Page 4 - HDFC Bank TPP Flipbook

P. 4

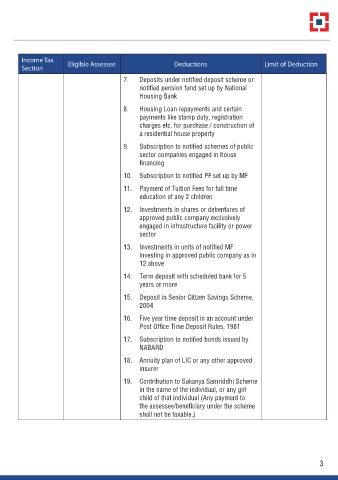

Income Tax Eligible Assessee Deductions Limit of Deduction

Section

7. Deposits under notified deposit scheme or

notified pension fund set up by National

Housing Bank

8. Housing Loan repayments and certain

payments like stamp duty, registration

charges etc. for purchase / construction of

a residential house property

9. Subscription to notified schemes of public

sector companies engaged in house

financing

10. Subscription to notified PF set up by MF

11. Payment of Tuition Fees for full time

education of any 2 children

12. Investments in shares or debentures of

approved public company exclusively

engaged in infrastructure facility or power

sector

13. Investments in units of notified MF

investing in approved public company as in

12 above

14. Term deposit with scheduled bank for 5

years or more

15. Deposit in Senior Citizen Savings Scheme,

2004

16. Five year time deposit in an account under

Post Office Time Deposit Rules, 1981

17. Subscription to notified bonds issued by

NABARD

18. Annuity plan of LIC or any other approved

insurer

19. Contribution to Sukanya Samriddhi Scheme

in the name of the individual, or any girl

child of that individual (Any payment to

the assessee/beneficiary under the scheme

shall not be taxable.)

3