Page 45 - HDFC Bank | Take the cut out of your tax cut

P. 45

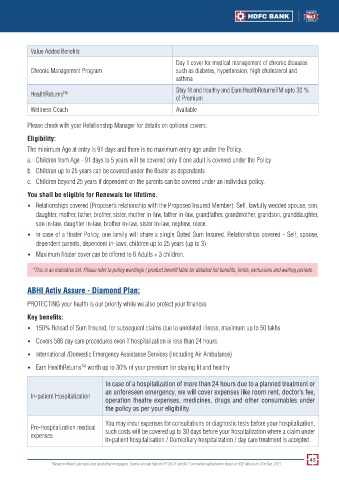

Value Added Benefits

Day 1 cover for medical management of chronic diseases

Chronic Management Program such as diabetes, hypertension, high cholesterol and

asthma

Stay fit and healthy and Earn HealthReturnsTM upto 30 %

HealthReturns TM

of Premium

Wellness Coach Available

Please check with your Relationship Manager for details on optional covers.

Eligibility:

The minimum Age at entry is 91 days and there is no maximum entry age under the Policy.

a. Children from Age - 91 days to 5 years will be covered only if one adult is covered under the Policy

b. Children up to 25 years can be covered under the floater as dependents

c. Children beyond 25 years if dependent on the parents can be covered under an individual policy.

You shall be eligible for Renewals for lifetime.

• Relationships covered (Proposer’s relationship with the Proposed Insured Member): Self, lawfully wedded spouse, son,

daughter, mother, father, brother, sister, mother in-law, father in-law, grandfather, grandmother, grandson, granddaughter,

son in-law, daughter in-law, brother in-law, sister in-law, nephew, niece.

• In case of a floater Policy, one family will share a single Opted Sum Insured. Relationships covered - Self, spouse,

dependent parents, dependent in-laws, children up to 25 years (up to 3)

• Maximum floater cover can be offered to 6 Adults + 3 children.

*This is an indicative list. Please refer to policy wordings / product benefit table for detailed list benefits, limits, exclusions and waiting periods.

ABHI Activ Assure - Diamond Plan:

PROTECTING your health is our priority while we also protect your finances

Key benefits:

• 150% Reload of Sum Insured, for subsequent claims due to unrelated illness, maximum up to 50 lakhs

• Covers 586 day care procedures even if hospitalization is less than 24 hours.

• International /Domestic Emergency Assistance Services (Including Air Ambulance)

TM

• Earn HealthReturns worth up to 30% of your premium for staying fit and healthy

In case of a hospitalization of more than 24 hours due to a planned treatment or

an unforeseen emergency, we will cover expenses like room rent, doctor’s fee,

In-patient Hospitalization

operation theatre expenses, medicines, drugs and other consumables under

the policy as per your eligibility.

You may incur expenses for consultations or diagnostic tests before your hospitalization,

Pre-hospitalization medical such costs will be covered up to 30 days before your hospitalization where a claim under

expenses

In-patient hospitalisation / Domiciliary hospitalization / day care treatment is accepted.

45

*Based on Retail Loan book size (excluding mortgages). Source: Annual Reports FY 20-21 and No.1 on market capitalisation based on BSE data as on 31st Dec, 2021