Page 35 - HDFC Bank TPP Flipbook

P. 35

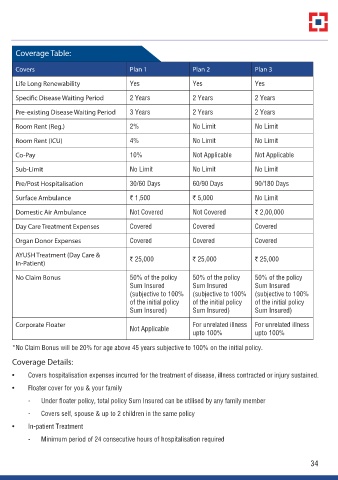

Coverage Table:

Covers Plan 1 Plan 2 Plan 3

Life Long Renewability Yes Yes Yes

Specific Disease Waiting Period 2 Years 2 Years 2 Years

Pre-existing Disease Waiting Period 3 Years 2 Years 2 Years

Room Rent (Reg.) 2% No Limit No Limit

Room Rent (ICU) 4% No Limit No Limit

Co-Pay 10% Not Applicable Not Applicable

Sub-Limit No Limit No Limit No Limit

Pre/Post Hospitalisation 30/60 Days 60/90 Days 90/180 Days

Surface Ambulance r 1,500 r 5,000 No Limit

Domestic Air Ambulance Not Covered Not Covered r 2,00,000

Day Care Treatment Expenses Covered Covered Covered

Organ Donor Expenses Covered Covered Covered

AYUSH Treatment (Day Care & r 25,000 r 25,000 r 25,000

In-Patient)

No Claim Bonus 50% of the policy 50% of the policy 50% of the policy

Sum Insured Sum Insured Sum Insured

(subjective to 100% (subjective to 100% (subjective to 100%

of the initial policy of the initial policy of the initial policy

Sum Insured) Sum Insured) Sum Insured)

Corporate Floater For unrelated illness For unrelated illness

Not Applicable

upto 100% upto 100%

*No Claim Bonus will be 20% for age above 45 years subjective to 100% on the initial policy.

Coverage Details:

• Covers hospitalisation expenses incurred for the treatment of disease, illness contracted or injury sustained.

• Floater cover for you & your family

- Under floater policy, total policy Sum Insured can be utilised by any family member

- Covers self, spouse & up to 2 children in the same policy

• In-patient Treatment

- Minimum period of 24 consecutive hours of hospitalisation required

34