Page 48 - HDFC Bank | Take the cut out of your tax cut

P. 48

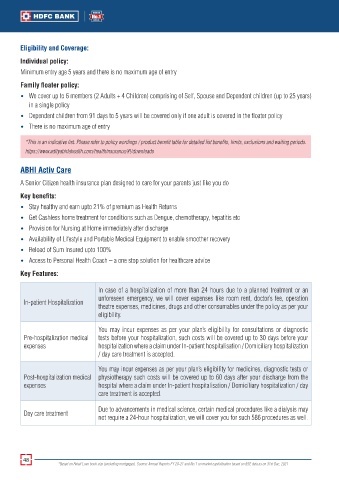

Eligibility and Coverage:

Individual policy:

Minimum entry age 5 years and there is no maximum age of entry

Family floater policy:

• We cover up to 6 members (2 Adults + 4 Children) comprising of Self, Spouse and Dependent children (up to 25 years)

in a single policy

• Dependent children from 91 days to 5 years will be covered only if one adult is covered in the floater policy

• There is no maximum age of entry

*This is an indicative list. Please refer to policy wordings / product benefit table for detailed list benefits, limits, exclusions and waiting periods.

https://www.adityabirlahealth.com/healthinsurance/#!/downloads

ABHI Activ Care

A Senior Citizen health insurance plan designed to care for your parents just like you do

Key benefits:

• Stay healthy and earn upto 21% of premium as Health Returns

• Get Cashless home treatment for conditions such as Dengue, chemotherapy, hepatitis etc

• Provision for Nursing at Home immediately after discharge

• Availability of Lifestyle and Portable Medical Equipment to enable smoother recovery

• Reload of Sum Insured upto 100%

• Access to Personal Health Coach – a one stop solution for healthcare advice

Key Features:

In case of a hospitalization of more than 24 hours due to a planned treatment or an

unforeseen emergency, we will cover expenses like room rent, doctor’s fee, operation

In-patient Hospitalization

theatre expenses, medicines, drugs and other consumables under the policy as per your

eligibility.

You may incur expenses as per your plan’s eligibility for consultations or diagnostic

Pre-hospitalization medical tests before your hospitalization, such costs will be covered up to 30 days before your

expenses hospitalization where a claim under In-patient hospitalisation / Domiciliary hospitalization

/ day care treatment is accepted.

You may incur expenses as per your plan’s eligibility for medicines, diagnostic tests or

Post-hospitalization medical physiotherapy such costs will be covered up to 60 days after your discharge from the

expenses hospital where a claim under In-patient hospitalisation / Domiciliary hospitalization / day

care treatment is accepted.

Due to advancements in medical science, certain medical procedures like a dialysis may

Day care treatment

not require a 24-hour hospitalization, we will cover you for such 586 procedures as well.

48

*Based on Retail Loan book size (excluding mortgages). Source: Annual Reports FY 20-21 and No.1 on market capitalisation based on BSE data as on 31st Dec, 2021