Page 36 - HDFC Bank TPP Flipbook

P. 36

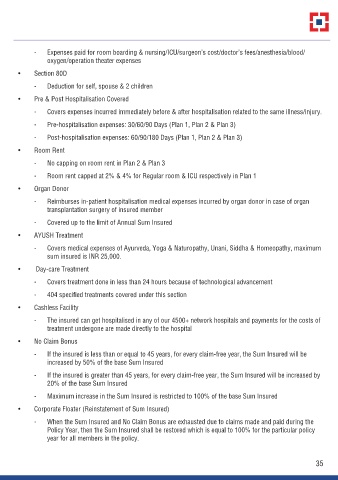

- Expenses paid for room boarding & nursing/ICU/surgeon’s cost/doctor’s fees/anesthesia/blood/

oxygen/operation theater expenses

• Section 80D

- Deduction for self, spouse & 2 children

• Pre & Post Hospitalisation Covered

- Covers expenses incurred immediately before & after hospitalisation related to the same illness/injury.

- Pre-hospitalisation expenses: 30/60/90 Days (Plan 1, Plan 2 & Plan 3)

- Post-hospitalisation expenses: 60/90/180 Days (Plan 1, Plan 2 & Plan 3)

• Room Rent

- No capping on room rent in Plan 2 & Plan 3

- Room rent capped at 2% & 4% for Regular room & ICU respectively in Plan 1

• Organ Donor

- Reimburses in-patient hospitalisation medical expenses incurred by organ donor in case of organ

transplantation surgery of insured member

- Covered up to the limit of Annual Sum Insured

• AYUSH Treatment

- Covers medical expenses of Ayurveda, Yoga & Naturopathy, Unani, Siddha & Homeopathy, maximum

sum insured is INR 25,000.

• Day-care Treatment

- Covers treatment done in less than 24 hours because of technological advancement

- 404 specified treatments covered under this section

• Cashless Facility

- The insured can get hospitalised in any of our 4500+ network hospitals and payments for the costs of

treatment undergone are made directly to the hospital

• No Claim Bonus

- If the insured is less than or equal to 45 years, for every claim-free year, the Sum Insured will be

increased by 50% of the base Sum Insured

- If the insured is greater than 45 years, for every claim-free year, the Sum Insured will be increased by

20% of the base Sum Insured

- Maximum increase in the Sum Insured is restricted to 100% of the base Sum Insured

• Corporate Floater (Reinstatement of Sum Insured)

- When the Sum Insured and No Claim Bonus are exhausted due to claims made and paid during the

Policy Year, then the Sum Insured shall be restored which is equal to 100% for the particular policy

year for all members in the policy.

35