Page 38 - HDFC Bank TPP Flipbook

P. 38

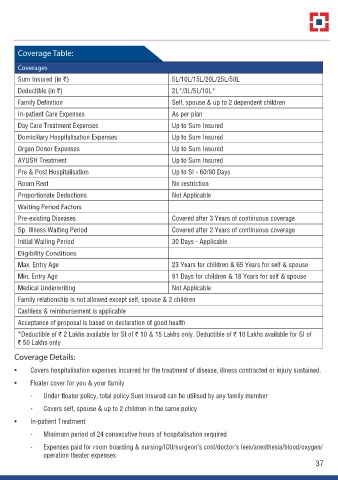

Coverage Table:

Coverages

Sum Insured (in r) 5L/10L/15L/20L/25L/50L

Deductible (in r) 2L*/3L/5L/10L*

Family Definition Self, spouse & up to 2 dependent children

In-patient Care Expenses As per plan

Day Care Treatment Expenses Up to Sum Insured

Domiciliary Hospitalisation Expenses Up to Sum Insured

Organ Donor Expenses Up to Sum Insured

AYUSH Treatment Up to Sum Insured

Pre & Post Hospitalisation Up to SI - 60/90 Days

Room Rent No restriction

Proportionate Deductions Not Applicable

Waiting Period Factors

Pre-existing Diseases Covered after 3 Years of continuous coverage

Sp. Illness Waiting Period Covered after 2 Years of continuous coverage

Initial Waiting Period 30 Days - Applicable

Eligibility Conditions

Max. Entry Age 23 Years for children & 65 Years for self & spouse

Min. Entry Age 91 Days for children & 18 Years for self & spouse

Medical Underwriting Not Applicable

Family relationship is not allowed except self, spouse & 2 children

Cashless & reimbursement is applicable

Acceptance of proposal is based on declaration of good health

*Deductible of r 2 Lakhs available for SI of r 10 & 15 Lakhs only. Deductible of r 10 Lakhs available for SI of

r 50 Lakhs only

Coverage Details:

• Covers hospitalisation expenses incurred for the treatment of disease, illness contracted or injury sustained.

• Floater cover for you & your family

- Under floater policy, total policy Sum Insured can be utilised by any family member

- Covers self, spouse & up to 2 children in the same policy

• In-patient Treatment

- Minimum period of 24 consecutive hours of hospitalisation required

- Expenses paid for room boarding & nursing/ICU/surgeon’s cost/doctor’s fees/anesthesia/blood/oxygen/

operation theater expenses

37