Page 43 - HDFC Bank TPP Flipbook

P. 43

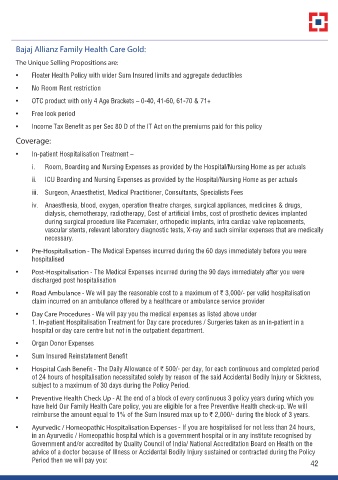

Bajaj Allianz Family Health Care Gold:

The Unique Selling Propositions are:

• Floater Health Policy with wider Sum Insured limits and aggregate deductibles

• No Room Rent restriction

• OTC product with only 4 Age Brackets – 0-40, 41-60, 61-70 & 71+

• Free look period

• Income Tax Benefit as per Sec 80 D of the IT Act on the premiums paid for this policy

Coverage:

• In-patient Hospitalisation Treatment –

i. Room, Boarding and Nursing Expenses as provided by the Hospital/Nursing Home as per actuals

ii. ICU Boarding and Nursing Expenses as provided by the Hospital/Nursing Home as per actuals

iii. Surgeon, Anaesthetist, Medical Practitioner, Consultants, Specialists Fees

iv. Anaesthesia, blood, oxygen, operation theatre charges, surgical appliances, medicines & drugs,

dialysis, chemotherapy, radiotherapy, Cost of artificial limbs, cost of prosthetic devices implanted

during surgical procedure like Pacemaker, orthopedic implants, infra cardiac valve replacements,

vascular stents, relevant laboratory diagnostic tests, X-ray and such similar expenses that are medically

necessary.

• Pre-Hospitalisation - The Medical Expenses incurred during the 60 days immediately before you were

hospitalised

• Post-Hospitalisation - The Medical Expenses incurred during the 90 days immediately after you were

discharged post hospitalisation

• Road Ambulance - We will pay the reasonable cost to a maximum of r 3,000/- per valid hospitalisation

claim incurred on an ambulance offered by a healthcare or ambulance service provider

• Day Care Procedures - We will pay you the medical expenses as listed above under

1. In-patient Hospitalisation Treatment for Day care procedures / Surgeries taken as an in-patient in a

hospital or day care centre but not in the outpatient department.

• Organ Donor Expenses

• Sum Insured Reinstatement Benefit

• Hospital Cash Benefit - The Daily Allowance of r 500/- per day, for each continuous and completed period

of 24 hours of hospitalisation necessitated solely by reason of the said Accidental Bodily Injury or Sickness,

subject to a maximum of 30 days during the Policy Period.

• Preventive Health Check Up - At the end of a block of every continuous 3 policy years during which you

have held Our Family Health Care policy, you are eligible for a free Preventive Health check-up. We will

reimburse the amount equal to 1% of the Sum Insured max up to r 2,000/- during the block of 3 years.

• Ayurvedic / Homeopathic Hospitalisation Expenses - If you are hospitalised for not less than 24 hours,

in an Ayurvedic / Homeopathic hospital which is a government hospital or in any institute recognised by

Government and/or accredited by Quality Council of India/ National Accreditation Board on Health on the

advice of a doctor because of Illness or Accidental Bodily Injury sustained or contracted during the Policy

Period then we will pay you: 42