Page 63 - HDFC Bank | Take the cut out of your tax cut

P. 63

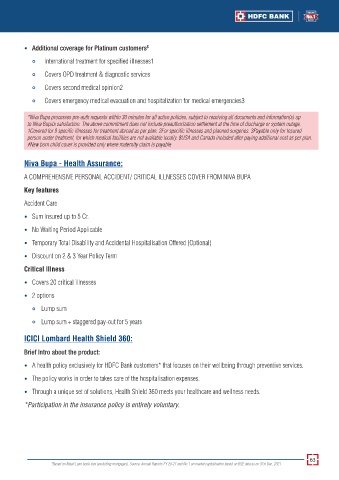

• Additional coverage for Platinum customers $

• International treatment for specified illnesses1

• Covers OPD treatment & diagnostic services

• Covers second medical opinion2

• Covers emergency medical evacuation and hospitalization for medical emergencies3

*Niva Bupa processes pre-auth requests within 30 minutes for all active policies, subject to receiving all documents and information(s) up

to Niva Bupa’s satisfaction. The above commitment does not include preauthorization settlement at the time of discharge or system outage.

1Covered for 9 specific illnesses for treatment abroad as per plan. 2For specific illnesses and planned surgeries. 3Payable only for Insured

person under treatment, for which medical facilities are not available locally. $USA and Canada included after paying additional cost as per plan.

#New born child cover is provided only where maternity claim is payable

Niva Bupa - Health Assurance:

A COMPREHENSIVE PERSONAL ACCIDENT/ CRITICAL ILLNESSES COVER FROM NIVA BUPA

Key features

Accident Care

• Sum Insured up to 5 Cr.

• No Waiting Period Applicable

• Temporary Total Disability and Accidental Hospitalisation Offered (Optional)

• Discount on 2 & 3 Year Policy Term

Critical Illness

• Covers 20 critical illnesses

• 2 options

• Lump sum

• Lump sum + staggered pay-out for 5 years

ICICI Lombard Health Shield 360:

Brief Intro about the product:

• A health policy exclusively for HDFC Bank customers* that focuses on their wellbeing through preventive services.

• The policy works in order to takes care of the hospitalisation expenses.

• Through a unique set of solutions, Health Shield 360 meets your healthcare and wellness needs.

*Participation in the insurance policy is entirely voluntary.

63

*Based on Retail Loan book size (excluding mortgages). Source: Annual Reports FY 20-21 and No.1 on market capitalisation based on BSE data as on 31st Dec, 2021