Page 6 - HDFC Bank TPP Flipbook

P. 6

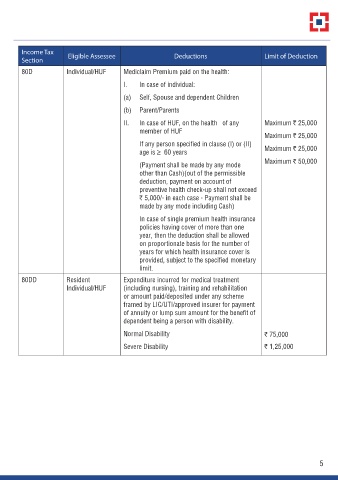

Income Tax Eligible Assessee Deductions Limit of Deduction

Section

80D Individual/HUF Mediclaim Premium paid on the health:

I. In case of individual:

(a) Self, Spouse and dependent Children

(b) Parent/Parents

II. In case of HUF, on the health of any Maximum r 25,000

member of HUF

Maximum r 25,000

If any person specified in clause (I) or (II) Maximum r 25,000

age is ≥ 60 years

Maximum r 50,000

(Payment shall be made by any mode

other than Cash)(out of the permissible

deduction, payment on account of

preventive health check-up shall not exceed

r 5,000/- in each case - Payment shall be

made by any mode including Cash)

In case of single premium health insurance

policies having cover of more than one

year, then the deduction shall be allowed

on proportionate basis for the number of

years for which health insurance cover is

provided, subject to the specified monetary

limit.

80DD Resident Expenditure incurred for medical treatment

Individual/HUF (including nursing), training and rehabilitation

or amount paid/deposited under any scheme

framed by LIC/UTI/approved insurer for payment

of annuity or lump sum amount for the benefit of

dependent being a person with disability.

Normal Disability r 75,000

Severe Disability r 1,25,000

5