Page 3 - HDFC Bank TPP Flipbook

P. 3

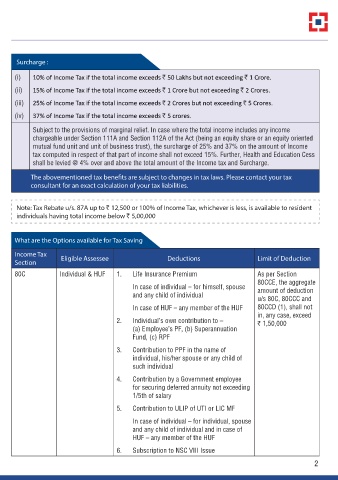

Surcharge :

(i) 10% of Income Tax if the total income exceeds r 50 Lakhs but not exceeding r 1 Crore.

(ii) 15% of Income Tax if the total income exceeds r 1 Crore but not exceeding r 2 Crores.

(iii) 25% of Income Tax if the total income exceeds r 2 Crores but not exceeding r 5 Crores.

(iv) 37% of Income Tax if the total income exceeds r 5 crores.

Subject to the provisions of marginal relief. In case where the total income includes any income

chargeable under Section 111A and Section 112A of the Act (being an equity share or an equity oriented

mutual fund unit and unit of business trust), the surcharge of 25% and 37% on the amount of Income

tax computed in respect of that part of income shall not exceed 15%. Further, Health and Education Cess

shall be levied @ 4% over and above the total amount of the Income tax and Surcharge.

The abovementioned tax benefits are subject to changes in tax laws. Please contact your tax

consultant for an exact calculation of your tax liabilities.

Note: Tax Rebate u/s. 87A up to r 12,500 or 100% of Income Tax, whichever is less, is available to resident

individuals having total income below r 5,00,000

What are the Options available for Tax Saving

Income Tax Eligible Assessee Deductions Limit of Deduction

Section

80C Individual & HUF 1. Life Insurance Premium As per Section

80CCE, the aggregate

In case of individual – for himself, spouse amount of deduction

and any child of individual u/s 80C, 80CCC and

In case of HUF – any member of the HUF 80CCD (1), shall not

in, any case, exceed

2. Individual’s own contribution to – r 1,50,000

(a) Employee’s PF, (b) Superannuation

Fund, (c) RPF

3. Contribution to PPF in the name of

individual, his/her spouse or any child of

such individual

4. Contribution by a Government employee

for securing deferred annuity not exceeding

1/5th of salary

5. Contribution to ULIP of UTI or LIC MF

In case of individual – for individual, spouse

and any child of individual and in case of

HUF – any member of the HUF

6. Subscription to NSC VIII Issue

2