Page 8 - HDFC Bank | Take the cut out of your tax cut

P. 8

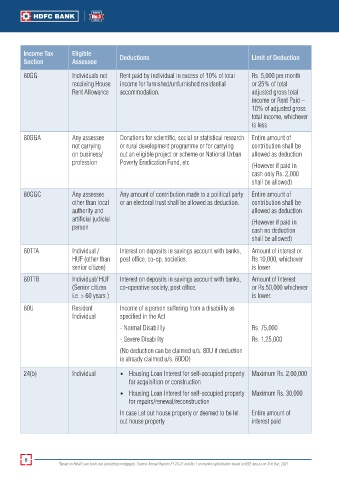

Income Tax Eligible Deductions Limit of Deduction

Section Assessee

80GG Individuals not Rent paid by individual in excess of 10% of total Rs. 5,000 per month

receiving House income for furnished/unfurnished residential or 25% of total

Rent Allowance accommodation. adjusted gross total

income or Rent Paid –

10% of adjusted gross

total income, whichever

is less

80GGA Any assessee Donations for scientific, social or statistical research Entire amount of

not carrying or rural development programme or for carrying contribution shall be

on business/ out an eligible project or scheme or National Urban allowed as deduction

profession Poverty Eradication Fund, etc (However if paid in

cash only Rs. 2,000

shall be allowed)

80GGC Any assessee Any amount of contribution made to a political party Entire amount of

other than local or an electoral trust shall be allowed as deduction. contribution shall be

authority and allowed as deduction

artificial judicial (However if paid in

person cash no deduction

shall be allowed)

80TTA Individual / Interest on deposits in savings account with banks, Amount of interest or

HUF (other than post office, co-op. societies. Rs.10,000, whichever

senior citizen) is lower

80TTB Individual/ HUF Interest on deposits in savings account with banks, Amount of Interest

(Senior citizen co-operative society, post office. or Rs.50,000 whichever

i.e. > 60 years ) is lower.

80U Resident Income of a person suffering from a disability as

Individual specified in the Act

- Normal Disability Rs. 75,000

- Severe Disability Rs. 1,25,000

(No deduction can be claimed u/s. 80U if deduction

is already claimed u/s. 80DD)

24(b) Individual • Housing Loan Interest for self-occupied property Maximum Rs. 2,00,000

for acquisition or construction

• Housing Loan Interest for self-occupied property Maximum Rs. 30,000

for repairs/renewal/reconstruction

In case Let out house property or deemed to be let Entire amount of

out house property interest paid

8

*Based on Retail Loan book size (excluding mortgages). Source: Annual Reports FY 20-21 and No.1 on market capitalisation based on BSE data as on 31st Dec, 2021