Page 7 - HDFC Bank TPP Flipbook

P. 7

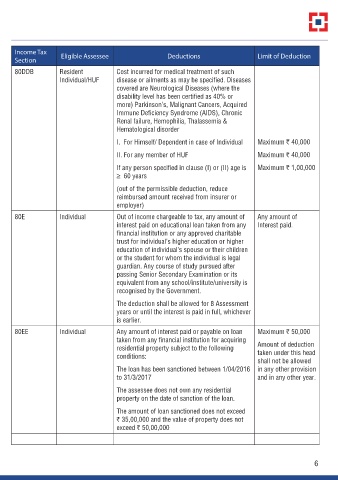

Income Tax Eligible Assessee Deductions Limit of Deduction

Section

80DDB Resident Cost incurred for medical treatment of such

Individual/HUF disease or ailments as may be specified. Diseases

covered are Neurological Diseases (where the

disability level has been certified as 40% or

more) Parkinson’s, Malignant Cancers, Acquired

Immune Deficiency Syndrome (AIDS), Chronic

Renal failure, Hemophilia, Thalassemia &

Hematological disorder

I. For Himself/ Dependent in case of Individual Maximum r 40,000

II. For any member of HUF Maximum r 40,000

If any person specified in clause (I) or (II) age is Maximum r 1,00,000

≥ 60 years

(out of the permissible deduction, reduce

reimbursed amount received from insurer or

employer)

80E Individual Out of income chargeable to tax, any amount of Any amount of

interest paid on educational loan taken from any Interest paid.

financial institution or any approved charitable

trust for individual’s higher education or higher

education of individual’s spouse or their children

or the student for whom the individual is legal

guardian. Any course of study pursued after

passing Senior Secondary Examination or its

equivalent from any school/institute/university is

recognised by the Government.

The deduction shall be allowed for 8 Assessment

years or until the interest is paid in full, whichever

is earlier.

80EE Individual Any amount of interest paid or payable on loan Maximum r 50,000

taken from any financial institution for acquiring Amount of deduction

residential property subject to the following

conditions: taken under this head

shall not be allowed

The loan has been sanctioned between 1/04/2016 in any other provision

to 31/3/2017 and in any other year.

The assessee does not own any residential

property on the date of sanction of the loan.

The amount of loan sanctioned does not exceed

r 35,00,000 and the value of property does not

exceed r 50,00,000

6