Page 5 - HDFC Bank TPP Flipbook

P. 5

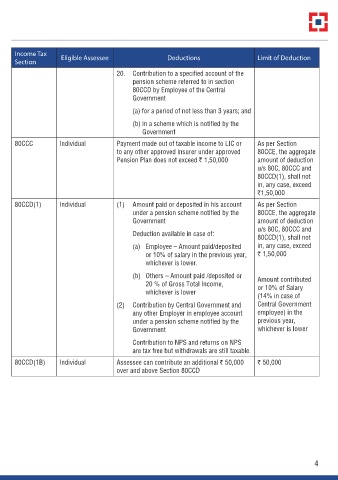

Income Tax Eligible Assessee Deductions Limit of Deduction

Section

20. Contribution to a specified account of the

pension scheme referred to in section

80CCD by Employee of the Central

Government

(a) for a period of not less than 3 years; and

(b) in a scheme which is notified by the

Government

80CCC Individual Payment made out of taxable income to LIC or As per Section

to any other approved insurer under approved 80CCE, the aggregate

Pension Plan does not exceed r 1,50,000 amount of deduction

u/s 80C, 80CCC and

80CCD(1), shall not

in, any case, exceed

r1,50,000

80CCD(1) Individual (1) Amount paid or deposited in his account As per Section

under a pension scheme notified by the 80CCE, the aggregate

Government amount of deduction

u/s 80C, 80CCC and

Deduction available in case of: 80CCD(1), shall not

(a) Employee – Amount paid/deposited in, any case, exceed

or 10% of salary in the previous year, r 1,50,000

whichever is lower.

(b) Others – Amount paid /deposited or Amount contributed

20 % of Gross Total Income, or 10% of Salary

whichever is lower

(14% in case of

(2) Contribution by Central Government and Central Government

any other Employer in employee account employee) in the

under a pension scheme notified by the previous year,

Government whichever is lower

Contribution to NPS and returns on NPS

are tax free but withdrawals are still taxable.

80CCD(1B) Individual Assessee can contribute an additional r 50,000 r 50,000

over and above Section 80CCD

4