Page 7 - HDFC Bank | Take the cut out of your tax cut

P. 7

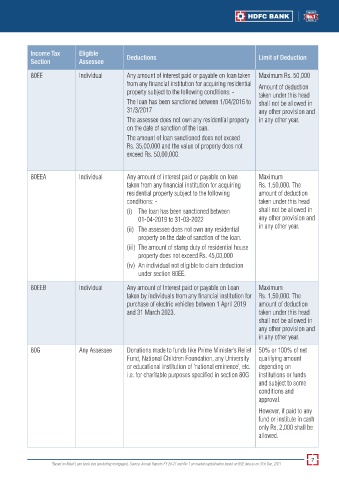

Income Tax Eligible

Section Assessee Deductions Limit of Deduction

80EE Individual Any amount of interest paid or payable on loan taken Maximum Rs. 50,000

from any financial institution for acquiring residential Amount of deduction

property subject to the following conditions: - taken under this head

The loan has been sanctioned between 1/04/2016 to shall not be allowed in

31/3/2017 any other provision and

The assessee does not own any residential property in any other year.

on the date of sanction of the loan.

The amount of loan sanctioned does not exceed

Rs. 35,00,000 and the value of property does not

exceed Rs. 50,00,000.

80EEA Individual Any amount of interest paid or payable on loan Maximum

taken from any financial institution for acquiring Rs. 1,50,000. The

residential property subject to the following amount of deduction

conditions: - taken under this head

(i) The loan has been sanctioned between shall not be allowed in

01-04-2019 to 31-03-2022 any other provision and

(ii) The assessee does not own any residential in any other year.

property on the date of sanction of the loan.

(iii) The amount of stamp duty of residential house

property does not exceed Rs. 45,00,000

(iv) An individual not eligible to claim deduction

under section 80EE.

80EEB Individual Any amount of Interest paid or payable on Loan Maximum

taken by individuals from any financial institution for Rs. 1,50,000. The

purchase of electric vehicles between 1 April 2019 amount of deduction

and 31 March 2023. taken under this head

shall not be allowed in

any other provision and

in any other year.

80G Any Assessee Donations made to funds like Prime Minister’s Relief 50% or 100% of net

Fund, National Children Foundation, any University qualifying amount

or educational institution of ‘national eminence’, etc. depending on

i.e. for charitable purposes specified in section 80G institutions or funds

and subject to some

conditions and

approval.

However, if paid to any

fund or institute in cash

only Rs. 2,000 shall be

allowed.

7

*Based on Retail Loan book size (excluding mortgages). Source: Annual Reports FY 20-21 and No.1 on market capitalisation based on BSE data as on 31st Dec, 2021