Financial Literacy & Inclusion

- 23,00,000+

Financial Literacy Camps conducted

- 1,71,00,000+

Individuals Impacted

Financial literacy is the first step towards real financial inclusion. Our Bank conducts financial literacy workshops for communities to enable them to make smart financial decisions and sustain themselves. Our Bank also disseminates information on general banking, credit counselling in schools and colleges, and among senior citizens and pensioners

- Case Studies

- Gallery

Weaving prosperity, one thread at a time

For the past 25 years Kala and her husband from Ramanali Colony, Salem have been involved in the traditional weaving business. Their son added a new spin to the family occupation when he started his own business of electronic weaving. Even though all three members of the family were working, they were not able to earn enough to live comfortably. HDFC Bank Parivartan empowered Kala by imparting financial knowledge and by providing her a loan of ₹ 25,000. She used the money to weave silk sarees and exported them to a shop in Arani, which had a high demand for the same. Today, Kala and her family are living a comfortable life with the money they make from their business. She has also invested a portion of their profits in a recurring deposit.

The recipe for sweet success

Maliga and her family of five used to toil in the fields of Periyathadhampatti, Virudhunagar for daily wages. Missing a day’s work used to cost them a meal. When their children taught Maliga and her husband to make sweets, they saw new doors opening for them in the form of a business opportunity. They raised funds by pawning their jewelry and started the business on a small scale. HDFC Bank Parivartan enabled them to avail a loan of ₹ 40,000 through their financial literacy programmes which assisted them to develop their business. Today, Maliga and her family own a sweet shop that sells a wide variety of sweets and snacks. They also have four employees whom she pays ₹ 500 each. From living in a small hut to owning a house of her own, Maliga has come a long way and is a source of inspiration to many girls.

A great idea on paper

Uma Devi Bari from Rajasthan lives in a joint family with her husband, children and in-laws. Her husband works in a socks factory and she joined her mother-in-law’s paper plate business. Unfortunately, the income they earned was not sufficient enough to support the whole family. HDFC Bank Parivartan empowered Uma and many others in her community to make sound financial decisions through workshops and provided them a group loan to develop their businesses. Uma invested the money she received in buying new machines and raw materials for her business. Soon afterwards, her productivity increased and she earned good returns. Today, Uma is selling her paper plates to many vendors and event organizers. She has ample number of customers and her family was able to buy a new house with her husband’s savings.

What sweet dreams are made of

Sukheri Dei lives with her husband and their four kids in Nayagarh, Odisha. Her husband owns a small business of homemade sweets. When Sukheri learnt to make sweets, she joined her husband’s business and supported him. HDFC Bank Parivartan empowered Sukheri by providing her with financial assistance and a group loan of ₹ 25,000. She used the money to develop their business by making and selling new varieties of sweets. Today, Sukheri sells a wide variety of sweets including cheesecake, gulab jamun, rasagulla and gajjak. She’s living a comfortable life and even has two employees to help her out.

Weaving a better life

Sudama Bai from Churikala, Koraba lives with her husband and their two kids. Even though her husband Laxmi Pratap has been involved in the weaving business for the past 40 years, he was unable to meet the family’s basic necessities. Sudama and her husband tried expanding the business to cotton weaving and later entered the Korba’s trademark Kosa handloom business. But they did not get sufficient returns for the money that they invested. HDFC Bank Parivartan enabled Sudama to make sound financial decisions through workshops following which she availed a group loan from the bank. Sudama invested the money to buy raw materials for weaving Kosa shirts and saris. Sudama is happy that she could expand her business and with the returns received they are able to meet their basic needs comfortably.

A stitch in time

Latha, a tailor from Thuthipet, Ambur who stitched leather shoes for a living. Her husband has been involved in the moulding business for the past 10 years. They have two children and were finding it difficult to make ends meet. HDFC Bank Parivartan enabled Latha to learn about managing finances through their financial literacy programmes. The loan provided to her further develop her business. Latha now owns a cloth shop and earns a regular income. Her children are studying in private schools and her family is leading a comfortable life.

Beneficiary receiving payment digitally for milk under Milk to Money initiative

SHG Monthly Meeting

SHG maintaining meeting records

Self Help Group members discussing in monthly meeting

Promoting Digital Literacy

Financial Literacy Credit Counseling

Financial Literacy Credit Counseling at branch

Financial Literacy Camp at Schools

Digital Literacy Center

Dhanchayat drive under Swachha Banking Initiative

OTHER INITIATIVES

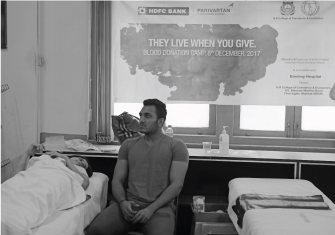

Organizing blood donation drive

HDFC Bank conducts one of India's largest single day blood...

Read moreOrganizing blood donation drive

HDFC Bank conducts one of India's largest single day blood donation drives. The Bank started this initiative in 2007 when over 4000 volunteers came forward to donate blood. Over the past eight years, this initiative has grown in size and stature. On 11th December 2015, HDFC Bank's All India Blood Donation Drive was attended by 1,76,022 volunteers, with 1,49,562 units collected.