Page 52 - HDFC Bank | Take the cut out of your tax cut

P. 52

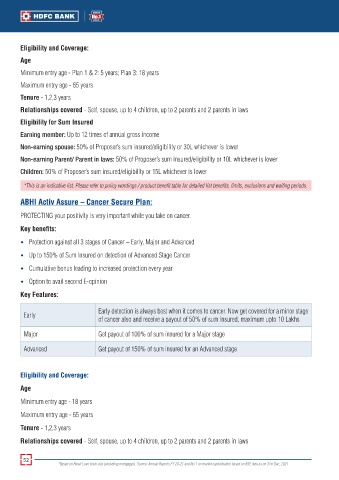

Eligibility and Coverage:

Age

Minimum entry age - Plan 1 & 2: 5 years; Plan 3: 18 years

Maximum entry age - 65 years

Tenure - 1,2,3 years

Relationships covered - Self, spouse, up to 4 children, up to 2 parents and 2 parents in laws

Eligibility for Sum Insured

Earning member: Up to 12 times of annual gross income

Non-earning spouse: 50% of Proposer’s sum insured/eligibility or 30L whichever is lower

Non-earning Parent/ Parent in laws: 50% of Proposer’s sum insured/eligibility or 10L whichever is lower

Children: 50% of Proposer’s sum insured/eligibility or 15L whichever is lower

*This is an indicative list. Please refer to policy wordings / product benefit table for detailed list benefits, limits, exclusions and waiting periods.

ABHI Activ Assure – Cancer Secure Plan:

PROTECTING your positivity is very important while you take on cancer.

Key benefits:

• Protection against all 3 stages of Cancer – Early, Major and Advanced

• Up to 150% of Sum Insured on detection of Advanced Stage Cancer

• Cumulative bonus leading to increased protection every year

• Option to avail second E-opinion

Key Features:

Early detection is always best when it comes to cancer. Now get covered for a minor stage

Early

of cancer also and receive a payout of 50% of sum insured, maximum upto 10 Lakhs

Major Get payout of 100% of sum insured for a Major stage

Advanced Get payout of 150% of sum insured for an Advanced stage

Eligibility and Coverage:

Age

Minimum entry age - 18 years

Maximum entry age - 65 years

Tenure - 1,2,3 years

Relationships covered - Self, spouse, up to 4 children, up to 2 parents and 2 parents in laws

52

*Based on Retail Loan book size (excluding mortgages). Source: Annual Reports FY 20-21 and No.1 on market capitalisation based on BSE data as on 31st Dec, 2021