Page 2 - HDFC Bank TPP Flipbook

P. 2

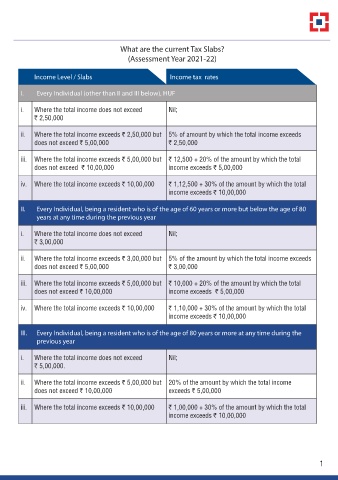

What are the current Tax Slabs?

(Assessment Year 2021-22)

Income Level / Slabs Income tax rates

I. Every Individual (other than II and III below), HUF

i. Where the total income does not exceed Nil;

r 2,50,000

ii. Where the total income exceeds r 2,50,000 but 5% of amount by which the total income exceeds

does not exceed r 5,00,000 r 2,50,000

iii. Where the total income exceeds r 5,00,000 but r 12,500 + 20% of the amount by which the total

does not exceed r 10,00,000 income exceeds r 5,00,000

iv. Where the total income exceeds r 10,00,000 r 1,12,500 + 30% of the amount by which the total

income exceeds r 10,00,000

II. Every Individual, being a resident who is of the age of 60 years or more but below the age of 80

years at any time during the previous year

i. Where the total income does not exceed Nil;

r 3,00,000

ii. Where the total income exceeds r 3,00,000 but 5% of the amount by which the total income exceeds

does not exceed r 5,00,000 r 3,00,000

iii. Where the total income exceeds r 5,00,000 but r 10,000 + 20% of the amount by which the total

does not exceed r 10,00,000 income exceeds r 5,00,000

iv. Where the total income exceeds r 10,00,000 r 1,10,000 + 30% of the amount by which the total

income exceeds r 10,00,000

III. Every Individual, being a resident who is of the age of 80 years or more at any time during the

previous year

i. Where the total income does not exceed Nil;

r 5,00,000.

ii. Where the total income exceeds r 5,00,000 but 20% of the amount by which the total income

does not exceed r 10,00,000 exceeds r 5,00,000

iii. Where the total income exceeds r 10,00,000 r 1,00,000 + 30% of the amount by which the total

income exceeds r 10,00,000

1