Page 3 - HDFC Bank | Take the cut out of your tax cut

P. 3

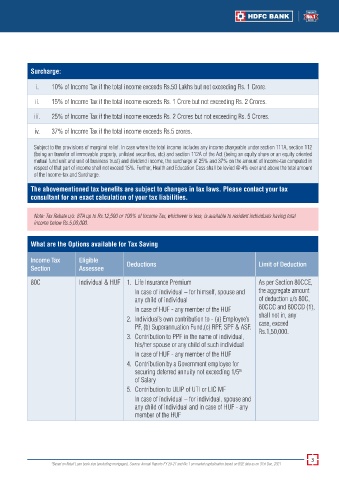

Surcharge:

i. 10% of Income Tax if the total income exceeds Rs.50 Lakhs but not exceeding Rs. 1 Crore.

ii. 15% of Income Tax if the total income exceeds Rs. 1 Crore but not exceeding Rs. 2 Crores.

iii. 25% of Income Tax if the total income exceeds Rs. 2 Crores but not exceeding Rs. 5 Crores.

iv. 37% of Income Tax if the total income exceeds Rs.5 crores.

Subject to the provisions of marginal relief. In case where the total income includes any income chargeable under section 111A, section 112

(being an transfer of immovable property, unlisted securities, etc) and section 112A of the Act (being an equity share or an equity oriented

mutual fund unit and unit of business trust) and dividend income, the surcharge of 25% and 37% on the amount of Income-tax computed in

respect of that part of income shall not exceed 15%. Further, Health and Education Cess shall be levied @ 4% over and above the total amount

of the Income-tax and Surcharge.

The abovementioned tax benefits are subject to changes in tax laws. Please contact your tax

consultant for an exact calculation of your tax liabilities.

Note: Tax Rebate u/s. 87A up to Rs.12,500 or 100% of Income Tax, whichever is less, is available to resident individuals having total

income below Rs.5,00,000.

What are the Options available for Tax Saving

Income Tax Eligible Deductions Limit of Deduction

Section Assessee

80C Individual & HUF 1. Life Insurance Premium As per Section 80CCE,

In case of individual – for himself, spouse and the aggregate amount

any child of individual of deduction u/s 80C,

In case of HUF - any member of the HUF 80CCC and 80CCD (1),

2. Individual’s own contribution to - (a) Employee’s shall not in, any

case, exceed

PF, (b) Superannuation Fund,(c) RPF, SPF & ASF. Rs.1,50,000.

3. Contribution to PPF in the name of individual,

his/her spouse or any child of such individual

In case of HUF - any member of the HUF

4. Contribution by a Government employee for

securing deferred annuity not exceeding 1/5

th

of Salary

5. Contribution to ULIP of UTI or LIC MF

In case of individual – for individual, spouse and

any child of individual and in case of HUF - any

member of the HUF

3

*Based on Retail Loan book size (excluding mortgages). Source: Annual Reports FY 20-21 and No.1 on market capitalisation based on BSE data as on 31st Dec, 2021