Page 5 - HDFC Bank | Take the cut out of your tax cut

P. 5

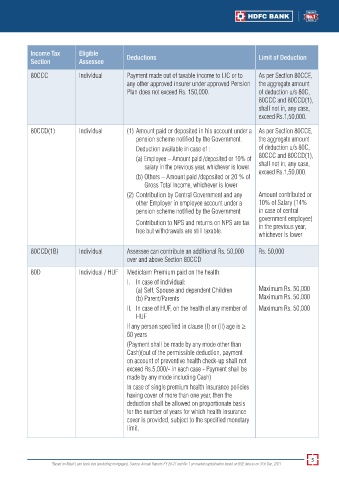

Income Tax Eligible

Section Assessee Deductions Limit of Deduction

80CCC Individual Payment made out of taxable income to LIC or to As per Section 80CCE,

any other approved insurer under approved Pension the aggregate amount

Plan does not exceed Rs. 150,000. of deduction u/s 80C,

80CCC and 80CCD(1),

shall not in, any case,

exceed Rs.1,50,000.

80CCD(1) Individual (1) Amount paid or deposited in his account under a As per Section 80CCE,

pension scheme notified by the Government. the aggregate amount

Deduction available in case of : of deduction u/s 80C,

(a) Employee – Amount paid /deposited or 10% of 80CCC and 80CCD(1),

salary in the previous year, whichever is lower. shall not in, any case,

(b) Others – Amount paid /deposited or 20 % of exceed Rs.1,50,000.

Gross Total Income, whichever is lower

(2) Contribution by Central Government and any Amount contributed or

other Employer in employee account under a 10% of Salary (14%

pension scheme notified by the Government in case of central

government employee)

Contribution to NPS and returns on NPS are tax in the previous year,

free but withdrawals are still taxable.

whichever is lower

80CCD(1B) Individual Assessee can contribute an additional Rs. 50,000 Rs. 50,000

over and above Section 80CCD

80D Individual / HUF Mediclaim Premium paid on the health:

I. In case of individual:

(a) Self, Spouse and dependent Children Maximum Rs. 50,000

(b) Parent/Parents Maximum Rs. 50,000

II. In case of HUF, on the health of any member of Maximum Rs. 50,000

HUF

If any person specified in clause (I) or (II) age is ≥

60 years

(Payment shall be made by any mode other than

Cash)(out of the permissible deduction, payment

on account of preventive health check-up shall not

exceed Rs.5,000/- in each case - Payment shall be

made by any mode including Cash)

In case of single premium health insurance policies

having cover of more than one year, then the

deduction shall be allowed on proportionate basis

for the number of years for which health insurance

cover is provided, subject to the specified monetary

limit.

5

*Based on Retail Loan book size (excluding mortgages). Source: Annual Reports FY 20-21 and No.1 on market capitalisation based on BSE data as on 31st Dec, 2021