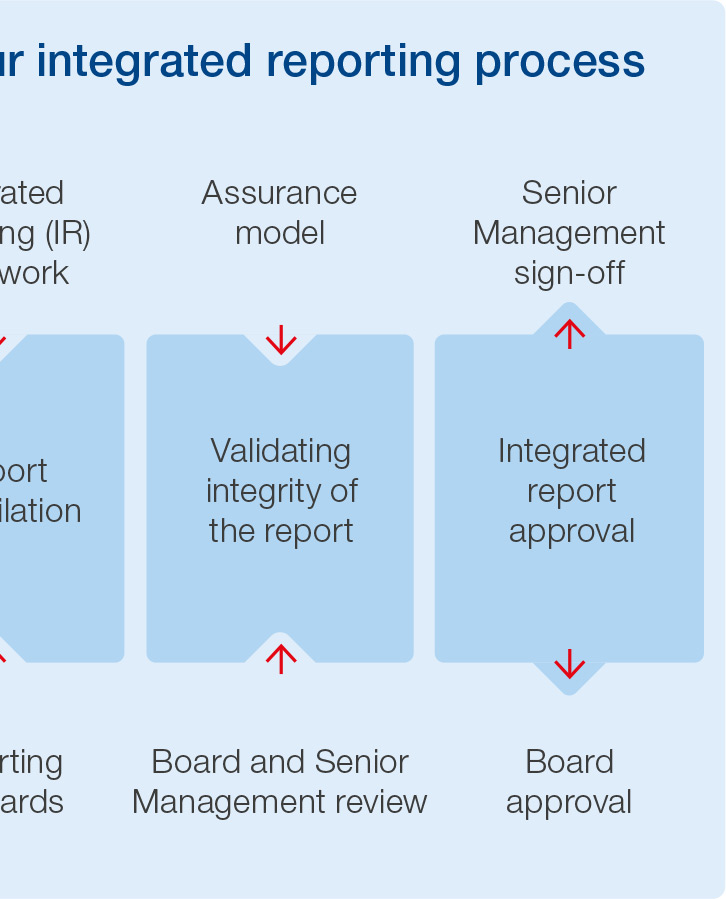

Governance over integrated reporting process

The 2022 Integrated Report is prepared through the joint effort of a cross-functional team, led by the Bank’s Chief Financial Officer (CFO), representing various departments as well as subject matter experts. The information is collated from Senior Management and Board discussions and decisions as well as inputs taken from internal stakeholders. Several drafts of the report are produced with oversight from the department heads and the CFO. Members of Bank’s Senior Management team and the Board are involved in the various approval processes, which are also supported by the oversight provided by independent assurance providers.

How to navigate the report

We have used the icons below to aid navigation and cross-referencing across the report.

Our Capitals

Financial Capital

Our disciplined and researched approach towards raising, lending and managing our financial capital forms the backbone of our strong capital base and consistent shareholder returns. Our financial capital includes customer deposits, shareholder equity, retained earnings and external borrowings, among others.

Read MoreHuman Capital

Our people and culture are fundamental to our success. Their collective knowledge, diverse skill sets and deep experience constitute our human capital. Our people enable us to stay agile, adapt to changing times, innovate and deliver competitive solutions.

Read MoreIntellectual Capital

Our Digital and Enterprise Factory along with our hybrid cloud strategy enables us to serve our customers and other stakeholders efficiently. The knowledge and expertise incorporated within our systems, processes and procedures and the equity built in the HDFC Bank brand, constitute our intellectual capital.

Read MoreSocial & Relationship Capital

We take a holistic approach to sustainable value creation by nurturing our longstanding relationships with our stakeholders. We are cognisant of the role we play as a Bank in nationbuilding and contribute responsibly to the economy. The way we manage our stakeholder expectations constitutes our social and relationship capital.

Read MoreManufactured Capital

Our pan-India distribution network of banking outlets, corporate offices, ATMs and other customer touch points, facilitates our engagement with customers, people, the society and other stakeholders and forms the core of our manufactured capital. It also covers our robust IT infrastructure and data centres.

Read MoreNatural Capital

The use of natural resources in our operations and the delivery of our products and services constitute our natural capital. Natural resources include energy and water consumed, waste generated and the impact of our business activities on the climate and the environment.

Read MoreOur stakeholders

![]() Customers

Customers

![]() Government/Regulatory Bodies

Government/Regulatory Bodies

![]() Community

Community

![]() Employees

Employees

![]() Investors

Investors

![]() Suppliers

Suppliers