Page 49 - HDFC Bank | Take the cut out of your tax cut

P. 49

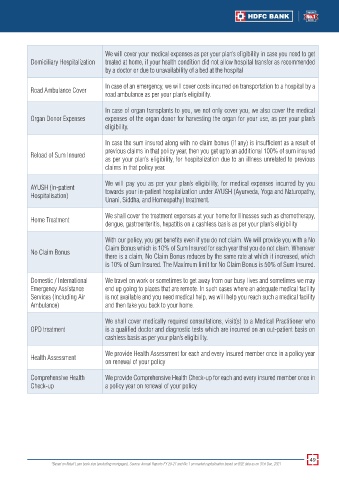

We will cover your medical expenses as per your plan’s eligibility in case you need to get

Domiciliary Hospitalization treated at home, if your health condition did not allow hospital transfer as recommended

by a doctor or due to unavailability of a bed at the hospital

In case of an emergency, we will cover costs incurred on transportation to a hospital by a

Road Ambulance Cover

road ambulance as per your plan’s eligibility.

In case of organ transplants to you, we not only cover you, we also cover the medical

Organ Donor Expenses expenses of the organ donor for harvesting the organ for your use, as per your plan’s

eligibility.

In case the sum insured along with no claim bonus (if any) is insufficient as a result of

previous claims in that policy year, then you get upto an additional 100% of sum insured

Reload of Sum Insured

as per your plan’s eligibility, for hospitalization due to an illness unrelated to previous

claims in that policy year.

We will pay you as per your plan’s eligibility, for medical expenses incurred by you

AYUSH (In-patient towards your in-patient hospitalization under AYUSH (Ayurveda, Yoga and Naturopathy,

Hospitalisation)

Unani, Siddha, and Homeopathy) treatment.

We shall cover the treatment expenses at your home for Illnesses such as chemotherapy,

Home Treatment

dengue, gastroenteritis, hepatitis on a cashless basis as per your plan’s eligibility

With our policy, you get benefits even if you do not claim. We will provide you with a No

Claim Bonus which is 10% of Sum Insured for each year that you do not claim. Whenever

No Claim Bonus

there is a claim, No Claim Bonus reduces by the same rate at which it increased, which

is 10% of Sum Insured. The Maximum limit for No Claim Bonus is 50% of Sum Insured.

Domestic / International We travel on work or sometimes to get away from our busy lives and sometimes we may

Emergency Assistance end up going to places that are remote. In such cases where an adequate medical facility

Services (Including Air is not available and you need medical help, we will help you reach such a medical facility

Ambulance) and then take you back to your home.

We shall cover medically required consultations, visit(s) to a Medical Practitioner who

OPD treatment is a qualified doctor and diagnostic tests which are incurred on an out-patient basis on

cashless basis as per your plan’s eligibility.

We provide Health Assessment for each and every insured member once in a policy year

Health Assessment

on renewal of your policy

Comprehensive Health We provide Comprehensive Health Check-up for each and every insured member once in

Check-up a policy year on renewal of your policy

49

*Based on Retail Loan book size (excluding mortgages). Source: Annual Reports FY 20-21 and No.1 on market capitalisation based on BSE data as on 31st Dec, 2021